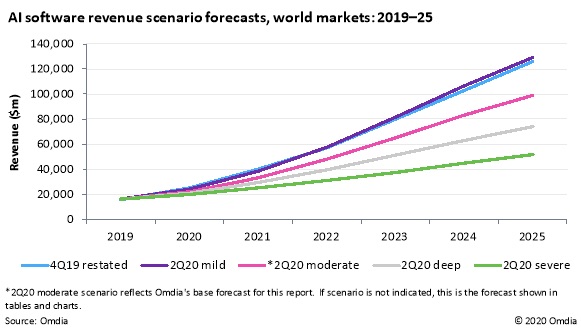

The worldwide market for artificial intelligence software will expand to $98.8 billion by 2025, rising by a factor of six from $16.4 billion in 2019—despite the varying effects of the COVID-19 pandemic across different industries, according to Omdia.

Editor’s Picks

Unsung Heroes Shine From the Chip Industry

By Dave Anderson, President of SEMI Americas “What do you see changing to be better prepared before the next crisis?”

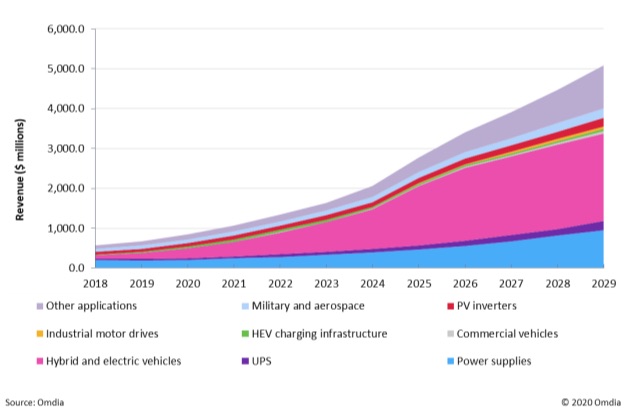

GaN and SiC Power Semiconductor Markets Set to Pass $1B Mark in 2021

The emerging market for silicon carbide (SiC) and gallium nitride (GaN) power semiconductors is forecast to pass $1 billion in 2021, energized by demand from hybrid & electric vehicles, power supplies, and photovoltaic (PV) inverters.

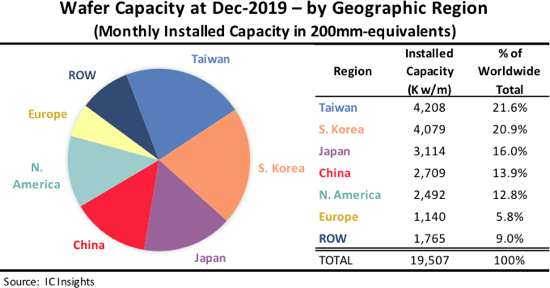

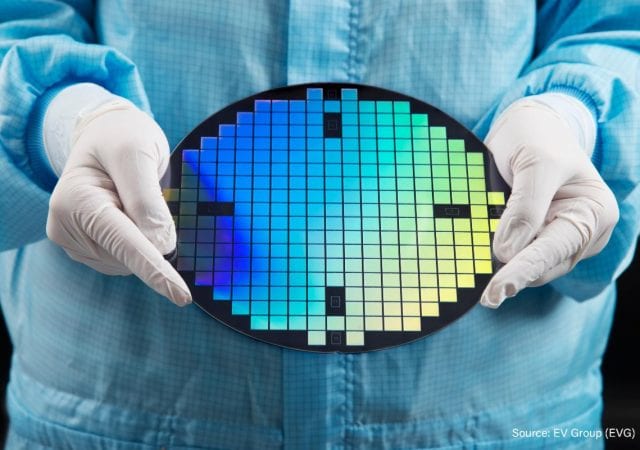

Taiwan Edges South Korea as Largest Base for IC Wafer Capacity

China capacity expansion forecast to push the country into second place in the regional rankings in 2022, trailing only Taiwan in size.

