The CMOS image sensor (CIS) industry is experiencing a transformative period, with a projected growth rate of 4.7% from 2023 to 2029. This growth trajectory is reflected in the anticipated rise in CIS shipments, from 6.8 billion units in 2023 to 8.6 billion units by 2029. The market dynamics present a mixed picture, with some segments facing declines while others are thriving.

Sector-specific trends

Smartphone sales, traditionally a significant driver of CIS demand, are experiencing a downturn in long-term sales, replacement rate being slowed down due to the recent inflationary context. Similarly, productivity imaging for laptops and tablets is also on a decline, following the end of stay-at-home policies. Conversely, the automotive sector is a bright spot, benefiting from stringent safety regulations and increasing automation demands. Automotive cameras are increasingly critical for advanced driver-assistance systems (ADAS) and autonomous driving technologies.

The security sector saw a stagnation in CIS revenues in 2022, but growth resumed in 2023 as the demand for enhanced security applications across various domains increased. In the industrial sector, factory automation and new machine vision applications in agriculture and traffic monitoring had been driving further CIS growth, even though growth will be more moderate for the next years. These industrial applications still require high-performance sensors, contributing to the sector’s robust demand.

Revenue and production insights

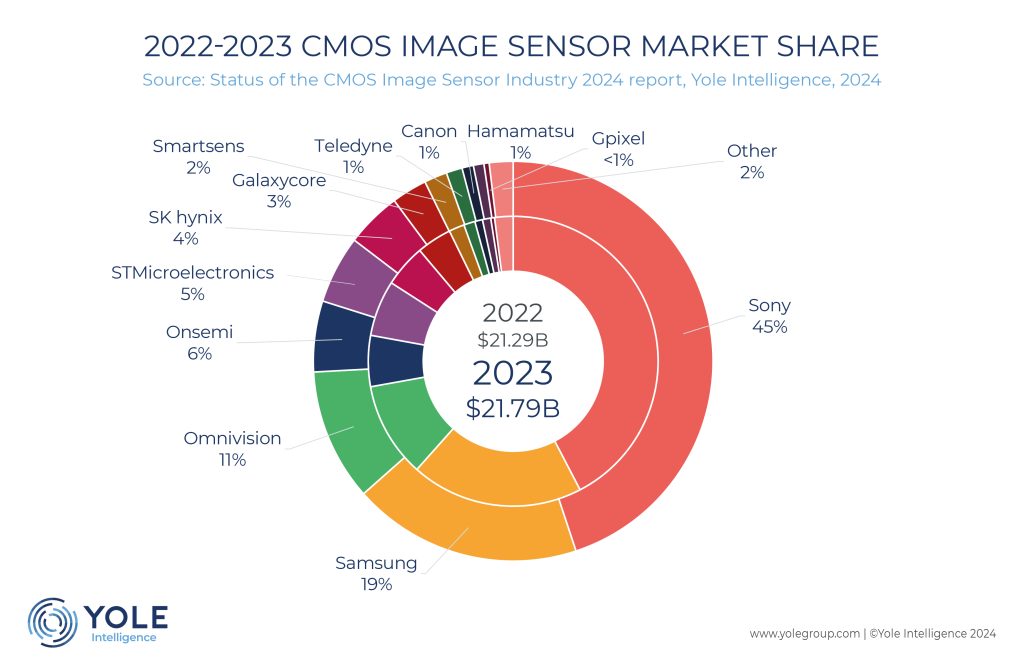

The average selling price (ASP) for CIS products exceeded US$3 in 2022 and is expected to remain above this threshold, indicating a steady revenue stream. According to Yole Group’s Status of the CMOS Image Sensor Industry 2024 report, the total revenue from CIS is projected to grow from US$21.8 billion to US$28.6 billion, reflecting a 4.7% compound annual growth rate (CAGR). Despite a drop in CIS wafer production in 2022, a 3.8% CAGR is forecasted for the next six years. Stacked CIS wafers, particularly those with triple-stack architecture, are maintaining a dominant production share of 75-77%.

Competitive landscape and market share

The competitive landscape of the CIS market is witnessing significant shifts. Sony is on track to achieve a 50% market share, driven by the success of its LYTIA brand and the expansion of its Fab 5 facility. In contrast, Samsung and SK Hynix are shifting their focus towards the memory business due to a drop in demand for their CIS products.

The US-China economic conflict initially benefited Chinese CIS players, who capitalized on US sanctions against Huawei. However, these players are now targeting higher-value markets like automotive and industrial sectors. Onsemi and SK Hynix’s growth has plateaued, while STMicroelectronics is diversifying with global shutter products. Galaxycore is facing challenges in lower-end markets, whereas Smartsens is recovering in the mobile and automotive sectors.

By 2024/2025, the Chinese smartphone market’s growth is expected to benefit local CIS suppliers. The automotive segment is set to grow steadily, with Sony and Samsung competing fiercely against onsemi and Omnivision. Investments in emerging technologies have slowed, but new products are anticipated in the next couple of years.

Technological innovations and future prospects

The CIS industry is advancing rapidly with innovations aimed at improving performance, integrability, and expanding sensing capabilities. Amidst consumer market stagnation, leading companies are focusing on enhancing the value of CIS by improving low-light performance, data management, compactness, and power efficiency.

Sony’s triple-stack sensor architecture has seen significant design wins, underscoring its technological edge. Omnivision and STMicroelectronics are also exploring similar architectures, with logic stacking moving towards the 22nm node and Fully Depleted Silicon On Insulator (FDSOI) technology for ultra-low power sensing applications. Canon’s Single-Photon Avalanche Diode (SPAD)-based color camera is setting new standards for low-light security imaging.

Event-based imaging is another emerging trend, with companies like Prophesee and Alpsentek, attracting investments for their innovative solutions. Metasurface technologies are enhancing product compactness and performance, particularly in applications such as biometrics, eye tracking, and robotics. Short-Wave Infrared (SWIR) imaging is gaining traction for both consumer and automotive markets.

The transition from imaging to sensing is becoming more pronounced as CIS technology expands into X-ray, UV, SWIR, polarization, and multispectral imaging. These advancements are not only broadening the application spectrum of CIS but also enhancing its overall value proposition in the market.

Conclusion

The CMOS image sensor industry is poised for sustained growth, driven by technological innovations and expanding applications across various sectors. While some market segments face challenges, the overall outlook remains positive, with significant opportunities in automotive, security, industrial, and advanced imaging technologies. As companies navigate this evolving landscape, those investing in cutting-edge technologies and diversifying their application focus are likely to emerge as market leaders.

Source:

Status of the CMOS Image Sensor 2024 report, Yole Group, 2024