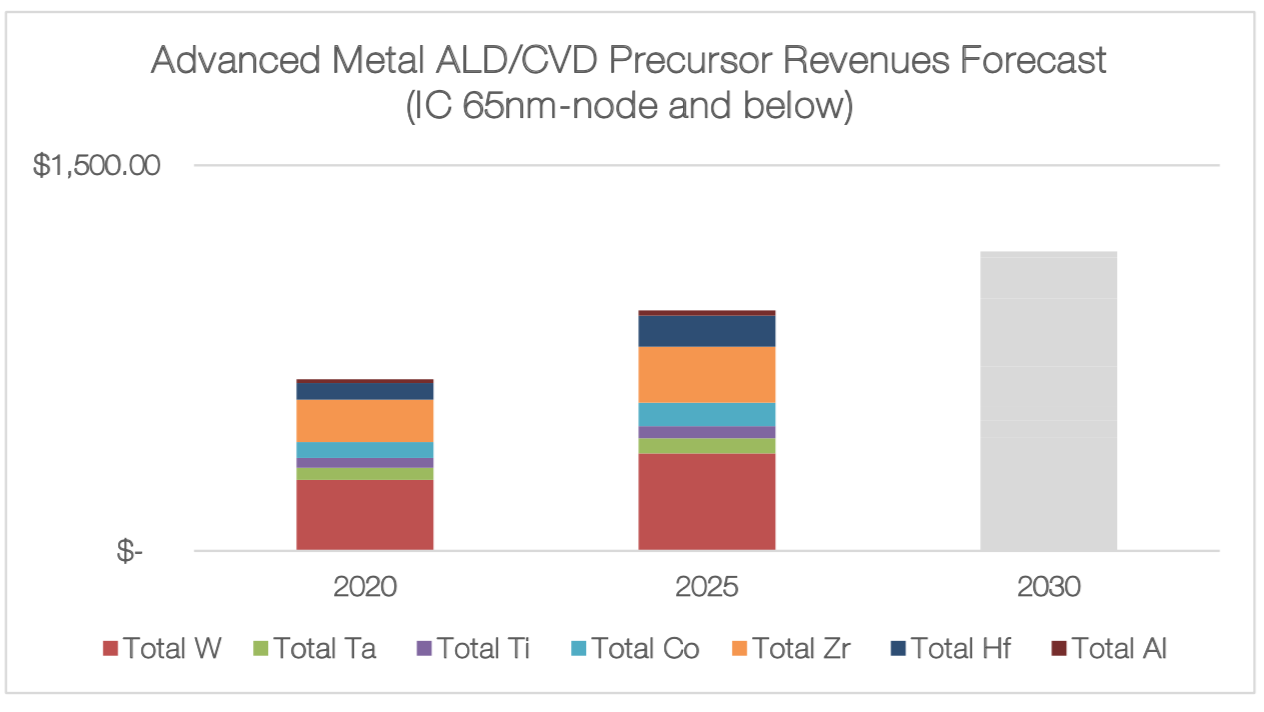

TECHCET—the advisory services firm providing electronic materials information— announced that the global market for atomic layer deposition (ALD) and chemical vapor deposition (CVD) precursors is showing strong growth despite semiconductor fabrication market challenges in 2019. CVD growth is mainly in plasma-enhanced CVD (PECVD) and metal-organic CVD (MOCVD) for silicon ICs and for newer devices including micro-displays, RF for 5G, and photonics. The combined ALD and CVD metal precursor market is estimated to be approximately US$582M in 2019 growing 6.3% from the prior year and forecasted to grow above US$930M by 2025, as detailed in the latest Critical Materials ReportTM (CMR) on ALD / High-K Metal Precursors (see Figure).

“Today, the top three suppliers ADEKA, Air Liquide, and Versum dominate the market by controlling ~75% of the segments,” explained Dr. Jonas Sundqvist, TECHCET senior technology analyst and author of the report. “However, due to the recent development that Merck will acquire Versum, there is a good chance that by doing so it will become the number one supplier for all type of metal, High-κ, and dielectric precursors.”

The CVD, ALD, and SOD market includes from both specialty gases (e.g. WF6) and liquid precursors, as well as a considerable segment of solid precursors (e.g. HfCl4, PDMAT). In addition, there are smaller segments for precursors that still do not reach annual sales of >US$5 million such as ruthenium and rare earth elements (REE).

This report covers the following suppliers: ADEKA, Air Liquide, Air Products, AZmax Co., BASF, DNF Co., Entegris, Epivalence, FujiFilm, Gelest, Hansol Chemical, H.C. Starck, Kojundo, Linde (Praxair), Mecaro, Merck EMD, Nanmat, Norquay, Pegasus Chemicals, Soulbrain, Strem, Tanaka Kikinzoku Group, Tokyo Chemical Industry Co., Tri Chemical Laboratories, Umicore, UP Chemical (Yoke), and Versum.