SIMONE BERTOLAZZI, PhD, Technology & Market analyst, Semiconductor, Memory and Computing Division at Yole Développement (Yole).

Semiconductor memory is a key strategic market in modern data-centric societies, and is driven by important megatrends, including mobility, cloud computing, artificial intelligence (AI) and the internet of things (IoT). NAND (non-volatile) and DRAM (volatile) are commodity products and are used, respectively, as storage and working memory for a broad spectrum of applications and systems, including smartphones, solid state drives, PCs, servers, and vehicles. In 2019, NAND and DRAM accounted together for 96% of the overall stand-alone memory market with combined revenue of US$107 billion.

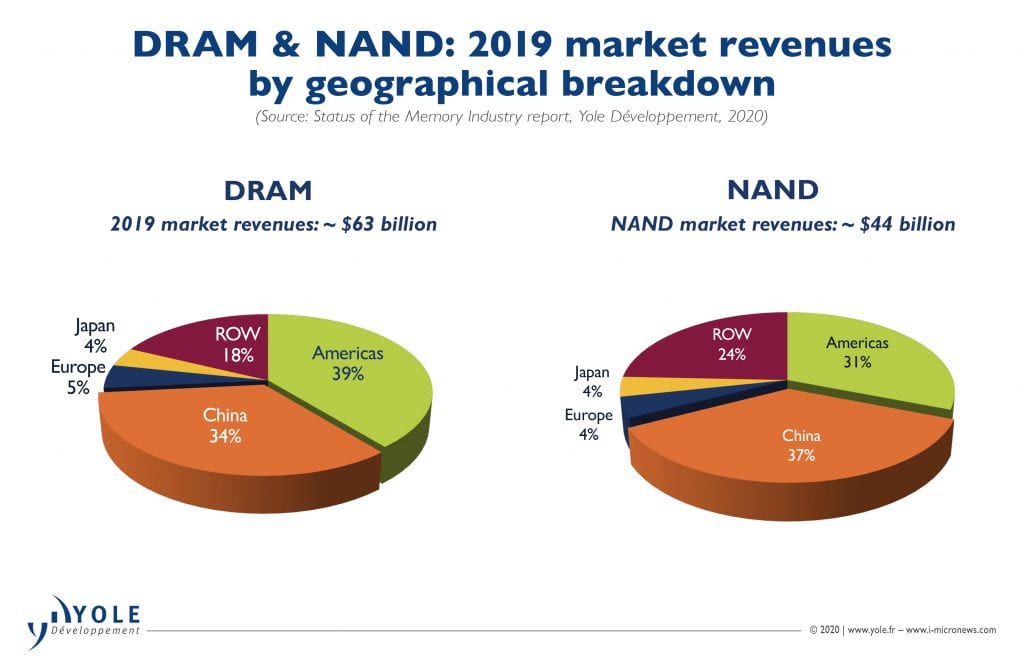

China is a key market for memory devices and continues to grow strongly thanks to high demand in the mobile, automotive and server markets. It is noteworthy that China purchases more than 1/3 of all the NAND and DRAM chips manufactured worldwide (FIGURE 1).

Chinese central and local governments, in partnership with private players, have been investing billions of dollars to develop a local semiconductor industry aiming at bridging the gap between domestic production and consumption. Back in 2015, the Chinese government launched a massive funding initiative – named “Made in China 2025” – to increase its domestic semiconductor IC production from less than 20% in 2015 to 70% by 2025. About 20 local governments have set up guidance funds reaching an overall investment plan worth in excess of US$90 billion. However, China has been struggling to keep up the pace with such an ambitious program. Building and operating semiconductor fabs with the same technical capability as market-leading players is not a task that can be accomplished merely via huge capital funding. In particular, memory is a very competitive and challenging business due to the high manufacturing complexity of 3D NAND and DRAM devices. Among the key challenges one should consider are the need for advanced technology IP and engineering talent. Foreign players, such as Micron, Samsung, and SK hynix, are not open to technology licensing for leading-edge memory products, or for partnerships with local players. Moreover, deals for the acquisition of foreign entities are often blocked by foreign governments worldwide.

