It’s 2024: the semiconductor industry is experiencing growth driven by AI and leading-edge technology, with demand expected to sharply increase in 2025 as fab expansions ramp. This surge in demand presents a unique investment opportunity in semiconductor materials and equipment. The sub-tier of the supply chain, often overlooked, is particularly intriguing due to the crucial role these companies play in the future of the chip industry. While the primary material supplier market may seem saturated by big-name companies, a closer look at the ‘farther back’ sub-tier landscape reveals where the most promising investment opportunities lie.

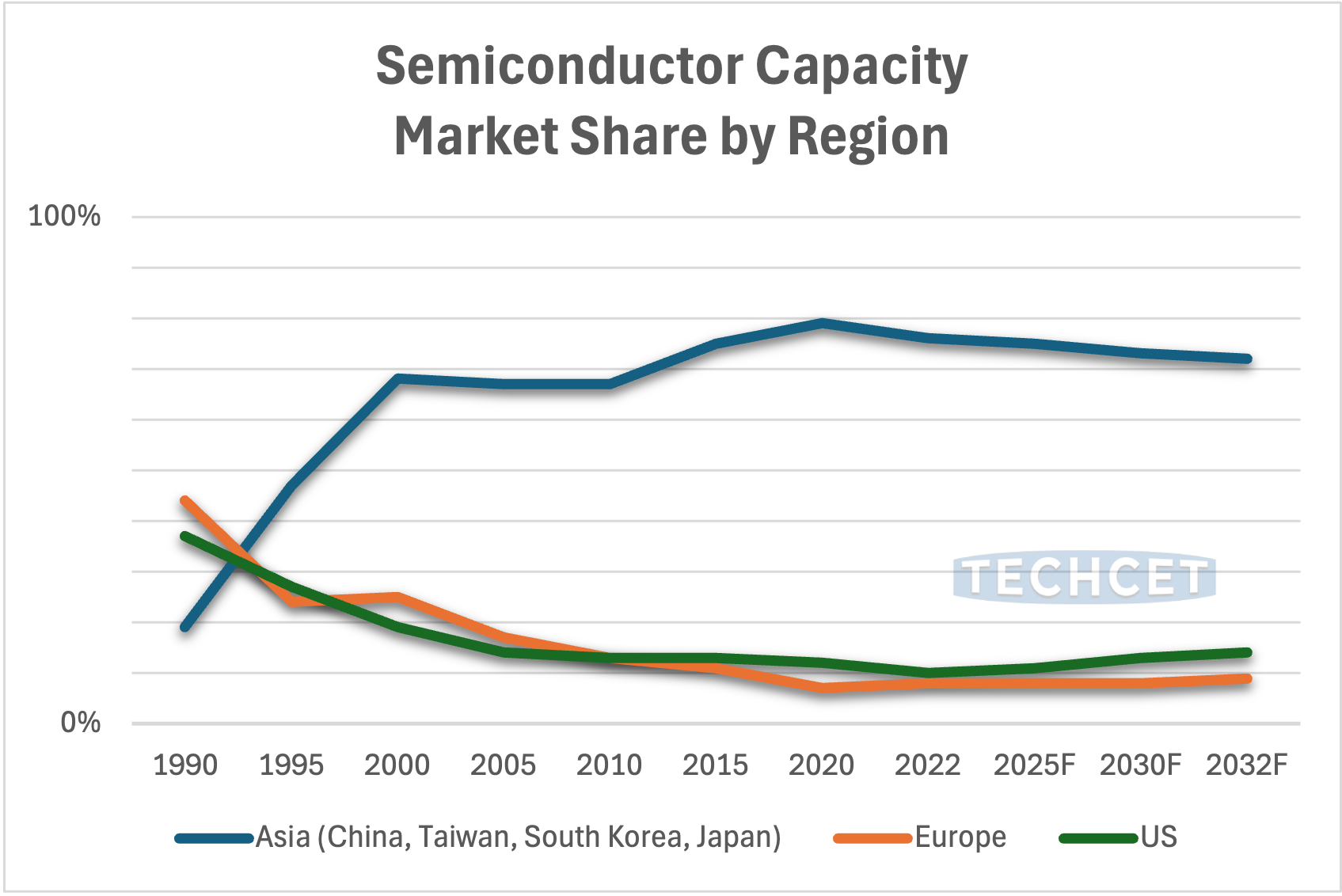

To thoroughly understand why these investment opportunities are so favorable, one must look at the progression of the semiconductor market landscape. Historically, investment or acquisition in the semiconductor materials supply chain has been marginal. For the past four decades, particularly in the US and EU, the market segment has been declining as device fabrication migrated to Asia, as illustrated by the enclosed graph:

