By Alan Ifould, Edwards Vacuum

Obvious benefits accrue to the environment and society from the adoption of a circular economic model that reduces waste and conserves energy, but that model will not be embraced by businesses until stakeholders become aware of the tangible benefits the approach can deliver. This blog post is adapted from a presentation developed by Edwards’ Nicolai Tallo for the recent Semicon SEA conference in Singapore.

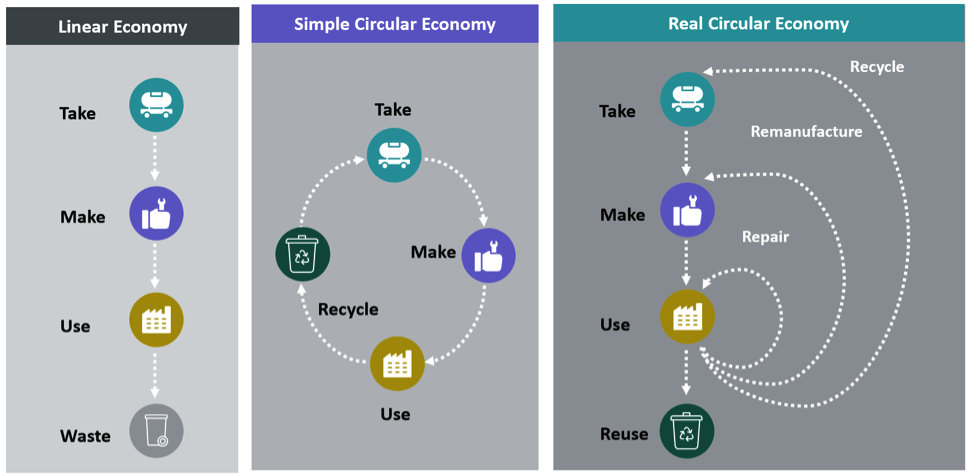

What is a circular economy? In a traditional linear model – sometimes characterized as take, make, use, and waste – resources are taken and used to make a product, the product is used for its normal life, and at the end of that it becomes waste, typically destined for landfill or something similar. This is clearly not a sustainable model as all resources are ultimately limited and much energy is wasted every time we create a new product from scratch. A circular model transforms the linear approach by considering any and all waste to be an input back into the system. Today, most companies in the semiconductor industry have taken some steps toward circularity in a simple circular model. But to truly reap the benefits of circular economy, we need to look at the process as a more complex set of interrelating systems.

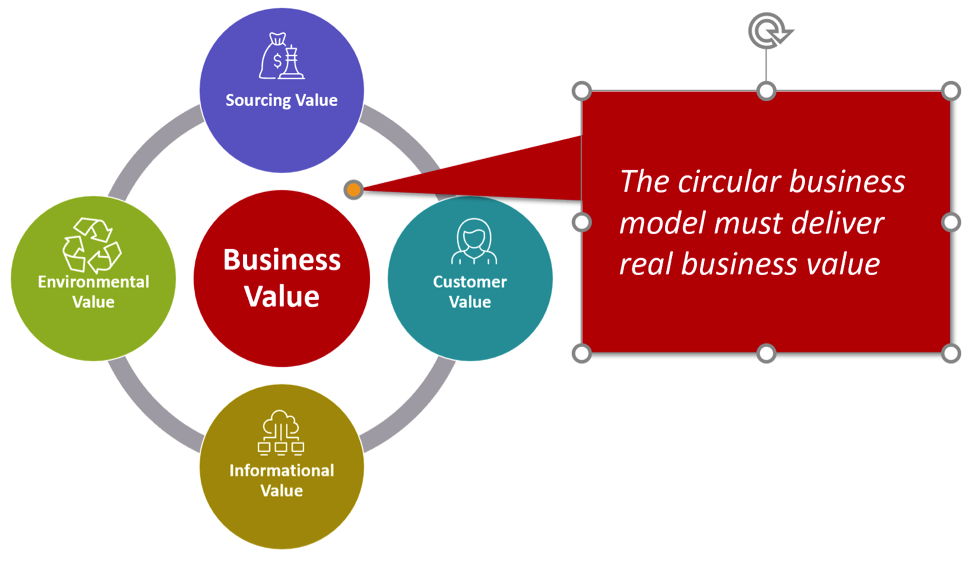

Transforming to the more complex model is not easy. We need to consider the entire supply chain and look at how value can be generated at each step. This requires an intimate relationship between the product manufacturer and the customer with multiple, closed-loop value chains. The information exchanged in such a relationship is invaluable for developing better, more sustainable products in the future. But most importantly, the transformation must generate tangible business benefits, or it will not occur.

What are the business benefits of circularity and how can we measure them? The first value category is sourcing, direct financial value derived from reducing costs, eliminating waste, entering new markets, and so on. The second category, environmentalvalue, becomes a business value only when it is communicated to stake holders – shareholders, customers, institutions, and employees – where it can increase brand value, customer loyalty, and employee satisfaction and retention. A third kind of value, customer value, can be generated by new products or services that better meet the customers’ requirements. Buy-back programs that give the customer a financial incentive to recycle also add customer value. The final category, informational value, is the value of the data and knowledge gained in a circular system from interactions with the customer and from analysis of the products themselves. This leads to a better understanding of customer needs and to products that better fit those requirements.