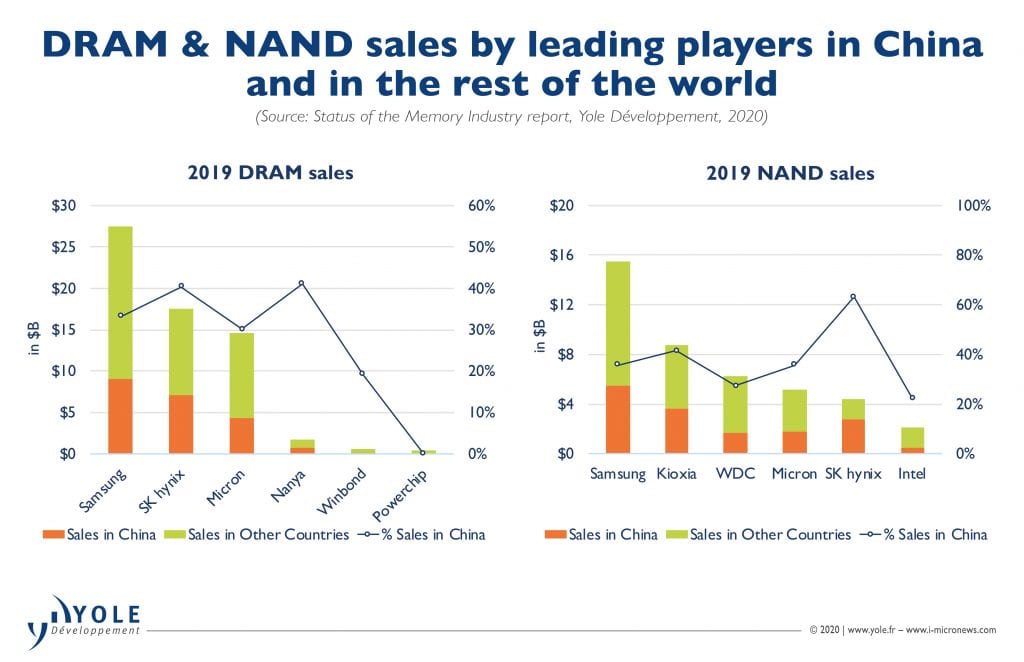

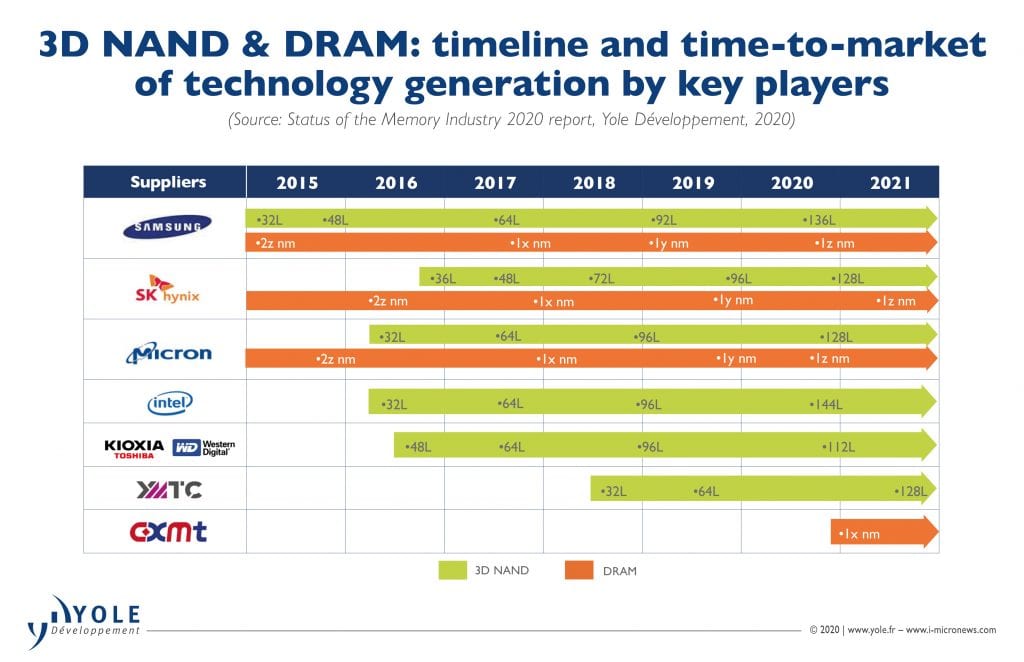

Nowadays, Chinese OEMs are obliged to purchase most of their NAND and DRAM chips from leading international suppliers, such as Micron, Intel and Western Digital (US), Samsung and SK hynix (Korea), and Kioxia (Japan). Such players are significantly ahead in terms of technology development and have fast and aggressive scaling plans. In 2019, the manufacturers with both NAND and DRAM product offerings – i.e. Samsung, SK hynix and Micron – sold more than 30% of their memory-chip production to companies located in China, and the pure NAND players – i.e. Kioxia, Western Digital and Intel – sold on average about 30% of their NAND production to China (FIGURE 2).

Amid escalating trade tensions with the West, the process of building a self-sufficient semiconductor ecosystem in China has strongly accelerated. However, leading semiconductor countries can easily put a brake on this process via trade restrictions, but at their own expense. Chinese semiconductor manufacturers rely on foreign companies to supply state-of-the-art wafer fab equipment (WFE), since local equipment suppliers are not capable of providing leading-edge manufacturing tools and the technology gap with global peers is too large to be reduced in the timespan of a few years. Hence, China is expected to remain for many years a key market for giant semiconductor equipment players based in the US (Applied Materials, Lam Research, KLA Tencor), as well as in Europe (ASML, EVG) and Japan (Canon and Tokyo Electron). Trade restrictions by the US government on chip-manufacturing technology would limit dramatically the serviceable market of such WFE players and would have a significant impact on China’s ability to manufacture memory. Besides, if US memory makers are restricted from shipping into China, they would have to find new customers to take their products while other makers in Korea or Japan would see a surge in demand from China. Chinese companies may see memory prices increase as the number of companies they can buy from is reduced.

