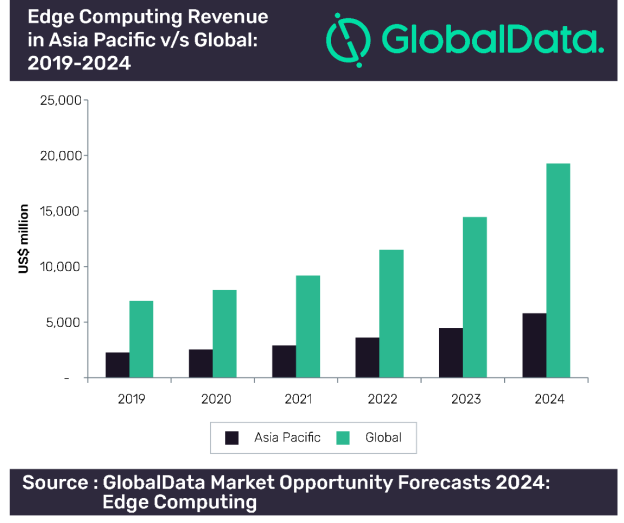

Edge computing is poised to garner a lot of interest in Asia-Pacific, as emphasis on improving networking technologies for remote working grows amidst the current coronavirus (Covid-19) pandemic. The market for edge computing in APAC is estimated to grow at a compound annual growth rate (CAGR) of 21% between 2019 and 2024 to reach US$ 5.8bn in 2024, says GlobalData, a leading data and analytics company.

It is not just the current situation that will push the adoption of edge computing in APAC, the Covid-19 situation is expected to accelerate the digital transformation initiatives amongst the enterprises in APAC, which would also necessitate the adoption of edge computing.

By 2024, Asia-Pacific is thus forecast to be the second-largest market in terms of edge computing behind North America. The growth in the APAC region would be primarily driven by China and Japan, which would together account for approximately 61% of the overall edge computing revenue in the region.

Manufacturing, BFSI, energy, information technology and consumer goods would be the five leading verticals in terms of edge computing spend and together account for half of the overall spending in 2024.

Shamim Khan, Senior Technology Analyst at GlobalData, comments: “IoT and 5G will be the crucial drivers for the increased adoption of edge computing offerings in the APAC region. Together, these technologies are expected to transform whole industries and create a host of new opportunities for enterprises.”

For manufacturing companies in APAC, Industrial IoT with edge computing would allow streamlining of industrial processes, improving supply chain and enabling industrial equipment work without or with less human intervention. Similarly, financial markets can leverage the benefit of edge computing secure gateways to enhance the security and privacy of data for enhanced banking solutions.

In addition, the surge in the connected devices ecosystem, comprising of smart cities, connected vehicles, and smart homes would further result in the generation of huge volumes of data, which would need to be stored, analysed and processed in order to facilitate timely and effective decision making.

Shamim continues: “Edge computing would be key in handling most of these challenges, as decentralized processing would allow for excellent response times and reduced latency.”

The recent weeks have seen a host of activity on this front with Amazon Web Services announcing updates to its ‘Snow’ family of edge computing, Microsoft announcing Azure Edge Zones, and Google unveiling its Global Mobile Edge Cloud (GMEC) strategy. While these offerings are primarily targeted at the US market for now, these are expected to shortly make their way to APAC, given the market for edge computing in the region. The availability of these offerings will unlock an entire new range of distributed applications with a consistent architecture for enterprises in APAC.

Shamim concludes: “A large number of applications across enterprises would spur up in the region, with 5G networks becoming more prevalent in the region. The shift from a cloud-based centralised model to intelligence at devices would, in turn, require next-generation applications and new IT architectures. The demand for edge computing will grow, as the enterprises would increasingly continue to link core and edge resources for supporting their digital transformation initiatives.”