PETE SINGER, Editor-in-Chief

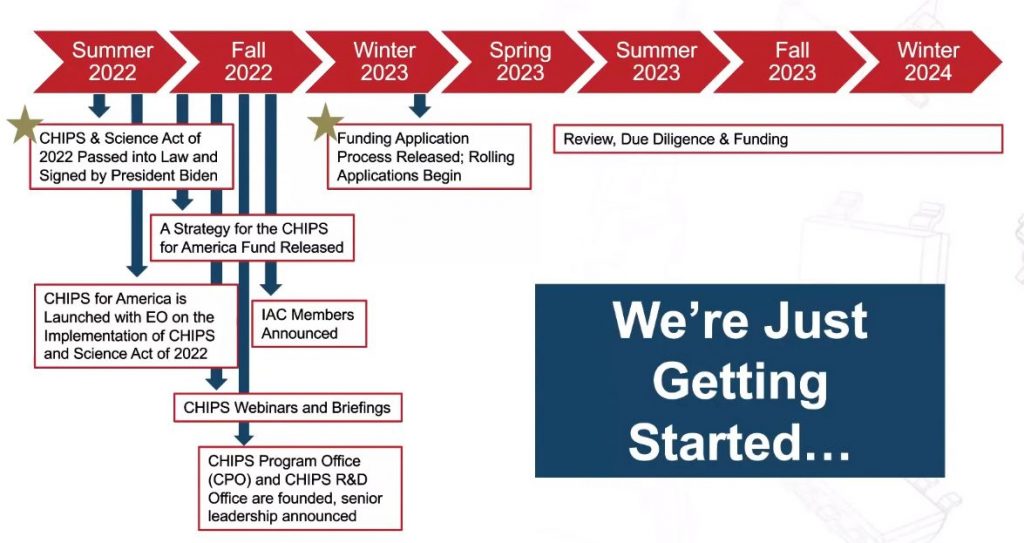

“Everybody just take a nice long, deep breath,” began Sree Ramaswamy, Senior Policy Advisor to U.S. Secretary of Commerce, speaking during a webinar on what interested parties need to consider when applying for funding from the CHIPS and Science Act of 2022. “This is a long-term program to transform the U.S. industry and the wider ecosystem. Both the actions and the outcomes will manifest over several years, if not more than a decade,“ he said.

“We will start to accept funding applications around February of 2023,” Ramaswamy said. “It will be a rolling process. We do not expect to start and stop and then start to evaluate applications after the stop. We will expect to see applicants coming in, and we will evaluate them as they come in to see if they merit further discussion, eventually leading up to the award itself. We are just getting started.”

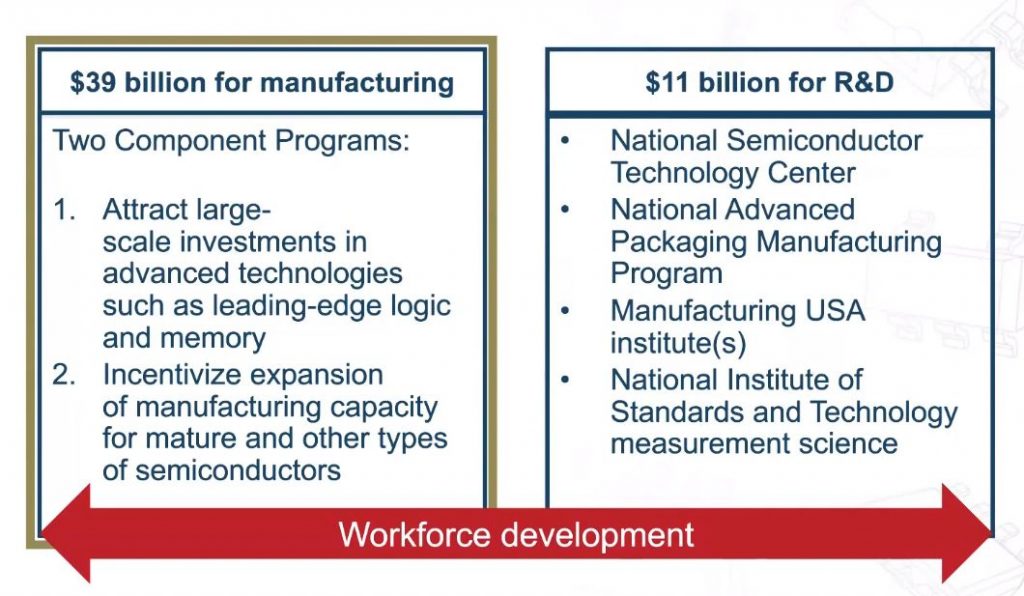

Through the CHIPS Act, $52.7 billion has been appropriated to various U.S. government agencies to provide incentives for semiconductor manufacturing and R&D and the wider ecosystem. The vast majority of that, $50 billion, goes to the Commerce Department. That $50 billion is split into two buckets, Ramaswamy said. “There is a $39 billion program for manufacturing incentives, and that program is primarily geared towards attracting large scale investments, both in leading edge logic and memory on the one hand, and in expanding manufacturing capacity for mature and other types of semiconductors. That includes a wide range of legacy, analog, logic and including things like compound semiconductors, and specialty technologies.” Separate from the $39 billion manufacturing incentive program is the $11 billion of R&D incentive (FIGURE 1). Underlying both of those is a workforce development program that has implications both on the manufacturing incentive side and on the R&D incentive side. The other $2.7 billion of CHIPS related funding goes to the Defense Department, the State Department and the National Science Foundation.

Another part of the CHIPS Act is a 25% advanced manufacturing tax credit for eligible capital expenses. “That incentive tax credit will be a significant force multiplier for the CHIPS funding, and we look forward to working with Treasury on that,” Ramaswamy said.

Wide eligibility

Expectations are that much of the funding will go to large U.S.-based IC manufacturers, such as Intel, who have been vocal about the need for such funding to build factories in Ohio, for example. Ramaswamy, however, said that a wide range of companies/groups/people are eligible for funding, including suppliers of IC manufacturing equipment and materials. “Certainly, chip manufacturers are core to the incentives program, and we would certainly hope that they are participating — not just the large companies, but also small firms that are in the ecosystem — but they’re not the only ones who are eligible to participate in the incentives program,” he said.

Eligible organizations include private sector firms, but also non-profit entities and consortia of both private entities and private and public entity. “That means consortia set up with a state government or a local government would be eligible. Consortia of non-profits would be eligible. Individual non-profit entities would also be eligible to participate in the manufacturing incentives program,” Ramaswamy said. “I would encourage folks to be thinking broadly and look to the statute to see if they’re eligible instead of making assumptions about whether they’re eligible or not.” The eligibility criteria extends to companies that can substantially finance semiconductor manufacturing facilities, or that can construct/modernize these facilities.

“We want to make sure that entities that are participating in these sorts of activities recognize that they can be potential participants in that $39 billion of manufacturing incentives. This is, of course, primarily about semiconductors, but it includes the materials that go into the manufacture of semiconductors and the tools and equipment that are used in those facilities are also eligible for manufacturing incentives,” he said.

Click here to read the full article in Semiconductor Digest magazine.