Chinese memory companies, an overview

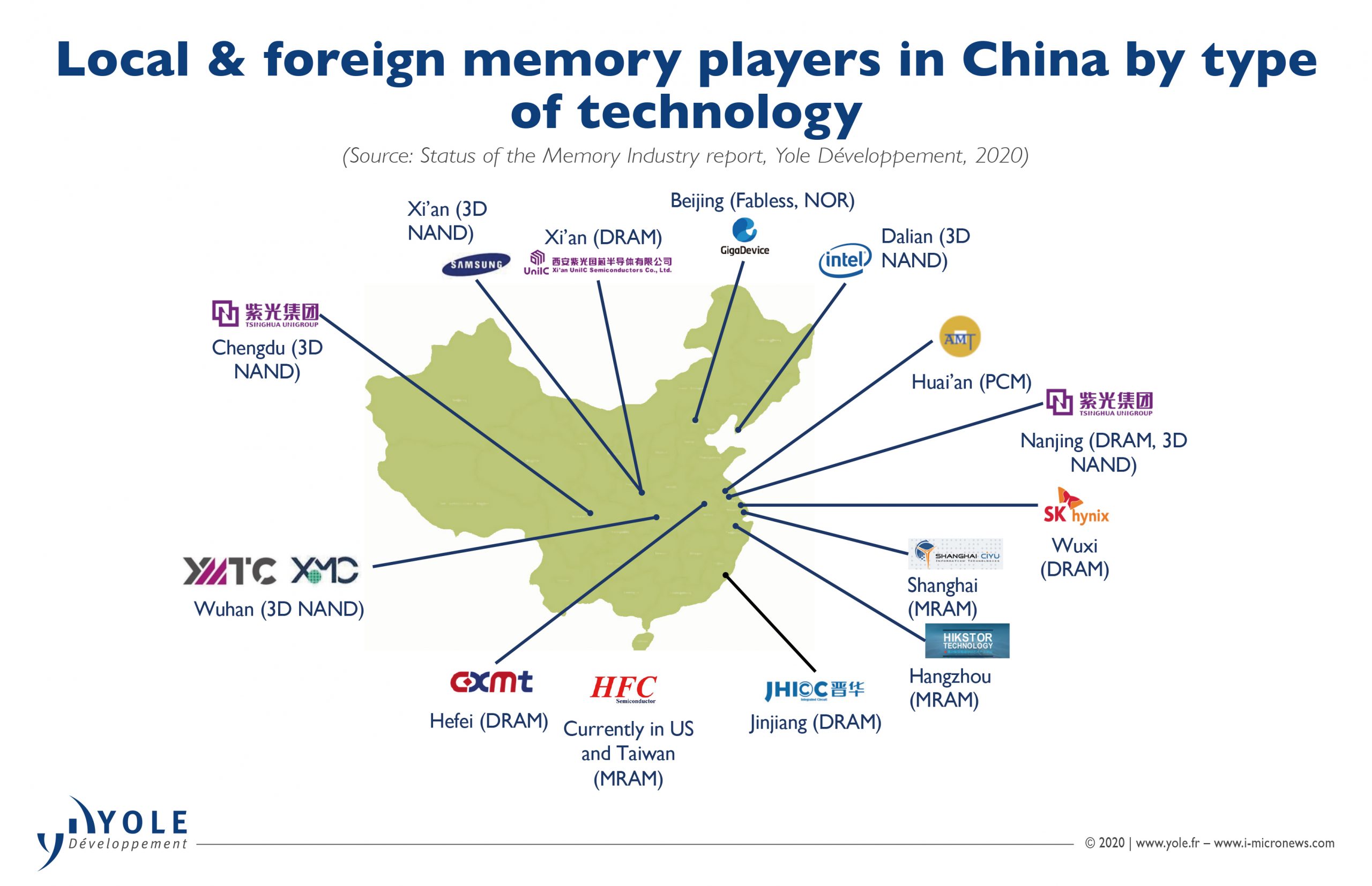

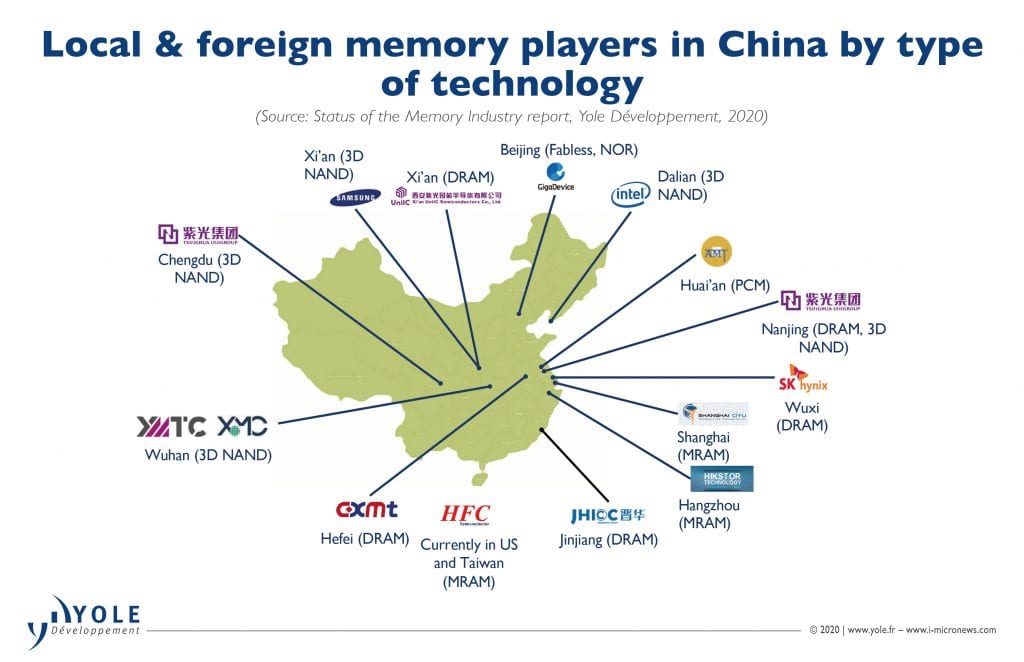

There are several semiconductor memory activities in China involving both foreign and local players (Figure 3). SK hynix, Samsung and Intel are the major foreign chip manufacturers with significant NAND and DRAM production in China. SK hynix’s DRAM fab in Wuxi has an installed capacity of 200,000 wafers per month (WPM), whereas Samsung’s and Intel’s 3D NAND fabs can produce120,000 WPM (Xi’an) and 65,000 WPM (Dalian), respectively.

The two most competitive local companies are Yangtze Memory Technologies (YMTC) and ChangXin Memory Technologies (CXMT). In the NAND business, YMTC is the leading player in China; the company is currently shipping 64L NAND domestically in low volumes (including SSDs), with 128L production in development and shipments expected in 2021. As for DRAM, CXMT is China’s most advanced DRAM company has entered the market with 8Gb DDR4 products based on the 10G1 process technology, also referred to as 19nm (note: we cannot at this stage confirm that this corresponds to the industry standards). In 2019, both YMTC and CXMT spent about US$1.5 billion in semiconductor manufacturing equipment, fueling the revenues of global WFE suppliers.

In the DRAM business, there are two other companies worth mentioning, namely Fujian Jinhua Integrated Circuit Co. (JHICC) and Tsinghua Unigroup. JHICC has been developing DRAM in collaboration with Taiwan-based UMC, but faced a critical slowdown in October 2018 when the US Department of Commerce put the company in the list of entities that cannot purchase technology goods – including software and components – from US firms due to a dispute over a IP infringement.

