By Pete Singer, Editor-in-Chief

The market drivers behind the semiconductor industry’s explosive growth are well known: AI, 5G, cloud computing, super computing, the IoT, gaming, automotive, medical and smart manufacturing, and of course, the work from home trend driven by the global pandemic.

This growth has, in turn, created a true data explosion. Projections are that the world will be creating 13.8 zettabytes (ZB) of data in 2021, rising to 30 ZB in 2022 and – by 2025 –57 ZB per year. One zettabyte is equal to one sextillion bytes or 1021 bytes. This explosion is pushing the need for faster, higher-bandwidth communications to move that data around, and AI computing to make sense of it.

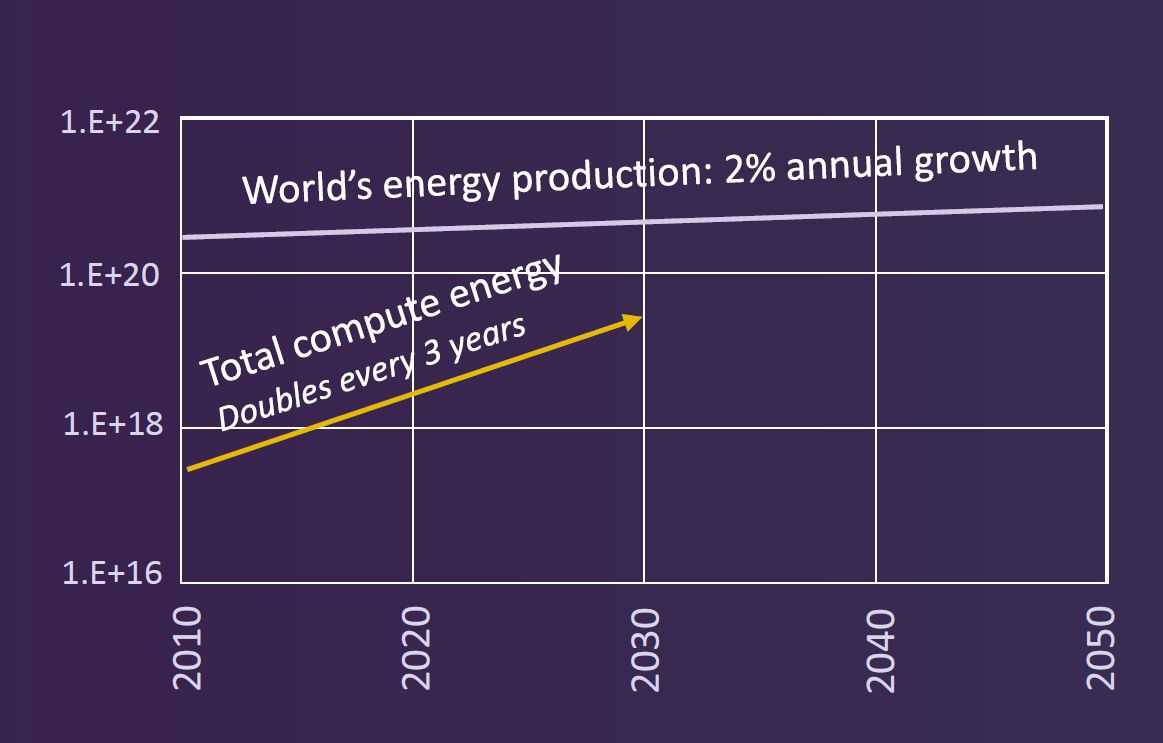

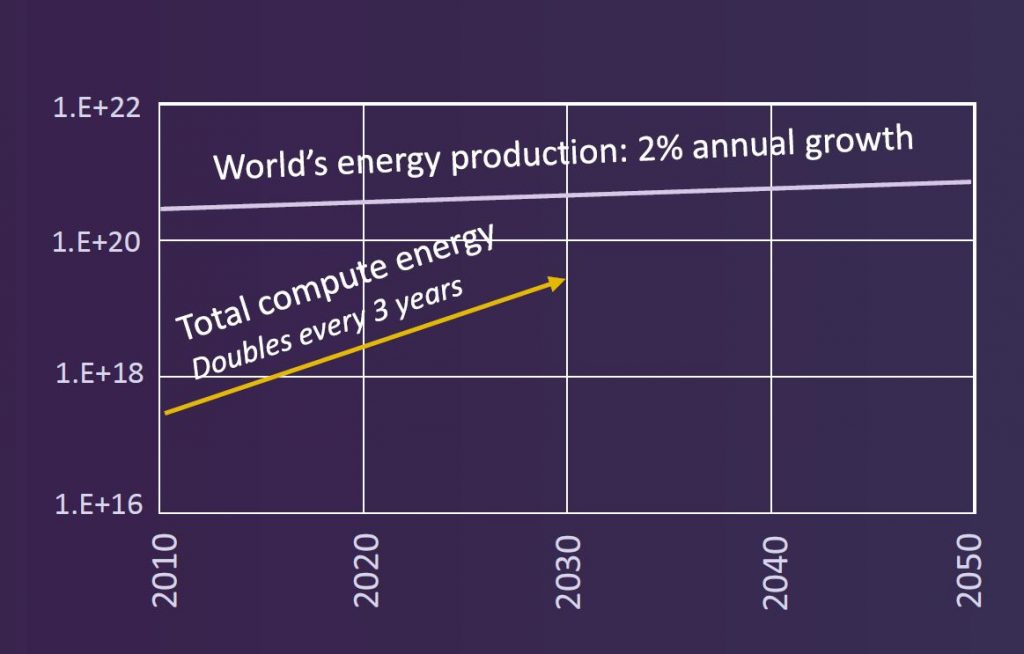

This sounds like great news – what industry doesn’t like to see explosive growth? The problem is that this huge amount of data processing consumes huge amounts of power. According to SRC’s Decadal Plan for Semiconductors, the total energy consumption by general-purpose computing continues to grow exponentially and is doubling approximately every three years. The world’s energy production, on the other hand, is growing only linearly, by approximately 2% a year. “There’s a big difference between doubling every three years and 2%,” said Kate Wilson, President of Edwards Vacuum. “Semiconductors will use the global electricity supply — all of it — by somewhere between 2040 and 2050 with those projections.”

Something needs to change, but what? The Decadal Plan describes a scenario where market dynamics will limit the growth of the computational capacity (i.e., people will need power for other things), but suggests that what is really required is a radical improvement in energy efficiency of computing. There’s also an important environmental element to consider. “As an industry, we really need to look at the impact of our products on the global power usage and then consequently on the environment,” Wilson said. She noted that power generation globally is gradually moving to renewables, but it is taking quite a long time. “How we can influence and impact governments and countries to change that infrastructure more quickly?” she asks.

