TECHCET— the advisory firm providing materials market information for semiconductor supply chain resilience — is forecasting a rebound in the global semiconductor materials market this year. After experiencing a year-over-year decline of 6% in 2023 due to a sluggish overall semiconductor industry environment, 2024 is poised to add nearly 7% as conditions turn favorable.

![]()

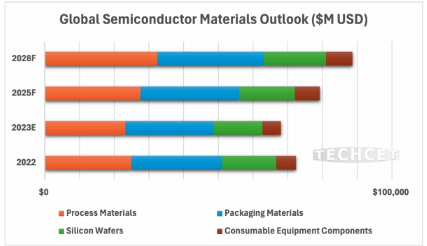

TECHCET anticipates revenue growth in the semiconductor materials sector throughout a 5-year period, with annual sales in 2028 forecasted to exceed $88 billion USD.

The semiconductor materials industry in 2023 faced instabilities as demand for consumer-based end products decayed, while trends in increasing semiconductor value content in the automotive sector remained strong. “Growth in the automotive industry included expanded integration of new materials such as SiC and GaN to further power functionality”, stated Mike Walden, TECHCET’s Sr. Director. Additionally, the year witnessed the industry shifting resources to address technology upgrades, an approach increasingly embraced during periods of broader slowdown.

Although the backdrop of 2024 has some persistent issues from the downturn (i.e., geopolitical tensions and uncertainty in inflationary pressures), pervasive drivers are moving the materials industry back into favorable conditions. Technology development work will result in increased demand for advanced materials and processes, including metal organic precursors, CMP consumables, advanced packaging materials, and cleaning chemistries among others. An even stronger uptick in demand is expected by 2025 when chip expansions blossom, driven by AI, and ever-expanding 5G infrastructure. Regulatory/policy developments and industry sustainability/circular economy initiatives represent wildcard opportunities for the future.