Tsinghua Unigroup is a well-known state-controlled industrial conglomerate and investment group operating in the framework of the governmental China Integrated Circuit Industry promotion strategy. It has control over various companies, amongst which are YMTC, Xi’an UniIC Semiconductors, UNIC Memory Technology – recently relocated to other subsidiaries – and Unimos Microelectronics (formerly ChipMos, Shanghai). In 2015, Tsinghua Unigroup initiated plans to buy Micron for US$23 billion, aiming at obtaining all the technologies and IP necessary to make DRAM and NAND, however the offer was rejected by Micron executives. Similarly, Tsinghua attempted to acquire 20% of SK hynix for US$5.3 billion, but also in this case the offer was turned down. In late 2018, Tsinghua Unigroup was reported to have broken the ground for 300mm memory fabs in Nanjing and Chengdu. The Nanjing facility will be dedicated to 3D NAND and DRAM, and the Chengdu plant to 3D NAND. In July 2019, Tsinghua Unigroup also formed a new DRAM business group in Beijing, named Ziguang.

While China is at the onset of developing its NAND and DRAM industries, it is one of the leading countries in the NOR Flash business thanks to a well-developed local supply-chain and to the activities of GigaDevice Semiconductor, a key local fabless player. In 2019, GigaDevice ranked 3rd in the world in the SPI NOR business, and 4th in the global NOR business after Winbond, Macronix and Cypress.

