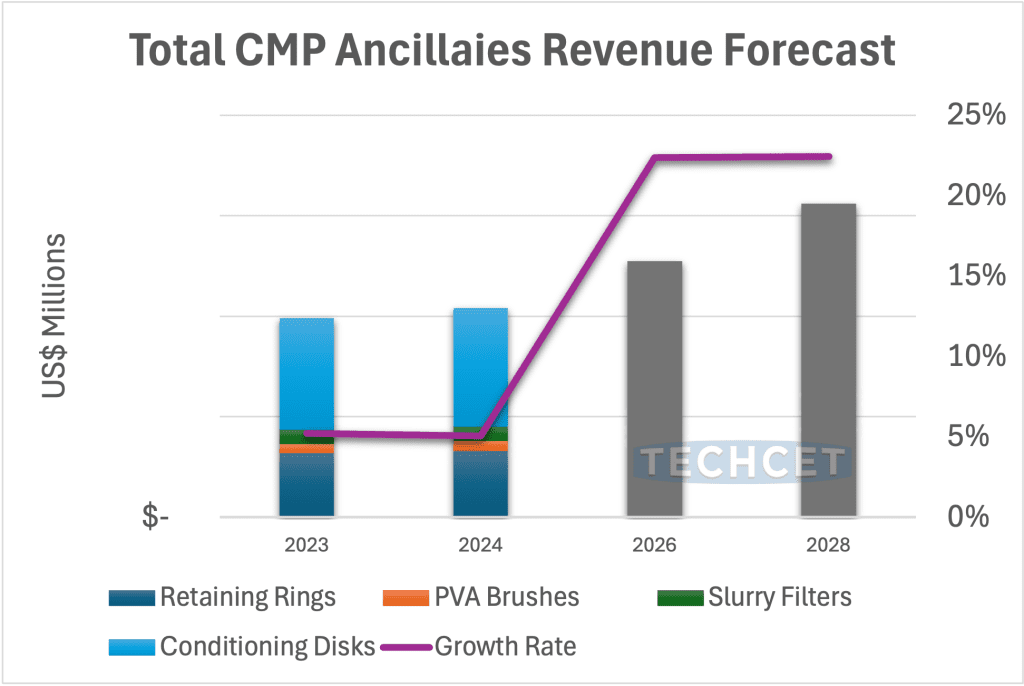

TECHCET— the electronic materials advisory firm providing semiconductor materials supply chain information —is forecasting ~ 11% growth for CMP Ancillaries revenues (including pad conditioners, PVA brushes, POU slurry filters, and retaining rings) in 2025, which is estimated to reach US$1.15 B. This increase is primarily driven by recovering wafer volumes and increasing usage in Cu/W metal CMP steps. 2024 is expected to see modest recovery of about 5%, with CMP pad conditioning disks holding the largest revenue and volume share, as indicated in TECHCET’s 2024-2025 Special Edition Market Report on CMP Ancillaries.

Through 2028, TECHCET is forecasting a 10% CAGR for CMP Ancillaries as the most advanced Logic, 3D NAND and DRAM devices continue to move into HVM. Additionally, upcoming fab expansion plans over the next 2-4 years will continue to increase demand for CMP ancillaries.

Device makers continue to look for ways to reduce consumables costs from their suppliers. However, in the current market climate with persistent inflation and the high degree of customization, there is little chance that prices will decrease. Cost drivers are shifting from the supply side to the demand side, allowing more room in price negotiations and margins. New process steps deemed critical for advanced packaging schemes and devices, such as 3DHI, chiplet integration, multi-Vt GAA, 3DNAND, and 3D DRAM, are all driving developments in improved performance and reduced defectivity requirements. These advances come at a premium, which are being reflected in the shift in conditioners to more expensive CVD diamonds.

The newly released TECHCET Special Edition Report on CMP Ancillaries contains details on market drivers and technology trends as well as detailed supplier profiles. For the full table of contents or to request a sample report, visit https://techcet.com/product/cmp-ancillaries-2/.