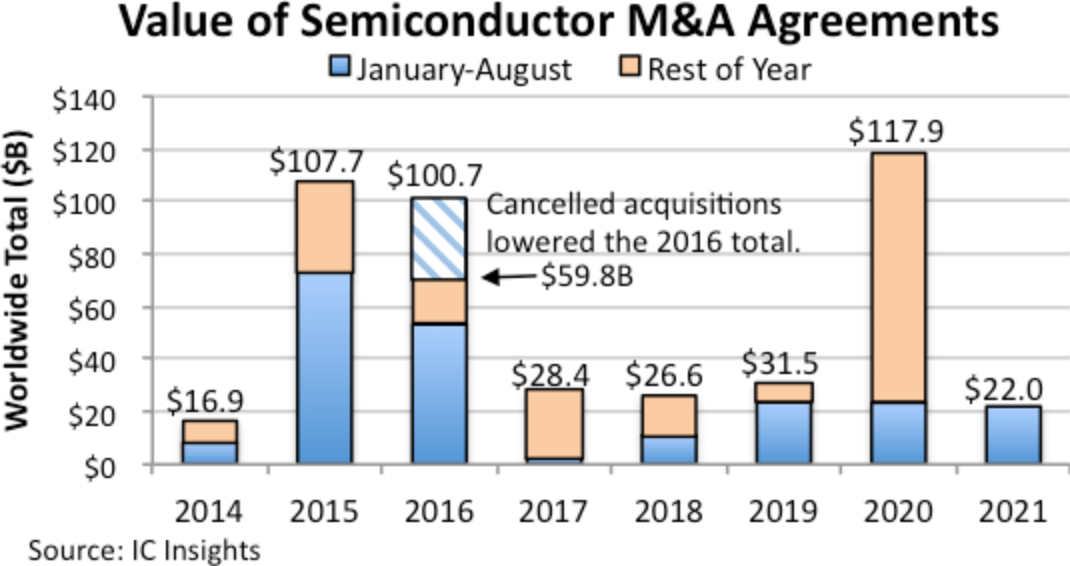

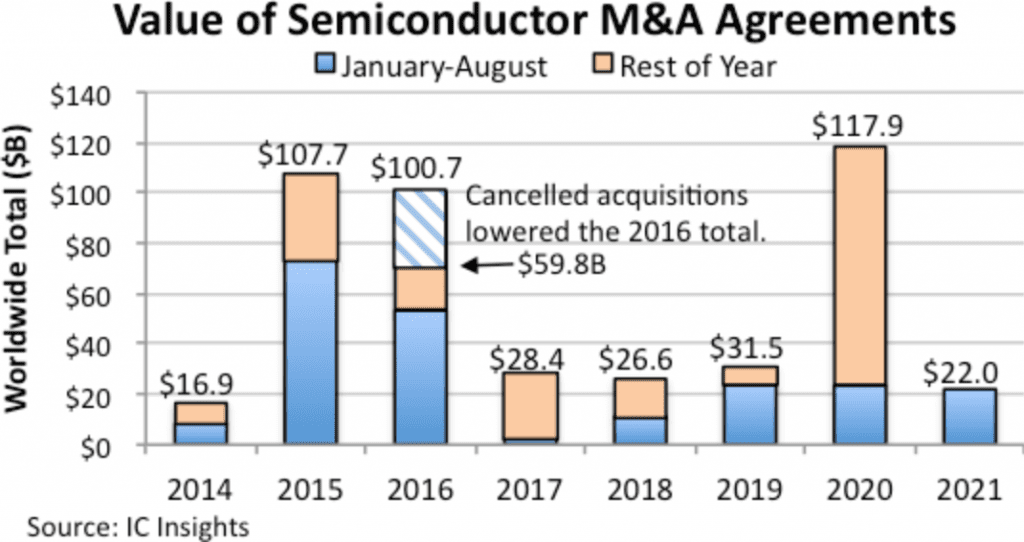

After a surge in semiconductor merger and acquisition announcements in the second half of 2020, the strong M&A momentum carried into the beginning of 2021, with purchase agreements for chip companies, business units, product lines, and related assets reaching a total value of $15.8 billion in 1Q21, setting a record-high level for the first quarter of a year. However, the pace of semiconductor acquisition agreements fell back over the next five months of 2021, putting this year’s total M&A value at $22.0 billion for the January-August timeperiod, according to IC Insights’ September Update of the 2021 McClean Report.

The combined value of semiconductor M&A agreements announced in the first eight months of 2021 was slightly below the total for the same periods in 2019 and 2020 ($24.7 billion and $23.4 billion, respectively), as shown in Figure 1.

The full-year 2020 M&A value jumped to an all-time annual record of $117.9 billion after business conditions stabilized in the second half of last year from the Covid-19 virus pandemic. Between September and December 2020, the combined value of semiconductor M&A deals amounted to $94.5 billion with the announcements of four megadeals in the four-month period: Nvidia’s planned $40 billion acquisition of processor-design technology supplier ARM; Advanced Micro Devices’ pending $35 billion purchase of FPGA leader Xilinx; Marvell Technology’s completed $10 billion takeover of interconnect chip supplier Inphi; and Intel’s announced $9 billion sale of its NAND flash business and 300mm fab in China to SK Hynix. Three of these four 2020 megadeals are still waiting for regulatory clearance, including China’s approval in the midst of its trade war with the U.S.

Like last year, the 2021 M&A total could get a significant boost in the next several months, if agreements are reached in potential megadeals that have been reported in the press and other major moves by companies looking to strengthen their positions in high-growth markets. In the summer, Intel was reportedly in talks to buy GlobalFoundries for about $30 billion to strengthen its renewed wafer foundry efforts, and a possible $20 billion-plus merger was being explored by NAND flash-memory partners Western Digital (owner of SanDisk) and Kioxia (formerly Toshiba’s Memory Division). However, GlobalFoundries and Kioxia are now believed to be moving ahead with planned initial public offerings (IPOs) of stock in 4Q21.

There were fourteen semiconductor acquisition announcements made between January and August this year with the 2021 average value being $1.6 billion versus the same number of agreements in the first eight months 2020, which had an average value per deal of about $1.7 billion.

As has been the case since in the middle of the last decade, semiconductor acquisitions in 2021 are primarily being driven by industry consolidation in a number of product and manufacturing segments as well as IC companies looking to increase their presence in strong end-use applications—particularly in industrial Internet of Things (IoT), robotics, self-driving vehicles and driver-assist automation, artificial intelligence (AI) and machine-learning capabilities, image recognition, and new high-speed wireless connections to embedded systems, including the build-out of 5G cellular networks.