Using its “baseline” assumptions shown in the April Update to the 2020 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (MR20), IC Insights forecasts that worldwide IC unit shipments will register their first-ever back-to-back annual decline in 2020.

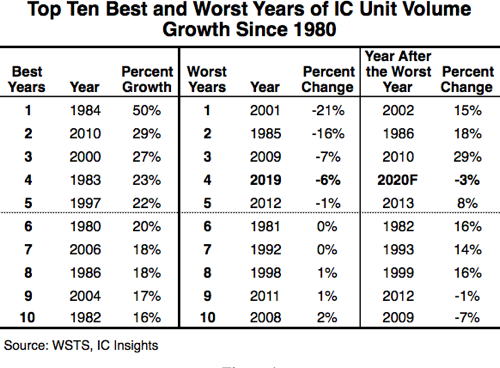

From 2013 through 2018, IC unit shipments were on a respectable growth path with an 8% increase logged in 2013, a 9% jump registered in 2014, a 5% increase displayed in 2015, a 7% increase shown in 2016, a double-digit growth rate of 15% in 2017, and a 10% increase in 2018. In contrast to the double-digit increases in 2017 and 2018, 2019 marked only the fifth time in the history of the IC industry that IC unit shipments registered a decline (Figure 1).

Before last year, the previous four years that IC unit shipments declined were 1985, 2001, 2009, and 2012. Two of the four years in which IC unit volumes declined (1985 and 2001) were preceded by big increases (spurred on by inventory builds) of IC unit shipments—50% in 1984 and 27% in 2000. Although there was only a 2% increase in IC unit shipments in 2008, and there was not an excessive amount of inventory to purge, the depth of the global recession and its negative impact on electronic system sales caused the third annual IC unit decline in history in 2009 (-7%).

IC Insights’ baseline forecast for global IC market growth for 2020 now stands at -4% with total IC unit shipments are expected to decline by 3% this year. If this forecast comes to fruition, IC Insights believes it would be the only back-to-back annual IC unit shipment declines in the history of the IC industry.