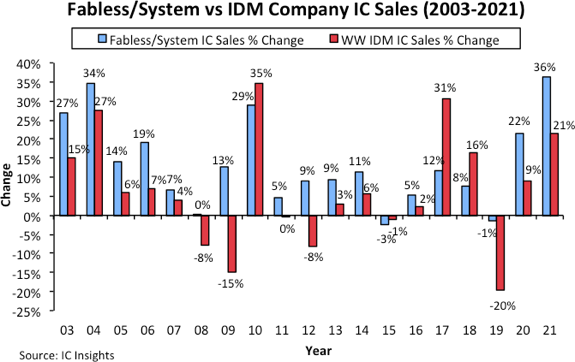

While there is a relatively close relationship between the annual market growth of the fabless IC suppliers and foundries, the sales growth rates of fabless IC companies versus IDM (integrated device manufacturers) IC suppliers have usually been very different (Figure 1). Typically, the sales growth rate registered by the fabless IC suppliers is better than that displayed by the IDMs. In fact, the first time on record that IDM IC sales growth outpaced fabless IC company sales growth was in 2010 when IDM IC sales grew 35% and fabless IC company sales grew 29%.

The disparity between fabless IC supplier growth and IDM IC supplier growth has been especially pronounced over the past three years. In 2019, driven by a collapse in the memory market, IDM IC sales plunged by 20%. In contrast, fabless IC supplier sales declined only 1%. In 2020, fabless IC company sales jumped by 22% while IDM sales increased by only 9%. Last year, fabless IC company sales surged 36% while IDM sales were up by 21%.

It is interesting to note that if Intel was excluded from the IDM listing in 2020 and 2021, total IDM supplier IC sales would have been up by 29% last year, eight points better than when the company is included. Moreover, if HiSilicon (which saw its sales plummet 81% last year) was excluded from the fabless company figures in 2020 and 2021, total fabless company IC sales growth last year would have been an amazing 44%!

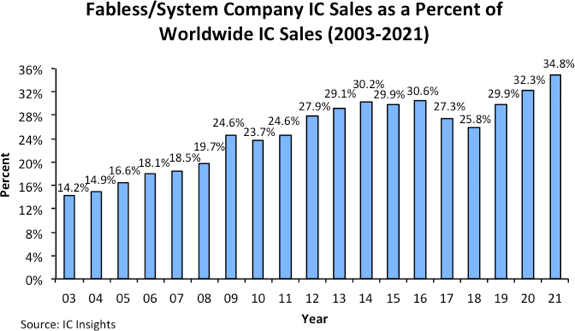

Fabless/system IC company sales were up 2.7x from 2011 to 2021 ($66.4 billion to $177.7 billion) whereas the total IDM IC sales were up 63% over this same timeperiod, from $203.9 billion in 2011 to $332.8 billion in 2021. Given the typical disparity in the annual growth rates in favor of the fabless/system IC suppliers, it comes as little surprise that, except in 2010, 2015, 2017, and 2018, fabless/system IC companies increased their share of the total IC market (Figure 2).

In 2003, fabless/system IC company sales accounted for only 14% of the total IC market. With the memory market soaring in 2017 and 2018, a market in which the fabless companies have very little share, the fabless share of the total IC market shrank in both of those years. However, with the memory market registering significant weakness in 2019, this situation reversed itself, with the fabless share of the total IC market jumping 4.1 percentage points that year to 29.9%.

With a 36% surge in fabless company IC revenue in 2021, the fabless companies’ share of worldwide IC sales set a new all-time record high in 2021 at 34.8%. Over the long-term, IC Insights believes that fabless/system IC suppliers, and the IC foundries that serve them, will continue to be a strong force in the total IC industry landscape with their percentage share of the total IC market expected to reach the high-30s over the next five years.