IC Insights has updated and released its comprehensive forecast and analysis of the worldwide semiconductor industry in its January Semiconductor Industry Flash Report, which is included as part of the 2022, 25th edition of The McClean Report service.

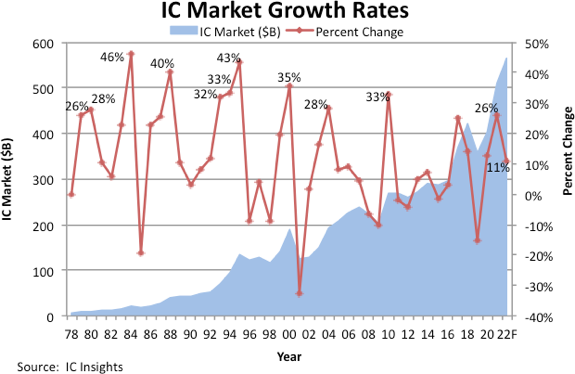

The report forecasts that the IC market will rise 11% this year following a strong 26% increase in 2021 and a 13% jump in 2020 (Figure 1). If achieved, it would mark the first time in 25 years that the IC market has enjoyed three consecutive years of double-digit growth. The previous time such an increase occurred was the four-year period from 1992-1995. Figure 1 highlights years when IC market growth exceeded 25%.

The IC Industry remains very resilient. It endured a steep decline of -15% in 2019 and then struggled through profound economic uncertainties in the first half of 2020 due to the global Covid-19 pandemic. The pandemic led to a transformation in how the world went about life. Individuals, businesses, educators, and governments turned increasingly to digital-based operations, providing the catalyst for a strong upturn in IC sales in the second half of 2020 and into 2021. Robust demand, coupled with rising average selling prices due to widespread supply chain disruptions, led to 26% IC market growth last year. The 26% surge in 2021 was tied with 1979 for the 8th-largest annual increase in IC sales dating back to 1978. The industry experienced a 28% increase in 1980 and 2004, and increased 33% in both 1994 and 2010.

Looking ahead, worldwide IC sales are projected to increase 11% in this year to a new record high of $565.1 billion after topping the half-trillion dollar plateau for the first time in 2021 to reach $509.8 billion.

The January Semiconductor Industry Flash Report includes additional forecast details on the IC market as well as forecasts for optoelectronics, sensor/actuators, and discretes, global GDP forecasts, and a semiconductor industry capital spending forecast. The January Semiconductor Industry Flash Report will be followed throughout 2022 by major quarterly updates providing refreshed five-year forecasts for all IC and O-S-D product categories (sales, unit shipments and average selling prices), assessments of global economic conditions impacting chip markets, and detailed analysis of industry capital spending. Quarterly updates in February, May, August, and November will also provide quarterly sales rankings of top semiconductor suppliers as well as dive into major industry trends, such as IC wafer foundry expansion, R&D spending, mergers and acquisitions, regional market growth, and analysis of IC revenue by electronic system end-use categories.