TECHCET— the electronic materials advisory firm providing semiconductor materials supply chain information — is forecasting a rebound in the global semiconductor chip manufacturing materials market in 2024. Following a 12% year-over-year decline in 2023 driven by a sluggish industry and inventory correction, revenues for total materials in 2024 is expected to see 3-4% growth as conditions improve.

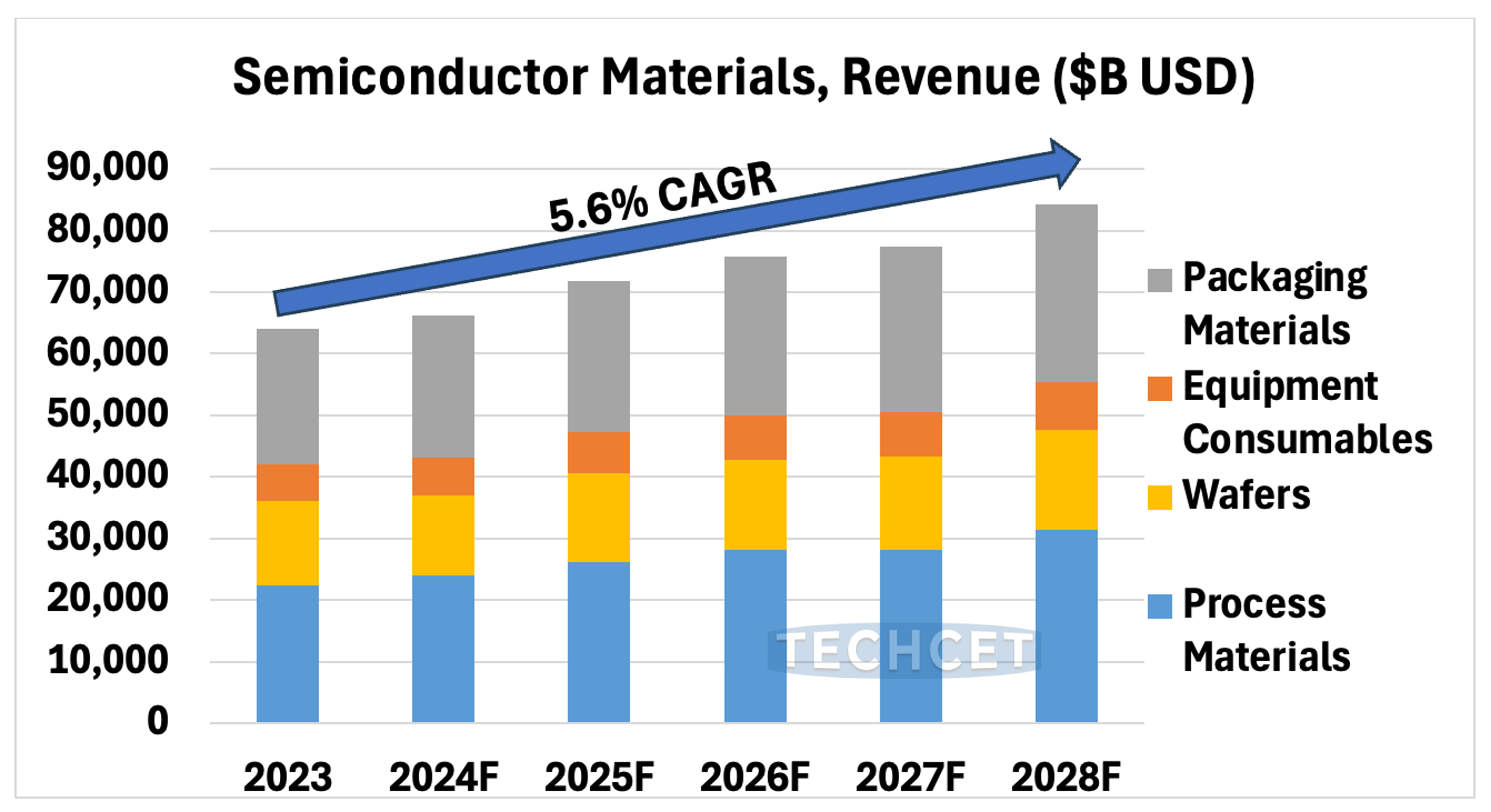

![]() TECHCET anticipates a 5.6% CAGR from 2023 to 2028, with total revenue exceeding $84 B USD by 2028. In 2024, front end “Process Materials” will lead the recovery with nearly 7% growth over 2023 and a 7% CAGR through 2028. Among all process materials tracked by TECHCET, ALD/CVD has the strongest growth, increasing more than 15% in revenues, followed by Specialty and Bulk Gases at over 9% growth in 2024/2023. Packaging Materials and Equipment Consumables are forecasted to have a moderate growth rate of ~5%. The wafer segment is forecast to decline ~5% due to inventory correction, and slowdown in consumer electronics and PC demand, but should rebound strongly in 2025.

TECHCET anticipates a 5.6% CAGR from 2023 to 2028, with total revenue exceeding $84 B USD by 2028. In 2024, front end “Process Materials” will lead the recovery with nearly 7% growth over 2023 and a 7% CAGR through 2028. Among all process materials tracked by TECHCET, ALD/CVD has the strongest growth, increasing more than 15% in revenues, followed by Specialty and Bulk Gases at over 9% growth in 2024/2023. Packaging Materials and Equipment Consumables are forecasted to have a moderate growth rate of ~5%. The wafer segment is forecast to decline ~5% due to inventory correction, and slowdown in consumer electronics and PC demand, but should rebound strongly in 2025.

The 2024 market has been plagued with geopolitical tensions, particularly between the U.S. and China, with stricter export controls on technology, certain materials, and semiconductor manufacturing equipment. Despite these and other global tensions, the semiconductor market shows signs of mixed recovery from the downturn of 2023, driven by a boom in AI-related demand and data center build outs. Fortunately, any excess chip inventory has been winding down and demand is stabilizing. However, consumer electronics, PC segments, and automotive sectors continue to struggle, keeping overall market growth to modest levels.