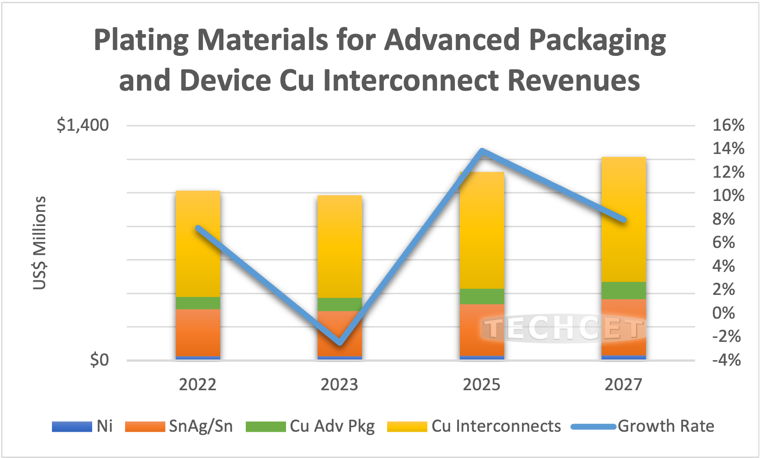

TECHCET— the electronic materials advisory firm providing business and technology information on semiconductor supply chains —is estimating that the market for Semiconductor Metal Plating Chemicals will reach US$987M in 2023, a 2% decrease from 2022. The decrease in the 2023 forecast is due to lower expectations for the amount of overall wafer starts. Additionally, the decline may be influenced by the overbuying of materials in 2020-2021 and subsequent inventory corrections within the market. The largest revenue within the 2023 metal plating chemicals segment is forecasted for copper, with $373M for copper advanced packaging wiring, and $614M for interconnect copper plating. Despite the current slowdown, the overall 2022-2027 CAGR is expected to be a positive 3.7% for advanced packaging and 3.3% for interconnect metal chemicals, as highlighted in TECHCET’s new Quarterly Update to the Metal Chemicals Critical Material Report.

![]()

Current economic environments will likely cause overall semiconductor device production to be reduced until at least the end of 2Q 2023. However, demand for more devices used for electric cars, faster charging stations, stronger data storage, and more applications, are expected to produce higher density and lower power devices in the coming years. Simultaneously, the US Chips Act and similar investments by Europe and China will push these developments along. This will drive increases in metal interconnect layers and advanced packaging use, which should revamp growth in the metal chemical plating market.

TECHCET is following new technologies for metal deposition, such as the introduction of Ruthenium (Ru) or Molybdenum (Mo) (or Vanadium (V) or Iridium (Ir)) to possibly displace the Tantalum (Ta) & Cobalt (Co) barrier layers at the smallest interconnect dimensions for the GAA nodes. Ru or Mo (ALD or CVD, not plating) will possibly fill the interconnects & vias between M0 to M2 metal layers for Advanced Logic. Possible wafer backside connections to the backside power rail will add Copper (Cu) plating to possibly match or exceed the Cu plating lost at the M8-M14 layers.

For more details on Metal Deposition market trends, supply-chain issues and supplier profiles like Dupont, Chang Chun Group, JX Nippon, Moses Lake Industries, MacDermid and more, go to: https://techcet.com/product/metal-chemicals-for-fe-advanced-packaging/ or https://techcet.com/product/sputter-targets/