GEORGE PARK, VP of Business Development, IPValue

Chinese firms have taken leading positions in a number of technology markets, such as DJI for drones and TikTok for social media. As part of their expansion strategies, many of these firms have set sights on strengthening their patent portfolios, particularly through patenting in their home jurisdiction. Patent applications rose 30% in China, and the China National Intellectual Property Administration granted around 700,000 patents in 2021, about a 31% rise from 2020.

In total, innovators applied for over 1 million Chinese patents in 2020, with over 80% of these from domestic Chinese applicants. In comparison, the United States’ Patent and Trademark Office received a total of over 600,000 patent applications, with about half from domestic applicants. In 2019, patent applications in China made up 43.4% of the total number of patent applications filed worldwide, followed by the United States’ 19.3%, and Japan’s 9.6%, according to the World Intellectual Property Organization (WIPO). Since 2011, the number of Chinese patent filings has grown by over 12% annually.

This growth has been attributed to several factors, including Chinese companies’ shift to more technologically advanced products, Chinese government incentives encouraging patenting, and China’s expanding domestic market. For these and other reasons, China is emerging as a leader in patent activity. This development will present new challenges for global high-technology enterprises as China-based companies continue to expand activities around the world.

The US patent regime is still robust.

Chinese enterprises’ growing attention to patent portfolios has been driven by many factors beyond the enterprises’ own expanded operations and increasing R&D investment. These factors include changes in Chinese government policy in the last few years, including streamlining the evaluation system to 20 months, bringing into effect the Fourth Amendment to China’s Patent Law, introducing a patent linkage system to align Chinese practice to international standards, and extending the term of protection from 10 to 15 years, as recently reported by IAM.

Despite these advances in the Chinese patent regime, some analysts have continued to express concerns about the quality of some Chinese patent applications. One recent industry article highlighted the identification of 815,000 applications of concern in the course of China’s crackdown on “abnormal” patent filings, which may be seen as indicative of a more relaxed patent review process in China compared to other jurisdictions.

On the other hand, some professionals have also argued that the US patent system has been weakened over the years by such factors as judges’ reluctance to award injunctions or maintain large awards in cases of infringement, an Inter Partes Review process at the US Patent Trial and Appeal Board that can be gamed by infringers, and simplistic “patent troll” narratives biasing lawmakers and judges to favor infringers.. Nevertheless, the US is still viewed by many as a venue that respects innovation and the rule of law, which may help explain why so many non-US enterprise innovators prioritize filings of US patent applications.

Chinese firms are growing in various markets, specifically the semiconductor industry.

In 2021, we witnessed three Chinese enterprises lead the pack in terms of China’s patent grants – Huawei with 7,619, Tencent with 4,537, and Oppo with 4,204, as reported by IAM. While these three are leaders in the relatively established telecommunications infrastructure, Internet services, and mobile device industries, we are also seeing increased patenting activities in areas such as artificial intelligence, machine learning, and supercomputing.

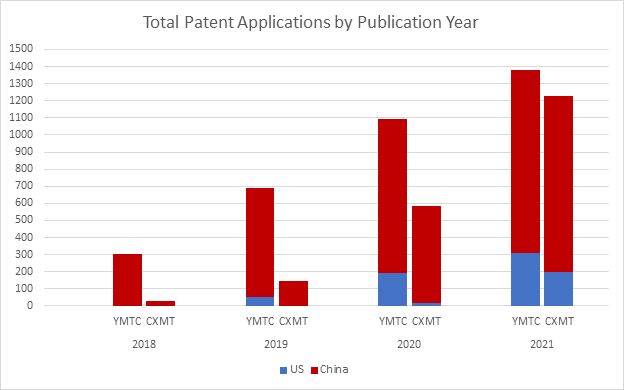

In the last few years, Chinese semiconductor companies have particularly increased the pace of patenting. Two semiconductor memory companies highlight this trend:

In the last few years, Chinese semiconductor companies have particularly increased the pace of patenting. Two semiconductor memory companies highlight this trend: Yangtze Memory Technologies Co. (YMTC) and ChangXin Memory Technologies (CXMT). YMTC and CXMT are both working aggressively to establish themselves as global players. Forbes recently reported that YMTC had increased its market share for NAND memory chips from 1% in early 2020 to 5% by mid-2022, and further, that it had recently signed a deal with Apple. YMTC and CXMT are developing their patent portfolios to enable this growth, as demonstrated in FIGURE 1 showing the growing number of Chinese and US patent applications filed by these two companies since 2018.

Click here to read the full article in Semiconductor Digest magazine.