To deliver these benefits, business models must also evolve from a traditional, product-oriented sales model to use- and results-oriented models. In a product-oriented model the supplier focuses on the sale of a particular product and the value that product delivers. In a use-oriented model, rather than paying a single price for a product or a service, the customer pays a regular fee for access to that product – product ownership and responsibility for managing the asset remains with the manufacturer. This incentivizes the manufacturer to make products that are longer lasting, more reliable, and more repairable. A result-oriented model goes one step further as the customer pays for a given outcome or result. This links the customers’ goals and objectives even more intimately to the suppliers’ goals and objectives.

Transitioning the business model from product-orientated sales to result-orientated sales requires the company’s circular capabilities to have evolved to a sufficient level. Within Edwards, we see the following three areas as key to starting this transition. It is important to be able to highlight the business values of these capabilities before looking at the additional values that can be gained by changing the business model.

Examples include:

Prolonging product life – The first example focuses on keeping a product at its highest value for as long as possible with maintenance, repair, and upgrades, rather than replacement with a new product. When a technology or application changes, we upgrade only those components that improve the performance and fit for the new application. For instance, in a turbo pump, we might upgrade the temperature control system and the heat emissivity of the rotors to deal with higher temperatures.

Remanufacturing – Used products are brought to a reprocessing facility where they are disassembled, decontaminated, and inspected. Components are replaced as required and the product is tested to confirm compliance with “as-new” specifications. The final step in a remanufacturing model is remarketing the renewed product. It may be returned to the original customer for a second life in the same application, or if the original customer’s process and requirements have changed, the product may be offered to a secondary market.

Designing out waste – We use the data we collect from our products and field operations to learn where disruptions and inefficiencies come from. Once a problem has been identified we take a holistic approach to eliminating risks and disruptions, ranging from the use of predictive algorithms and machine learning to optimize maintenance schedules to standardizing procedures for support engineers.These examples were drawn from our experience in a product-oriented business model, but all three would fit well within a use- or results-oriented model that combines product data and domain knowledge to optimize asset utility and lifetime before products are returned for repair or remanufacture.

A result-oriented model for Semiconductor Manufacturing – Applying the value system to the Vacuum and Abatement Eco-system

The result-oriented model means moving away from ownership of equipment and transactional maintenance services to an agreement where the customer pays for the ability to reach agreed performance goals.

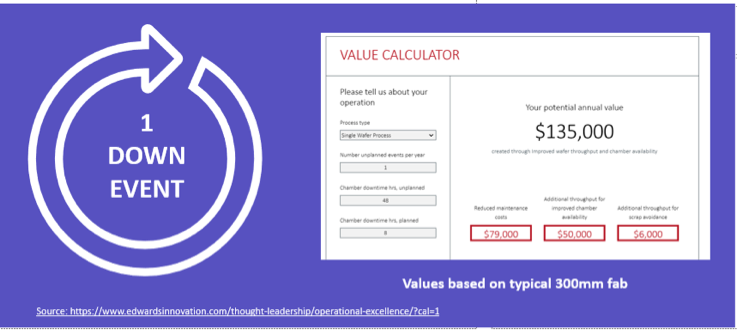

Using input from our customers and focusing on key fab performance metrics – wafer loss, throughput and total cost of ownership- we developed a simple calculator to estimate the cost of failure. The illustration below estimates the annual cost of one catastrophic turbo pump failure per year at $135,000. In many fab operations, unplanned events like this may occur tens of times per year.

When a result-oriented model is applied, there are 3 key areas of business value:

- Reduce risk and disruption during manufacturing through a sharing of common goals and objectives with the customer and a sharing of risk. If we avoid catastrophic failure, there is less damage to the product and less disruption and loss in the customer’s process. Once the risk is controlled, inefficiencies in other aspects of the process, like spare parts inventories, can be identified and reduced. A detailed use case available here.

- Fully utilize assets before repair or remanufacture. One of our customers achieved a 25% increase in pump lifetime by transitioning from a time-based maintenance schedule to a condition-based maintenance plan that integrated equipment monitoring with predictive maintenance (PdM) and remaining-useful-life (RUL) technologies. Key to their success was Edwards Operational Excellence approach, which combines predictive analytics with specific domain knowledge. A detailed use case available here.

- Guarantee access to the most robust, reliable and repairable products and processes that meet the customers’ exact performance requirements as performance has a direct impact on the supplier’s bottom line. A detailed use case available here.

Many of our customers are starting to see how they can leverage their vacuum eco-system to advance in their wider growth objectives, but full realization of these benefits does not come without significant challenges and transformation. These changes include a fundamental re-thinking of the way assets are designed, manufactured, used, re-used and owned; collaborative engagement between manufacturer and customer with intimate sharing of information, goals, risks and rewards; and a holistic operational approach to managing assets.

Stay tuned for next month’s blog article on “the Chamber to the SubFab, what’s the difference”.

Further Market Insights can be found on Edwards Operational Excellence web site.