China has also initiated several activities toward the commercialization of novel non-volatile memory (NVM) technologies, such as spin transfer torque magnetoresistive RAM (STT-MRAM), phase change memory (PCM) and resistive RAM (ReRAM). Some of the emerging NVM companies are listed in FIGURE 3.

China has chosen its NAND and DRAM champions: YMTC and CXMT. GigaDevice will continue growing in the NOR market and beyond

Yangtze Memory Technologies Company (YMTC) – also known as Yangtze River Storage – was established in 2016 with US$24 billion funding. The company is headquartered in Wuhan where it operates the most advanced 3D NAND fab in China and has indicated a long-term production target of 300,000 WPM. With about 4,000 employees, YMTC is controlled by Tsinghua Unigroup, which holds 51% of the company. Soon after its foundation, YMTC acquired the Wuhan Xinxin Semiconductor Manufacturing Co. (XMC) foundry to leverage its 300mm fabs. XMC is the first manufacturer of image sensors based on TSV technology in China and has been working with Spansion – which later merged with Cypress – to develop and manufacture 32L NAND devices. A key milestone for YMTC was the introduction in 2018 of XtackingTM, a wafer-to-wafer stacking technology that has been in the works at XMC since 2012. In the XtackingTM approach, a 3D NAND memory array and CMOS logic circuitry are first fabricated on two different wafers, and then a hybrid bonding process is used to put the two parts together. XtackingTM is claimed to enable higher I/O speed, larger bit-density per die, shorter development time and faster manufacturing cycle.

In September 2019, YMTC announced mass production of China’s first 64L 3D NAND based on XtackingTM. From there, YMTC plans to skip the 96L technology and move to 128L to catch up with international NAND players who are about to ramp up the production of the first 1xxL 3D NAND generation (see Figure 4). It is worthy of note that YMTC has already begun the development of 128L NAND and its 128L 1.33Tb QLC 3D NAND has passed sample verification with multiple controller partners. Overall, the outbreak of the COVID-19 pandemic in Wuhan in January 2020 did not seem to have impacted significantly YMTC’s roadmap.

In May 2020, Phison announced that its controllers support 3D NAND by YMTC, paving the way for SSDs based on Chinese NAND to hit the market. YMTC could also soon launch its own-brand SSDs based on its 64L 3D NAND chips, initially targeting PC OEMs in China. So far, those chips have been adopted by two Chinese companies: Longsys Electronics for its Lexar-branded SSDs and Power Electronic Technology for its Gloway-branded SSDs.

In the present context of fierce price competition, the entrance of YMTC in the NAND market is being regarded as a possible trigger for a new round of market consolidation. Regardless of the quality level of its 3D NAND chips, YMTC will be able secure purchase support by Chinese brand vendors. At the same time, being China’s selected “memory champion”, it will enjoy robust financial support from the Chinese government.

ChangXin Memory Technologies (CXMT) – formerly known as Innotron, Hefei RuiLi or Hefei ChangXin – was founded in 2017 in Hefei (Anhui Province). The company belongs to the government-owned Hefei Industry Investment Group (HIIG). Back in 2017, CXMT announced a US$7.2 billion deal for a 300mm DRAM fab with target capacity of 120,000 WPM. CXMT completed the construction of the phase-1 facility (Fab 1) in the third quarter 2019 and brought in equipment for production of 40,000 WPM. It has approximately 3,000 employees and more than 75% of them are engineers working on various R&D-related projects. CXMT has licensed IP originally designed by Qimonda. CXMT has access to 10 million documents covering model, design, manufacturing, controls, quality systems, OPC, test modes, packaging, etc. In April 2020, CXMT also signed a licensing agreement with Rambus.

The initial target of CXMT is to capture some of the domestic DRAM demand. Besides Longsys and Gloway, also ADATA Technology – the second largest memory-module supplier – has adopted CXMT’s 8Gb DDR4 chips for DIMM products targeting the Chinese desktop/laptop market.