Environmental impact

Chip makers are responding. Earlier this year, in September, foundry giant TSMC announced a commitment to reach net zero emissions by 2050. “TSMC is deeply aware that climate change has a severe impact on the environment and humanity. As a world-leading semiconductor company, TSMC must shoulder its corporate responsibility to face the challenge of climate change,” said Dr. Mark Liu, Chairman of TSMC and Chairman of the Company’s ESG Steering Committee, when making the announcement.

The semiconductor industry has also played a leadership role in coordinating worldwide action to reduce greenhouse gas (GHG) emissions, despite being a minor contributor to GHG emissions (electronics manufacturing in the US in 2020 it accounted for 0.23 % of direct GHG emissions reported by industrial sources to the EPA’s Greenhouse Gas Reporting Program and only 0.09% of GHG emissions from all sources included in the EPA’s broader Greenhouse Gas Inventory). In an article in the November issue of Semiconductor Digest, “The Time is Now: Sustainable Semiconductor Manufacturing,” Mike Czerniak, Environmental Solutions Business Development Manager at Edwards Vacuum notes that, in 1999, quite early in the history of global warming awareness, semiconductor manufacturers committed to reduce PFC emissions by at least 10% below baselines for each region over the next 10 years. By 2010 they had achieved a reduction of 32%, far surpassing the original goal. At that time, they recommitted to further reductions, targeting a normalized emission rate 30% lower than the 2010 baseline. By 2020 they had achieved a 22.9% decrease, this despite increasingly complex products with more layers, and advanced etch processes that use new gases.

Greenhouse gas emissions are often categorized into three groups or ‘Scopes’ by the most widely-used international accounting tool, the GHG Protocol. Scope 1 covers direct emissions from owned or controlled sources. Scope 2 covers indirect emissions from the generation of purchased electricity and other resources consumed by the reporting company. Scope 3 includes all other indirect emissions that occur in a company’s value chain.