![]()

The market landscape is changing dramatically as sovereign national governments recognize the strategic importance of leading-edge domestic semiconductor device production. Multiple sources, such as Bank of America, have begun referring to semiconductors as the “new oil.” National governments in all of the world’s semiconductor-producing areas have responded to this realization with various incentive programs to spur domestic production.

These various investments, generally referred to as “Chips Acts,” have spurred global activity. There are now a total of 30 new fabs or fab expansions and 35 new material production facilities or announced expansions of existing facilities (TECHCET, 2024). The publicly announced chip fab expansions total approximately $548 billion and are focused on the US, Taiwan, and Korea, as per the following pie chart.

![]()

Regardless of this activity level, an initial investigation could lead to the misconception that the materials supply chain investment opportunities are very limited. This is a result of the materials market being dominated by a limited number of large suppliers that are, in most cases, part of multi-billion-dollar multi-national companies such as:

- BASF

- Tokyo Ohka Kogo

- Solvay

- Dow

Although that initial assessment may look accurate when considering those chemical and material suppliers that sell directly to semiconductor manufacturers, work done by the Critical Materials Council of TECHCET has identified that the majority of materials supply problems or quality issues come from other entities that lie beneath the surface. These ‘sub-tier’ companies are often the “real makers” of materials or raw material inputs critical to producing semiconductor devices or equipment. Being smaller operations in many cases and unable to meet the increasing expectations of leading-edge companies offers an investment opportunity.

To more clearly understand what we are referring to as ‘subtier,’ it is best to segregate semiconductor materials suppliers into multiple tiers depending on that supplier’s proximity and interaction with the semiconductor device manufacturer, as illustrated by TECHCET:

![]()

Looking at this breakdown in the context of the materials supply chain, a couple of interesting trends can be seen:

- When moving backward through the supply chain, the number of investment opportunities increases significantly. As a rough example, each Tier 1 Supplier may be supported by 10 or more Tier 2 and Tier 3 Suppliers.

- Sub-Tier Suppliers are, in general, smaller in revenue than Tier 1 suppliers and present more manageable investment opportunities.

While this alone presents an immediate opportunity for investing in sub-tier suppliers, the evolving dynamics in the overall semiconductor materials supply chain point to further investment incentivization.

A decade ago, semiconductor device manufacturers showed only marginal interest in Sub-Tier Suppliers. However, this situation is rapidly changing as supply chain issues and next-generation device architecture place increasing demands on the supply and availability of chemicals and materials used in the device manufacturing process. This shift in focus is a clear indicator of the growing importance of Sub-Tier Suppliers and the potential for future investment.

The increasing technical requirements of materials, tied to geopolitical pressures and the push for supply chain resilience by device manufacturers have focused attention on Sub-Tier Suppliers. As a result, many device manufacturers now include Sub-Tier Suppliers in quality audits.

As the importance of Sub-Tier Suppliers continues to be recognized, their value in the overall supply chain and the potential return on investment will only increase. This growing recognition should instill confidence in the future potential of these investments.

In order to realize this investment opportunity, it is best to engage with a company that can offer visibility into the sub-tier. TECHCET, the leading materials supply chain analysis and market research firm, actively monitors these sub-tier suppliers and has identified more than 100 materials manufacturers that play a critical role across 14 material segments actively used to manufacture semiconductors.

Part of this active monitoring effort is detailed profiling of active suppliers to the market. TECHCET currently maintains a library of approximately 300 supplier profiles. And that total continues to grow.

The time for addressing the sub-tier of the supply chain is now, with opportunities shrouded in the form of quality and availability problems. In the words of Voltaire:

“Present opportunities are not to be neglected; they rarely visit us twice.” Currently, semiconductor supply chains and makers of materials are more valued than ever before. For more information, contact TECHCET at [email protected], or +1-480-382-8336 x1