CXMT plans to complete development of its 17 nm process technology by 2021. The company has also outlined the future processes: in the mid-term it will use HKMG and air-gap bit line technology, whereas in longer term it will use pillar capacitors, gate all-around transistors, as well as (EUV) lithography. However, the technology gap with leading DRAM suppliers is too large – with more than 2 years of delay from global suppliers – to expect that CXMT could become a competitive player in the global DRAM market in the forthcoming years.

GigaDevice Semiconductor was established in 2005 with headquarters in Beijing and operates on a fabless model, maintaining strong relationships with foundry partners and assembly-and-test houses. GigaDevice and its foundry partner Semiconductor Manufacturing International Co. (SMIC) are fueling the Chinese NOR market with a production capacity of at least 25,000 WPM. The current product portfolio includes NOR (512Kb – 512Mb, 1-2Gb now sampling), SLC NAND (1-8Gb) memory and microcontrollers (MCU). GigaDevice also established a joint venture with Rambus – named Reliance Memory – to focus on emerging memories, mainly resistive RAM (ReRAM). Recently, it obtained licenses for more than 180 ReRAM technology-related patents and applications from Rambus and Reliance Memory.

GigaDevice has experienced strong growth with revenue up 46% in 2019 to ca. US$460 million and has plans to expand its business further. Back in 2017, it teamed up with the Hefei Industry Investment Group (HIIG) and CXMT for a 5-year agreement to develop 19nm DRAM technology at a total investment of US$2.7 billion (80% HIIG and 20% GigaDevice). The access to DRAM technology, coupled with its existing NOR flash and SLC NAND businesses, could make GigaDevice a new force in China’s memory industry.

China is poised to change the memory market landscape, starting with 3D NAND

Chinese players are starting to threaten the market’s equilibrium and could trigger profound changes in the memory business. Thanks to significant financial backing from government investment funds and a head start in R&D and manufacturing, YMTC is the most likely to succeed out of all the announced Chinese memory players. Yole expects that significant NAND output (~4%) from YMTC could reach the market in 2021, while it will take longer for DRAM. Manufacturing DRAM wafers is incredibly difficult, and it will likely take a while longer for China to achieve competitive parity with the rest of the industry. CXMT, China’s most advanced DRAM maker, will be ramping up production on the 19nm process (10G1) in 2020 – with significant delay (> 2 years) compared to the industry’s leading players.

Nowadays, the priority is clearly given to mainstream memories that are critical for the growing datacenter and mobile businesses. 3D NAND and DRAM projects have captured the majority of financial resources, and investments in other memory technologies have been either rather limited or are focused mainly on the most promising players. However, China is not overlooking at all the emerging NVM business and has initiated a number of projects that aim at acquiring new memory know-how and IP and developing new technology processes and products to get ready for the next evolution in the overall semiconductor memory business. Meanwhile, stand-alone NOR flash will remain the sturdiest memory business in China thanks to a well-developed local supply-chain and the activities of GigaDevice.

About the author

Simone Bertolazzi, PhD, is a Technology & Market analyst at Yole Développement (Yole) working with the Semiconductor, Memory and Computing Division. He is a member of Yole’s memory team, and contributes on a day-to-day basis to the analysis of nonvolatile memory technologies, their related materials and fabrication processes.

Previously, Simone carried out experimental research in the field of nanoscience and nanotechnology, focusing on emerging semiconducting materials and their opto-electronic device applications. He (co-) authored several papers in high-impact scientific journals and was awarded the prestigious Marie Curie Intra-European Fellowship.

Simone obtained a PhD in physics in 2015 from École Polytechnique Fédérale de Lausanne (Switzerland), where he developed novel flash memory cells based on heterostructures of two-dimensional materials and high-κ dielectrics.

Simone earned a double M. A. Sc. degree from Polytechnique de Montréal (Canada) and Politecnico di Milano (Italy), graduating cum laude.