At SEMI’s 2020 Industry Strategy Symposium (ISS), held January 12-15th at Half Moon Bay in California, Bob Johnson, vice president, Gartner, talked about the challenges ahead in the semiconductor market.

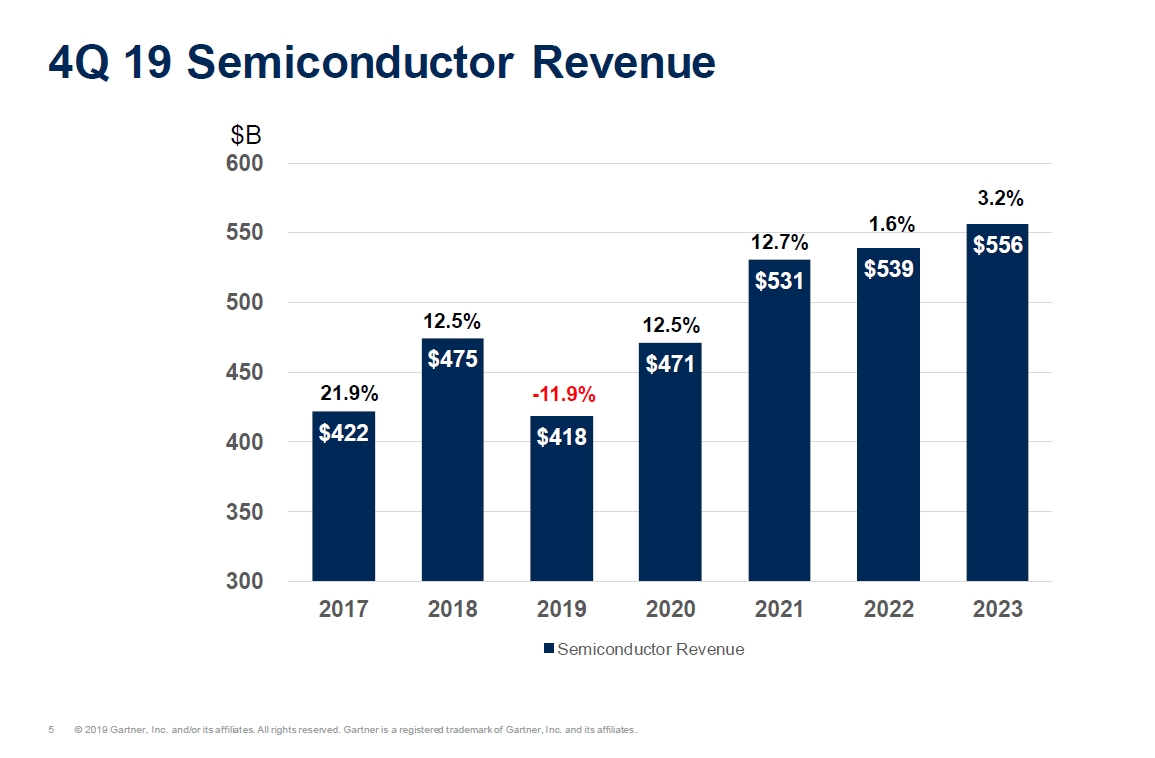

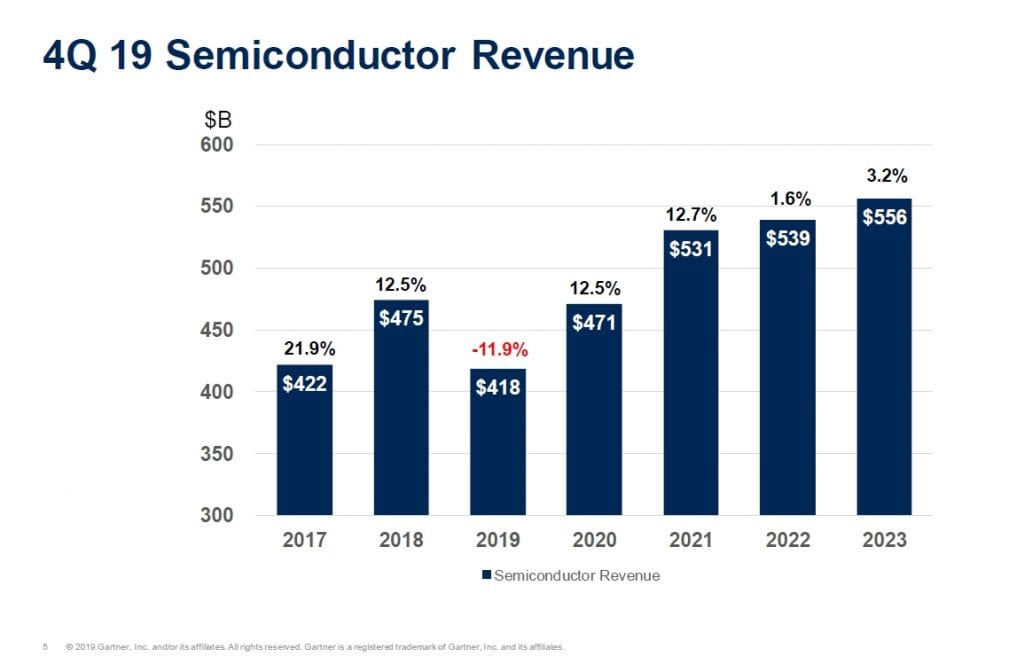

Johnson has a positive outlook for 2020 and 2021 after what he called a “somewhat disastrous 2019.” That “disaster” was primarily the result of a correction in the memory market. The semiconductor industry saw phenomenal growth in 2017 and 2018, driven by what Johnson said was a “totally abnormal memory cycle, which is then doing a somewhat abnormal correction.” The result was that semiconductor revenues dropped about 12% in 2019. Figure 1 shows the growth in 2017 and 2018, the drop in 2019 and the projected growth for the next few years.

