The semiconductor industry is at a turning point. The slowdown in CMOS scaling, coupled with escalating costs, has prompted the industry to rely on IC packaging to extend the benefits of the More-than-Moore era. Thus, advanced packaging has entered its most successful period, boosted by widespread needs for better integration; the slowdown of Moore’s law; and megatrends in transportation, 5G, consumer, memory & computing, IoT (and IIoT ), AI , and HPC.

The market research & strategy consulting company, Yole Développement (Yole) releases today its annual technology & market analysis, Status of the Advanced Packaging Industry. This report explores the field of advanced packaging and represents a comprehensive yearly overview of the latest market and technology developments. Yole’s analysts propose a review of the drivers for advanced packaging and the latest market dynamics. They also examine packaging technology evolution with the help of short- and long-term roadmaps. This new edition also includes is an analysis of the trends and challenges related to advanced packaging technology, supported by detailed roadmaps for the various packaging platforms.

What is the status of the advanced packaging industry? What happened in 2018 and what to expect in 2019 and 2020? What will be the impact of the US-China trade war on semiconductor business & related supply chain? What is the strategy of the leading advanced packaging companies? Yole’s analysts draw up a review of this industry and detail their expectations.

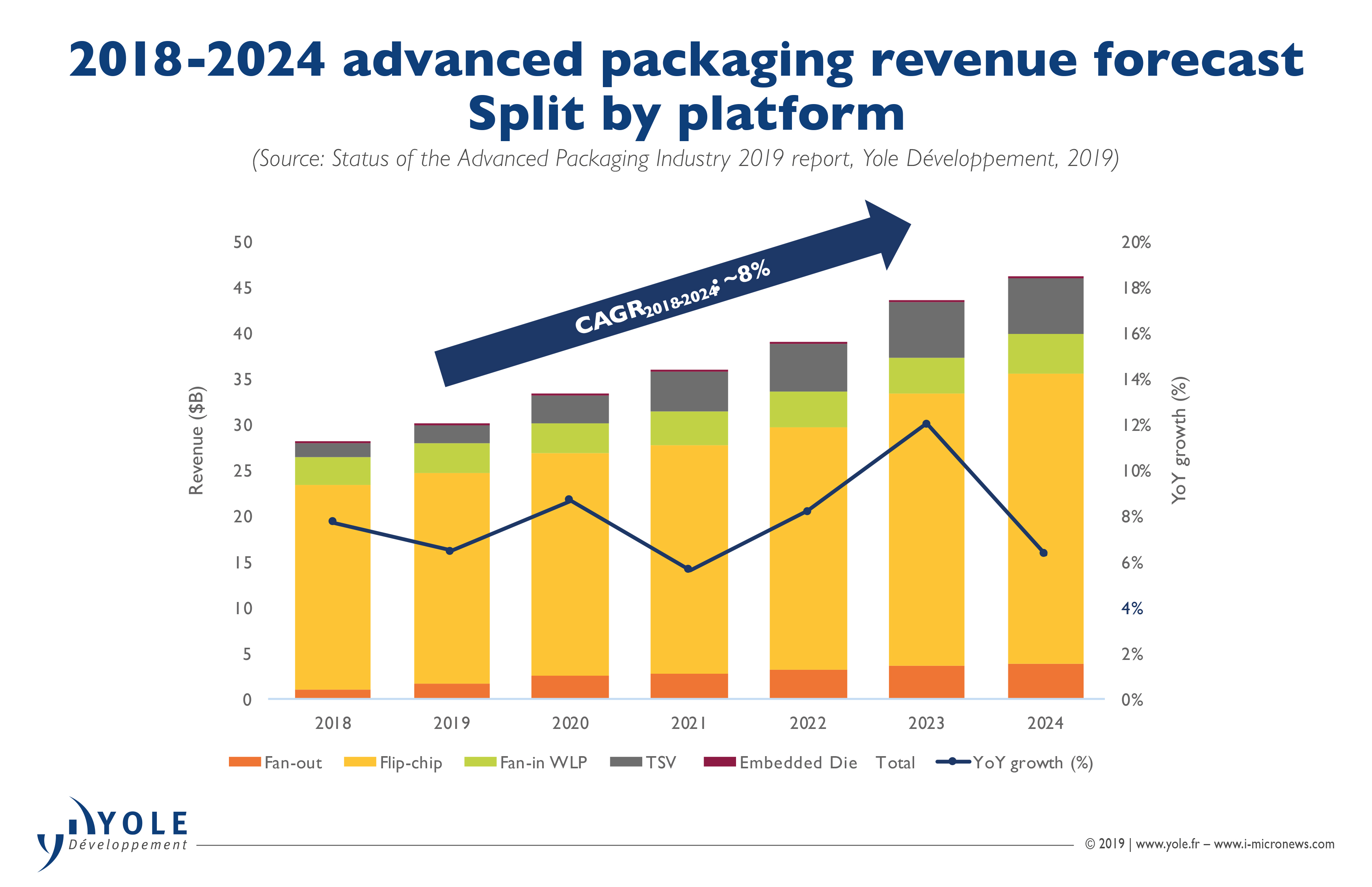

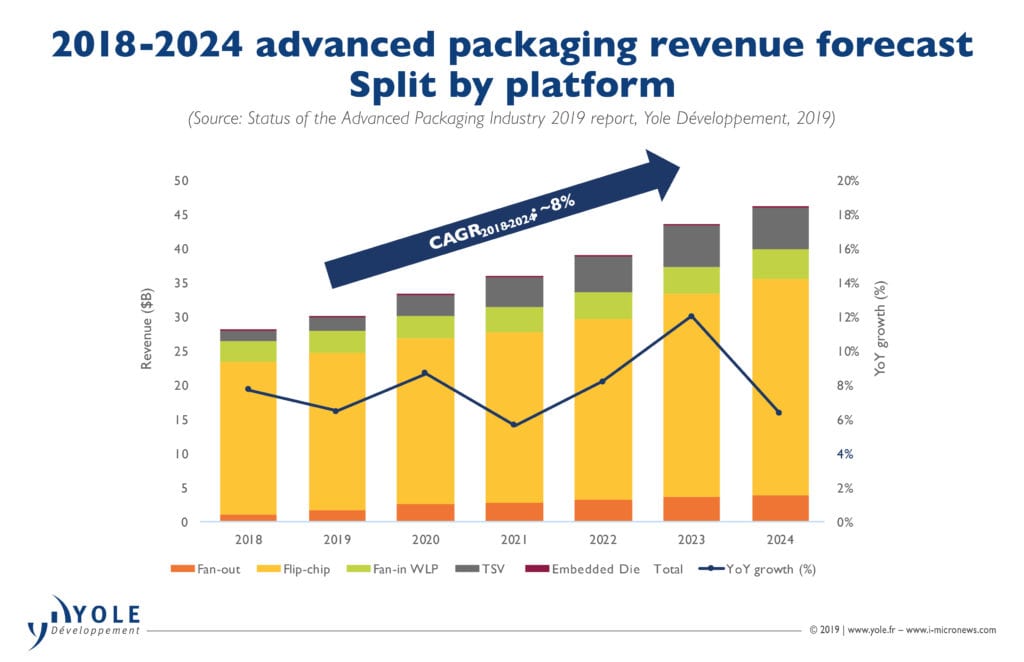

After experiencing double-digit growth and achieving record revenue in 2017 and 2018, Yole expects a slowdown (negative YoY growth) in the semiconductor industry for 2019. However, advanced packaging is expected to maintain its growth momentum, with ~ 6% YoY growth. Overall, the advanced packaging market will grow at an 8% CAGR, reaching almost US$44 billion in 2024. Conversely, during the same period the traditional packaging market will grow at a 2.4% CAGR, and the total IC packaging business will exhibit a 5% CAGR.