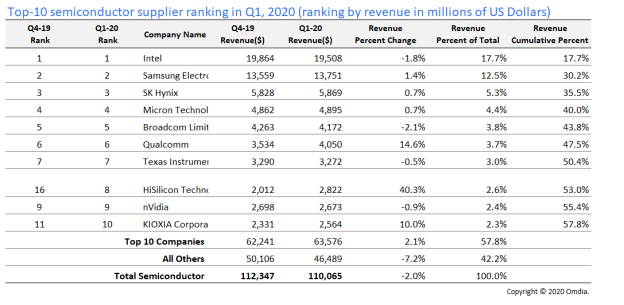

Top-10 Semiconductor Suppliers Defy Weak Market Conditions in Q1

Defying a decline in market revenue, the world’s top-10 semiconductor suppliers managed to generate revenue growth of 2.1 percent in the first quarter, as the companies benefitted from a COVID-19-driven increase in PC and server sales.

Taking Some Heat: Thermal Imaging for Fever Detection in 2020

As government and business leaders start to talk about “returning to normal,” and looking to thermal cameras to help, questions remain about how and whether the latest technology can help prevent the spread of COVID-19.

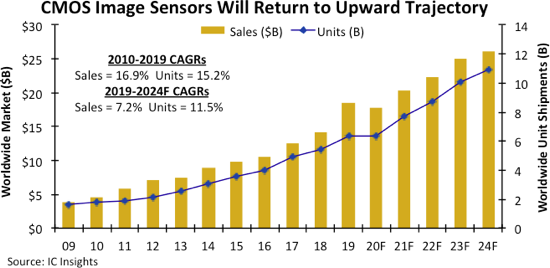

CMOS Image Sensors to Resume Record Run in 2021

The fallout from the Covid-19 virus crisis in 2020 is expected to lower CMOS image sensor sales for the first time in 10 years, but new record-high revenues are seen next year, says new O-S-D Report.

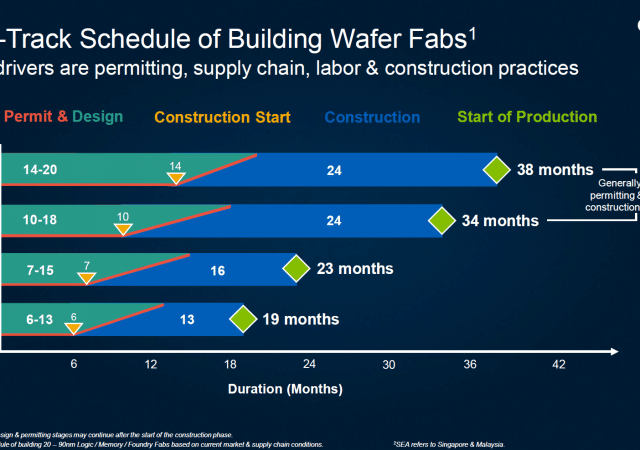

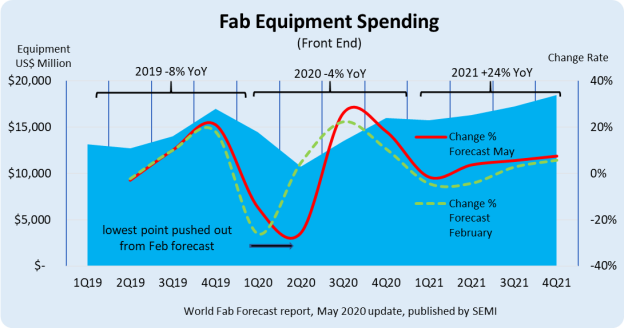

Semiconductor Fabs to Log Record Spending of Nearly $68 Billion in 2021 After 2020 Lull, SEMI Reports

2021 is poised to mark a banner year for global fab equipment spending with 24 percent growth to a record US$67.7 billion.

Memory, Power and AI Semiconductors in 5G to Hit $15.03 Billion in Revenues by 2025, Finds Frost & Sullivan

Frost & Sullivan’s recent analysis finds that the 5G AI, memory, and power amplifier (PA) semiconductor market is rapidly transitioning from a nascent stage to a growth stage.

Sampling of 2Q Semiconductor Sales Guidance Now At -5%

Six companies expecting an increase in 2Q sales; 15 anticipating a decline or flat sales.