IC Insights will release its March Update to the 2021 edition of The McClean Report later this month. In addition to presenting its 2021 IC market forecast revision, the Update will also present listings of the top 40 IDM and top 50 fabless IC suppliers in 2020. This data was used to determine the “final” worldwide IC market figure for 2020, which was raised from 10% to 13% growth as compared to 2019.

The remaining portion of the March Update will include newly revised 2021-2025 forecasts by product type as well as updated semiconductor industry capital spending forecasts by company for 2021.

In 2020, the global pandemic accelerated the digital transformation of the worldwide economy, which led to an increase in sales of new electronic systems and a marked uptick in the IC market in the second half of the year. Moreover, this demand has continued in full force in 1Q21. While the Covid-19 situation is still very fluid, many semiconductor companies have released strong 1Q21 guidance and expect healthy demand to continue throughout this year.

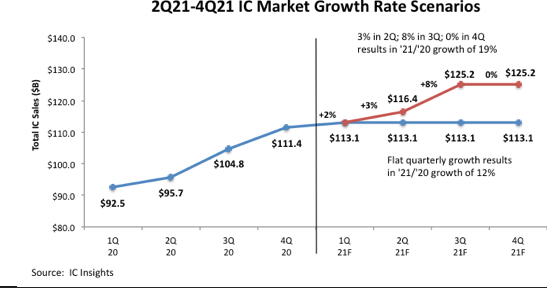

IC Insights believes that the 1Q21/4Q20 IC market will show a 2% increase. If this forecast comes to fruition, it would be the first 1Q/4Q sequential IC market increase since a 1% growth rate was registered 10 years ago in 1Q11.

Figure 1 shows that if total 1Q21/4Q20 IC sales increase 2% to $113.1 billion and remain flat from 2Q21 through 4Q21, the full-year 2021 worldwide IC market would register a 12% increase. Interestingly, this 12% IC market growth rate figure is the same as the 2021 forecast originally presented in MR21.

However, Figure 1 also shows that if incorporating IC Insights’ moderate quarterly expectations for 3% growth in 2Q21, an 8% increase in 3Q21, and 0% growth in 4Q21, the global IC market will display a 19% increase this year, which IC Insights believes is a rather conservative global IC market forecast for 2021. The 19% market growth is forecast to be driven by a 17% surge in IC unit volume shipments and a 1% increase in IC ASP this year.