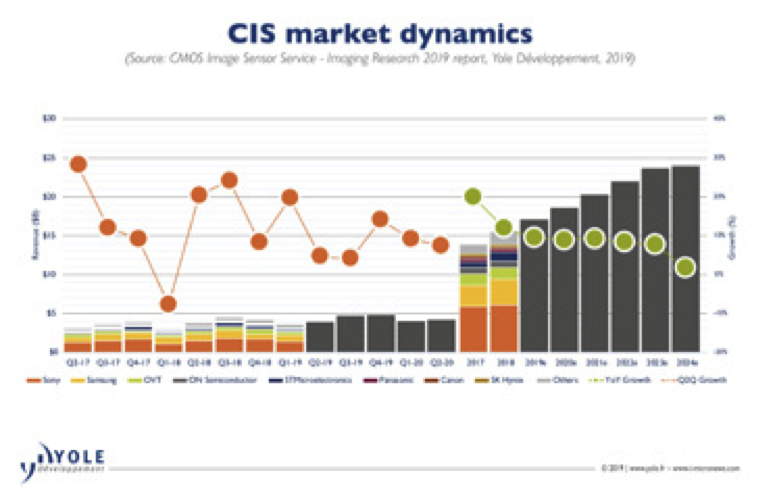

“CIS has become a key market segment in the semiconductor industry, reaching US$15.5 billion in 2018”, asserts Chenmeijing Liang, Technology & Market Analyst, Photonics, Sensing and Display at Yole Développement (Yole). And Yole’s analyst adds: “And it should exceed 3% of the total semiconductor sales”.

This segment has seen Sony become a significant semiconductor player, alongside other CIS players such as Samsung, OVT, and ON Semiconductor. Innovative approaches like wafer stacking technologies have emerged specifically for CIS, and have become key develop- ments for the semiconductor market in general. In the context of a fierce rivalry in the technology sector, imaging has become a key focal point of OEMs and the entire semiconductor supply chain (Figure 1).

The market research & strategy consulting company announces today a new product, published in quarterly installments. Titled CIS Service – Imaging Research, this monitor contains world-class research, data, and insights pertaining to the imaging markets. With a full package including an Excel database with quarterly update on historical and forecast data, a PDF slide deck with graphs and analysis covering the expected evolution and a direct access to Yole’s analysts for one year. The new product powered by Yole, proposes a detailed description of the CIS markets’ evolution in terms of revenue, shipments, capex, and near-term price evolution, as well as demand per market segment and CIS technology evolution. NIR (near infrared) sensing is also included in this quarterly imaging monitor, as well as detailed profiles of main suppliers.

In 2007, smartphones began disrupting the imaging market and its corresponding technology. Just five years later, the production peak for digital still-cameras was reached, and phones became the primary imaging device for consumers. “New use-cases linked to social media began fueling the need for high-quality rear (world-facing) cameras for photography, quickly followed by front (selfie) cameras for videos and top-grade photography”, details Pierre Cambou, Principal Analyst, Imaging at Yole.

2015 – 2017 saw additional cameras attached, either to extend the zoom capability on the rear or to provide 3D biometric interaction on the front. Pierre Cambou adds: “In 2019, 3D rear cameras are pushing the trend further to the back, improving the photographic experience and making inroads into AR (augmented reality) applications.”

In 2019, the overall attachment rate for CIS cameras per phone is moving towards in aver- age of 2.5 units per phone, and the growth rate for CIS attachment will rise from 6.5% to 7.8% from 2019 to 2021. Amidst stagnant smartphone volume, CIS attachment rate is a central, successful strat- egy for main smartphone OEMs like Apple, Huawei, and Samsung.

Alongside mobile, which is the main application market with 70% of all CIS sales, security and automotive are experiencing double-digit growth and have grown into billion-dollar CIS segments.

So what do the upcoming quarters hold? 2019 looks slightly different than 2018, confirm Yole’s analysts with the new tool, CIS Service – Imaging Research. With a low Q1, the CIS market faces a slowly eroding ASP (average selling price) since most players can now match Sony’s proposition. Nevertheless, the market re- mains constrained in terms of capacity, with capex the main limiting factor since customers always want more CIS cameras. The outlook though remains very positive. Yole announce a range of 10% year-on-year in 2019 and 8% over the long-term. In 2024, CIS is heading forUS$24 billion. Without doubt, the CIS industry is still showing a bright future…

These results will be presented in Shenzhen, China beginning of September. Therefore, Yole is proud to collaborate once more with the China International Optoelectronic Expo (CIOE) to organize a new edition of the Executive Forums on Photonics, from September 4 to 6, 2019 in Shenzhen, alongside the 21th CIOE.

4 dedicated sessions have been planned: IR imaging – Si photonics – LiDAR – 3D sensing. List of speakers is impressive: HIK Vision, HP Electronics, Innoviz, Intel, LGE, Oxford Instruments, Sicoya, System Plus Consulting, Teem Photonics, ULIS, Valeo, Yole Développement and more… Program & registration oni-micronews.com.