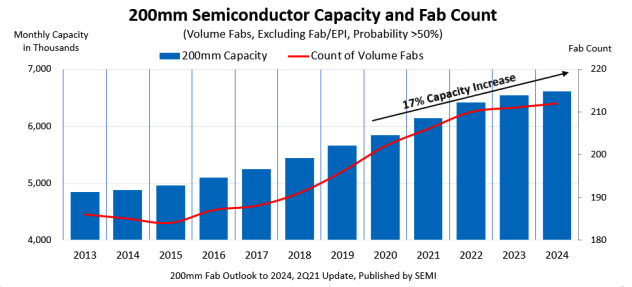

Semiconductor manufacturers worldwide are on track to boost 200mm fab capacity by 950,000 wafers, or 17%, from 2020 through 2024 to reach a record high of 6.6 million wafers per month, SEMI announced today in its 200mm Fab Outlook Report. 200mm fab equipment spending is expected to reach nearly $4 billion in 2021 after passing the $3 billion mark in 2020 and hovering between $2 billion and $3 billion from 2012 to 2019. The spending increase reflects in part the global semiconductor industry’s push to overcome the current chip shortage with 200mm fab utilization continuing at high levels.

“The 200mm Fab Outlook Report shows that, during the same period, wafer manufacturers will add 22 new 200mm fabs to help meet growing demand for 5G, automotive and Internet of Things (IoT) devices that rely on analog, power management and display driver integrated circuits (ICs), MOSFETs, microcontroller units (MCUs) and sensors,” said Ajit Manocha, SEMI president and CEO.

The SEMI 200mm Fab Outlook Report, covering the 12 years from 2013 to 2024, also reveals that foundries will account for more than 50% of fab capacity worldwide this year, followed by analog at 17% and discrete/power at 10%. Regionally, China will lead the world in 200mm capacity with 18% share in 2021, followed by Japan and Taiwan at 16% each.

Equipment investments are projected to remain above $3 billion in 2022, with the foundry sector accounting for more than half of the spending, followed by discrete/power at 21%, analog at 15%, and MEMS and sensors at 7%.

The SEMI 200mm Fab Outlook Report reflects 365 updates across 146 facilities and lines since the most recent update of the report in 2019. The report includes details on more 300 200mm fabs and lines.