TECHCET—the electronic materials advisory firm providing business and technology information— has uncovered a significant supply chain risk for germanium and gallium for the global semiconductor market. Both germanium and gallium are critical metals essential to producing RF and sensor devices, 5G, IT communications, and automotive applications. China is the world’s leading producer of refined germanium and gallium, which has increased risk for the US semiconductor supply chain. Global supply risks have been further amplified by recent announcements from China regarding export permit requirements for both metals, as explained in TECHCET’s new Report on Germanium and Gallium Supply Chain Risks.

![]()

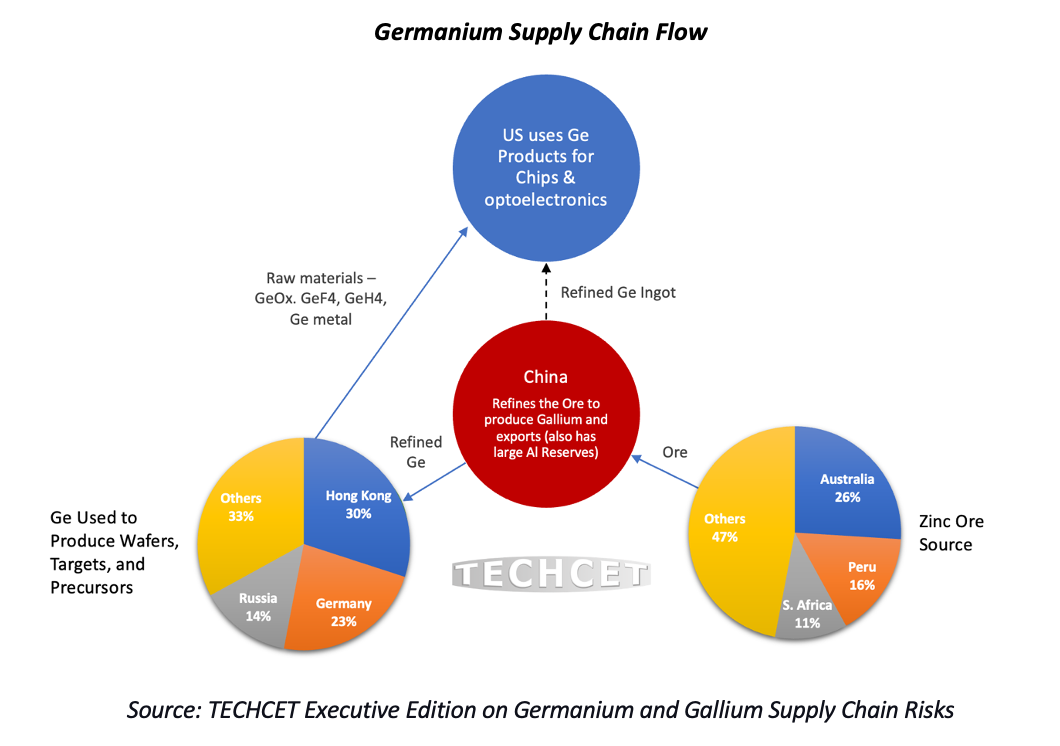

While there are other reserves and capacities for germanium and gallium outside China, producing viable material would require significant investment and time. Any reduction in gallium supply from China over the next 1-3 years poses an issue for the US. China primarily dominates the refining resources required to produce these materials, and the ore emanates from other non-US sources, as shown in the Figure above on germanium.

Ramping up production and capacity for germanium and gallium within the US would help to stabilize the supply of these much-needed metals. However, mineral and chemical companies within the US face various hurdles in justifying the investment in new capacity for these materials. For example, chemical companies in China benefit from support through free or tax-free land, government money, and loans for building plants. US chemical companies do not have these benefits and are burdened with more expensive labor and power costs than offshore alternatives. This results in less willingness for companies to independently expand capacity within the US, indicating a high need for government support or improved trade relations with outside sources.

In the short term, improved trade relations are tantamount to a continued supply of these critical materials. Since building a refining or mining operation requires several years to become productive, it may be wise for the US to cultivate better trade relations with China to ensure current supply needs, while also developing other supply sources from allied nations or domestically within the US. Operating parallel paths would help reduce risk in the short term while working on a longer-term solution to minimize risks to the overall US chip manufacturing supply chain.