IC Insights recently released its Mid-Year Update to The McClean Report 2021. The update includes IC Insights’ ranking of revenue growth rates for the 33 IC product categories defined by the World Semiconductor Trade Statistics (WSTS) organization and confirms that vigorous end-use demand is affecting market growth across all product segments.

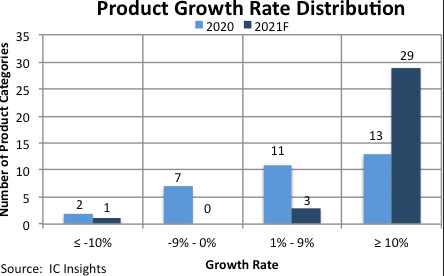

Figure 1 shows the distribution of growth rates for the 33 IC product categories in 2020 and IC Insights’ forecast for 2021. IC Insights expects 32 of the 33 product categories to experience sales growth this year with 29 product categories expected to see double-digit growth, representing one of the strongest and broadest sales industry outlooks that IC Insights has ever documented. In previous strong-growth years, perhaps a handful of IC products had extraordinary sales gains that helped raise overall IC market growth. But, in 2021, it appears that robust growth has permeated nearly all product categories across the entire IC industry. Only the fading and insignificant gate array market (forecast sales of $58 million in 2021) is expected to decline in sales.

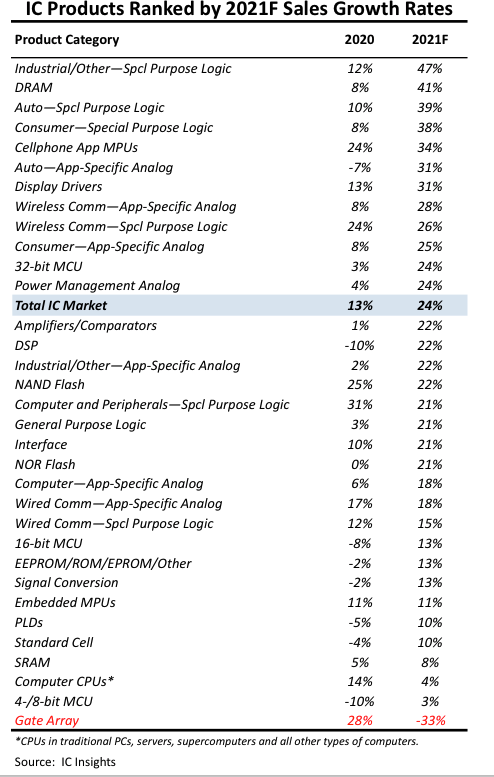

The 33 major IC product categories ranked by their forecast sales percentage growth rates for 2021 are shown in Figure 2. Many Special Purpose Logic categories are forecast to rank high on the growth list this year, along with DRAM, cellphone MPUs, and display drivers, which are all on track to see sales rise by more than 30%, with the total IC market now forecast to rise 24%.