The highest revenue CAGRs is expected from 2.5D / 3D TSV ICs, ED (in laminate substrate) and Fan-Out, at 26%, 49% and 26% respectively, as high volume products further penetrate the market: Fan-Out in mobile, networking, automotive; 2.5D/3D TSV in AI/ML, HPC, data centers, CIS , MEMS/sensors; ED in automotive and medical.

By segment, mobile & consumer constitutes 84% of the total advanced package units shipped in 2018.

“It is expected to grow at 5% CAGR and constitute 72% of the advanced packaging units by 2024,” confirmed Santosh Kumar, Principal Analyst & Director, Yole Korea. And he adds: “Telecom & infrastructure is the fastest growing segment for advanced packaging market by units (almost 28%) and it’ll double its market share from 6% in 2018 to 15% by 2024. In terms of revenue, automotive & transportation segment will increase its share from 9% to11% in 2024.”

Amidst an evolving business environment, the semiconductor supply chain is undergoing change at various levels.

Some players have successfully managed to expand into a new business model and significantly impact the IC manufacturing chain, while others have failed to take off. Different players have different motivations to move or expand into new businesses… Status of the Advanced Packaging Industry report provides an impressive analysis of this supply chain, including player positioning and strategy/production per player. In addition to a financial inquiry of the top 25 OSATs, it concludes by providing revenue, wafer, and unit forecasts per packaging platform, along with a review of future production and possible developments during the 2018 – 2024 timeframe.

“To remain competitive, we will see lots of mergers and acquisition activity in the OSAT sector in the coming years,” commented Favier Shoo, Technology & Market Analyst at Yole. “This trends could be observed at various levels. At Yole, we identified some consolidations amongst big players, the merger or acquisition of two midsize players with complementary services offerings and small OSATs being acquired by big players for example. And niche WLP players like Deca Technologies and LB Semicon are strong candidates for acquisition.”