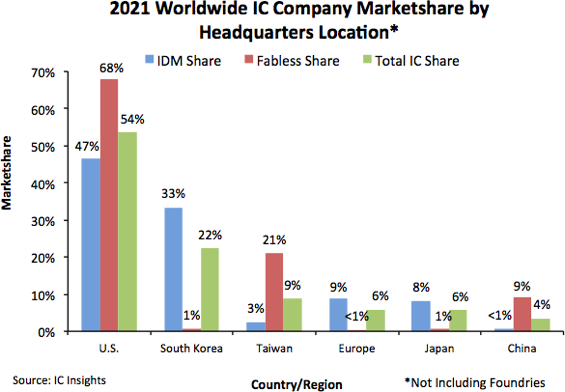

Regional marketshares of IDMs (companies with wafer fabs), fabless companies, and total IC sales were led by U.S. headquartered companies in 2021, according to the 2Q Update to The McClean Report 2022 that will be released in May.

Figure 1 shows the 2021 IDM and fabless company shares of IC sales as well as the total worldwide share of the IC market by company headquarters location (pure-play foundries are excluded from this data).

U.S. companies held 54% of the total worldwide IC market (the combined total of IDM and fabless IC sales) in 2021 followed by the South Korean companies with a 22% share. Taiwanese companies, on the strength of their fabless company IC sales, held 9% of global IC sales as compared to a 6% share held by the European and Japanese suppliers (the Taiwanese companies first surpassed the European companies in IC industry marketshare in 2020).

The South Korean and Japanese companies have an extremely weak presence in the fabless IC segment and the Taiwanese and Chinese companies have a very low share of the IDM portion of the IC market. Overall, U.S.-headquartered companies show the most balance with regard to IDM, fabless, and total IC industry marketshare.

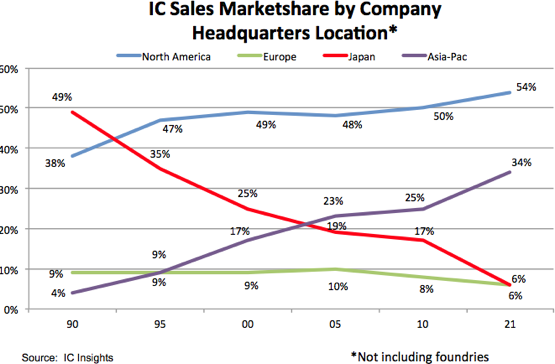

In 2021, the Japanese companies’ IC sales marketshare continued its decent that first began in the 1990s. As shown in Figure 2, Japanese companies held almost half of the worldwide IC marketshare in 1990 only to see that share fall precipitously over the past 30 years to only 6% in 2021. While the European companies’ marketshare decline has not been as steep as the Japanese companies, the European firms also held only a 6% share of the global IC market last year, down from 9% in 1990.

In contrast to the Japanese and European companies’ IC marketshare slide over the past three decades, the U.S. and Asian IC suppliers have seen their shares climb since 1990. As shown in Figure 2, the Asian companies have witnessed their share of the worldwide IC market surge from a miniscule 4% in 1990 to 34% in 2021. This increase in share by the Asian IC suppliers equates to a 31-year IC sales CAGR of 15.9%, almost double the total IC market CAGR of 8.2% over this same timeperiod.