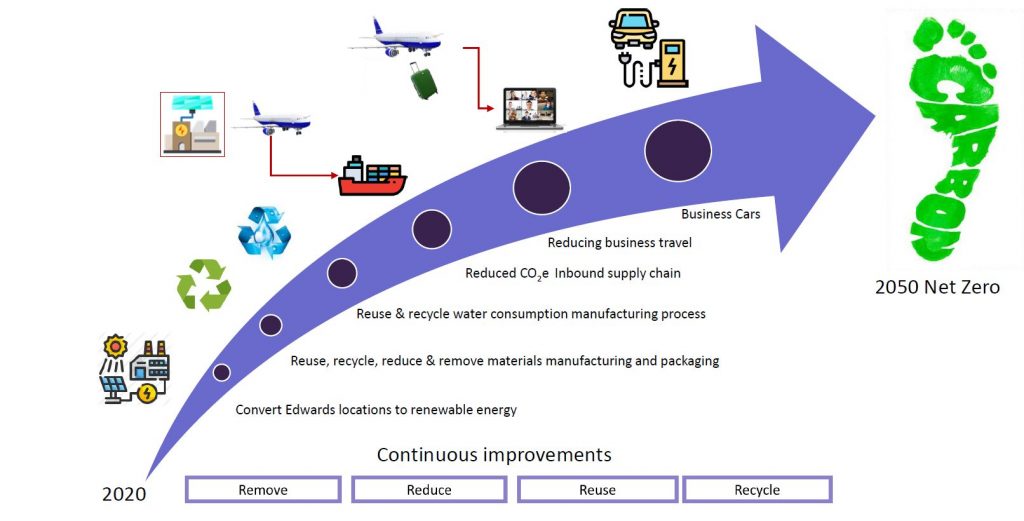

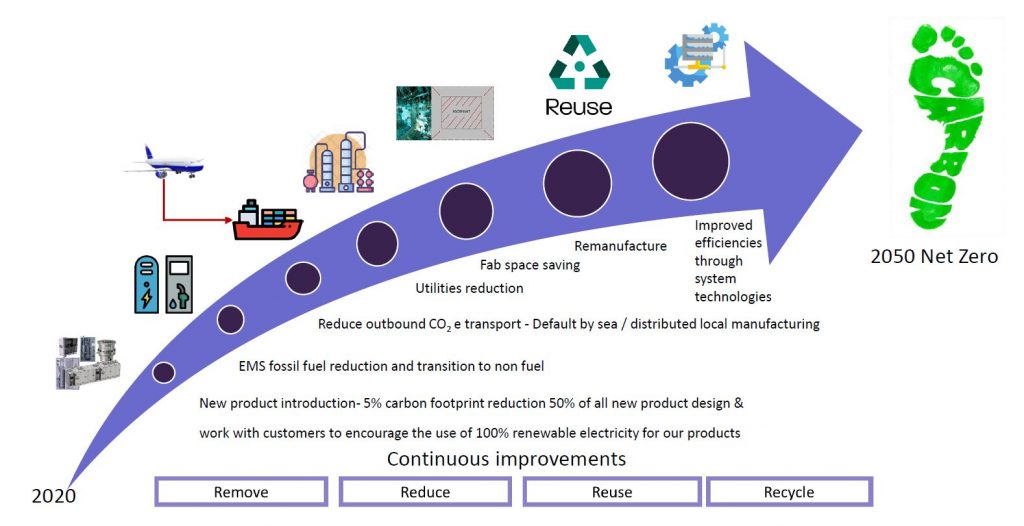

Increasingly, this same kind of “Scopes 1, 2, 3” categorization is being applied to all aspects of environmental sustainability. “It’s not just global warming but the whole environmental impact of the industry,” Wilson said. Figure 2 shows what Edwards is doing internally (or upstream) to address Scope 1, 2 and 3 and Figure 3 shows the company’s initiatives on the customer (or downstream) Scope 3 side.

The Science Based Target Initiative (SBTi) is another way of addressing the issue (www.sciencebasedtargets.org). Science-based targets provide companies with a clearly-defined path to reduce emissions in line with the Paris Agreement goals. “One thing I’m particularly proud of is the Atlas Copco group, which Edwards been a part of since 2014, has signed up to science-based targets,” Wilson said.

To work effectively, science-based targets and Scopes categorization need to be embraced by all parts of the supply chain, and that requires collaboration. “There are really concrete things that we can all do together,” Wilson said. “We need to map where that takes us to on science-based targets and see where the gaps are and work together to resolve those. The closer we work together, the better we will be at eliminating the waste, improving the efficiencies and finding real step change solutions to get to a different level.”