The emerging market for silicon carbide (SiC) and gallium nitride (GaN) power semiconductors is forecast to pass $1 billion in 2021, energized by demand from hybrid & electric vehicles, power supplies, and photovoltaic (PV) inverters.

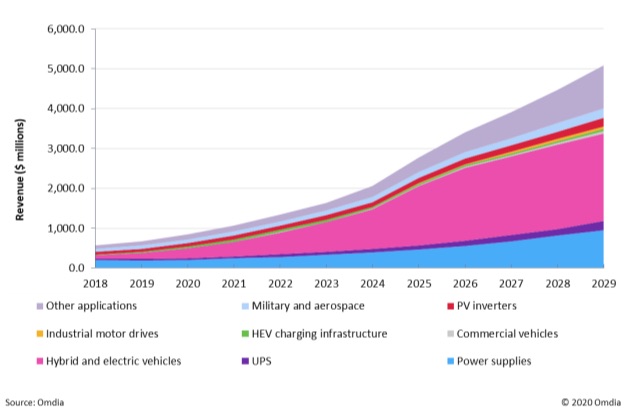

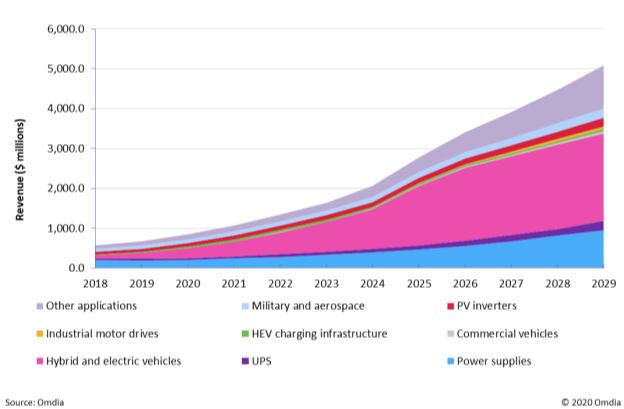

Worldwide revenue from sales of SiC and GaN power semiconductors is projected to rise to $854 million by the end of 2020, up from just $571 million in 2018, according to Omdia’s SiC & GaN Power Semiconductors Report – 2020. Market revenue is expected to increase at a double-digit annual rate for the next decade, passing $5 billion by 2029.

These long-term market projection totals are about $1 billion lower than those in last year’s edition of this report. This is because demand for almost all applications has slowed since 2018. Moreover, device average prices fell in 2019. A note a caution: The equipment forecasts used to create this year’s forecast all date from 2019, and do not take account of the impact of the COVID-19 pandemic.

Global market revenue forecast for GaN and SiC power semiconductors (millions of US dollars)

SiC Schottky diodes have been on the market for more than a decade, with SiC metal-oxide semiconductor field-effect transistors (SiC MOSFETs) and junction-gate field-effect transistors (SiC JFETs) appearing in recent years. SiC power modules are also becoming increasingly available, including hybrid SiC modules, containing SiC diodes with Si insulated-gate bipolar transistors (IGBTs), and full SiC modules containing SiC MOSFETs with or without SiC diodes.

SiC MOSFETs are proving very popular among manufacturers, with several companies already offering them. Several factors caused average pricing to fall in 2019, including the introduction of 650, 700 and 900 volt (V) SiC MOSFETs priced to compete with silicon superjunction MOSFETs, as well as increasing competition among suppliers.

“Declining prices will eventually spur faster adoption of SiC MOSFET technology,” said Richard Eden, senior principal analyst for power semiconductors at Omdia. “In contrast, GaN power transistors and GaN system ICs have only appeared on the market quite recently. GaN is a wide-bandgap material offering similar performance benefits as SiC, but with a higher cost-reduction potential. These price and performance advantages are possible because GaN power devices can be grown on either silicon or sapphire substrates, which are less expensive than SiC. Although GaN transistors are now available, sales of GaN system integrated circuits (ICs), from companies such as Power Integrations, Texas Instruments and Navitas Semiconductor are forecast to rise at a faster rate.”

SiC and GaN power semiconductor market trends

By the end of 2020, SiC MOSFETs are forecast to generate revenue of approximately $320 million to match those of Schottky diodes. From 2021 onwards, SiC MOSFETs will grow at a slightly faster rate to become the best-selling discrete SiC power device. Meanwhile, SiC JFETs are each forecast to generate much smaller revenues than those of SiC MOSFETs, despite achieving good reliability, price and performance.

“End users strongly prefer normally-off SiC MOSFETs, so SiC JFETs appear likely to remain specialized, niche products,” Eden said. “However, sales of SiC JFETs are forecast to rise at an impressive rate, despite having very few active suppliers.”

Hybrid SiC power modules, combining Si IGBTs and SIC diodes, are estimated to have generated approximately $72 million in sales in 2019, with full SiC power modules estimated to have generated approximately $50 million in 2019. Full SiC power modules are forecast to achieve over $850 million in revenue by 2029, as they will be preferred for use in hybrid and electric vehicle powertrain inverters. In contrast, hybrid SiC power modules will be used in photovoltaic (PV) inverters, uninterruptible power supply systems and other industrial applications, mainly, delivering a much slower growth rate.

What has changed since 2019?

There are now trillions of hours of device field experience available for both SiC and GaN power devices. Suppliers, even new market entrants, are demonstrating this by obtaining JEDEC and AEC-Q101 approvals. There do not appear to be any unexpected reliability problems with SiC and GaN devices; in fact, they usually appear better than silicon.

SiC MOSFETs and SiC JFETs are available at lower operating voltages, such as 650V, 800V and 900V, allowing SiC to compete with Si Superjunction MOSFETs on both performance and price.

End-products with GaN transistors and GaN system ICs inside are in mass production, particularly USB type C power adaptors and chargers for fast charging of mobile phones and notebook PCs. Also, many GaN devices are being made by foundry service providers, offering in-house GaN epitaxial crystal growth on standard silicon wafers, and potentially unlimited production capacity expansion as volumes ramp.