What was abnormal about the memory cycle was that the demand shifted from applications that were sensitive to price, such as PCs, to things were relatively insensitive to price, such as smartphones and data centers, which could absorb the cost. Those two segments accounted for about 95% of DRAM demand. “Much to their amazement, when prices started to go up, demand didn’t go down, as it used to. They could ride those prices to higher profits and huge cashflows,” Johnson said. To give it some perspective, Johnson noted that in 2014, the DRAM market was about $40 billion in revenue, and that was the first time it hit $40 billion in revenue since 1996. In 2018, the DRAM market was over $100 billion.

This boom led to billions being invested in 3D NAND fab construction, followed 3D NAND production. That, in turn, led to an oversupply which brought the memory markets back down again. “We’re seeing another typical memory cycle going out through 2023,” Johnson said.

Johnson said to expect good growth this year and going forward. “We will pass $500 billion sometime in the middle of 2021, roughly, which is a major milestone for the industry,” he said. Figure 2 shows the Gartner prediction for growth in logic, memory and other types of semiconductors.

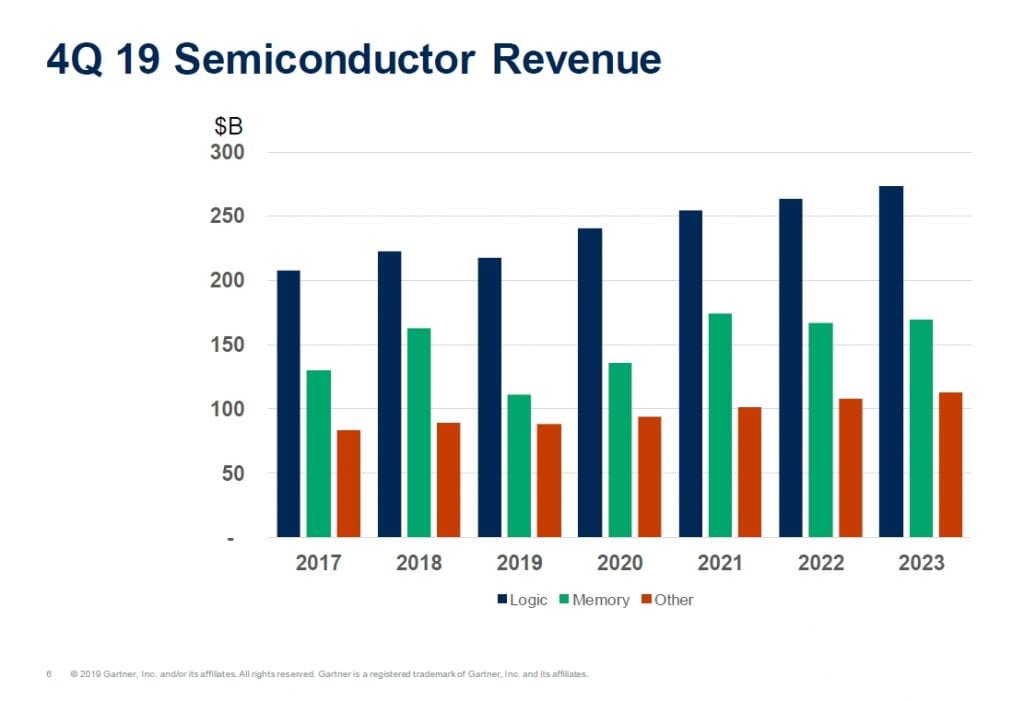

On the logic side, Johnson said one of the main factors determining growth will be the 5G rollout: how fast it will happen, how big it will be and what impact it will have on the smartphone market. Although initial reactions to 5G users have been lukewarm (see “5G Underwhelms in Its First Big Test” reported by the Wall Street Journal in December 2019), industry watchers expect big things. Most notably, foundry TSMC announced an additional $2 billion in capex spending in late 2019 in anticipation of a big demand in 5G chips, particularly leading-edge 5nm 5G chips. Apple has not yet announced a 5G phone, but such an announcement would of course have a huge impact on smartphone demand.

Gartner recently revised its smartphone forecast upward adding – in the firm’s Q3 forecast, the prediction was 180 million smartphones. In the revised Q4 forecast, the prediction is 220 million smartphones, mostly due to 5G (Figure 3). “The total semiconductor revenue for smart phones and the percentage of total revenue is going to peak at around 27% in 2021. And a large part of this is driven by the move to 5G phones coming out then. This doesn’t seem like a huge amount, but when you start thinking about what it translates into capital investment, it becomes significant.” Johnson said.

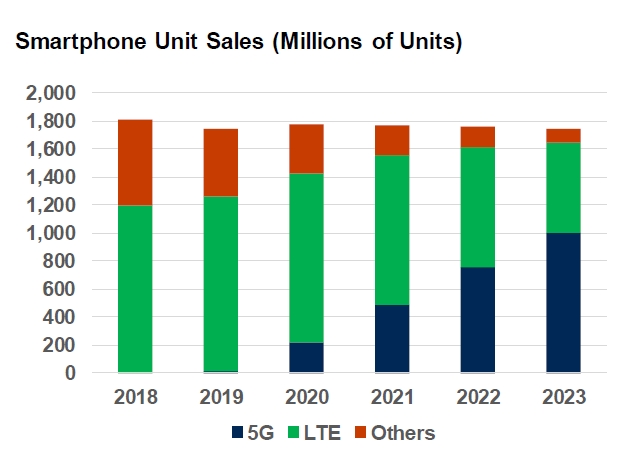

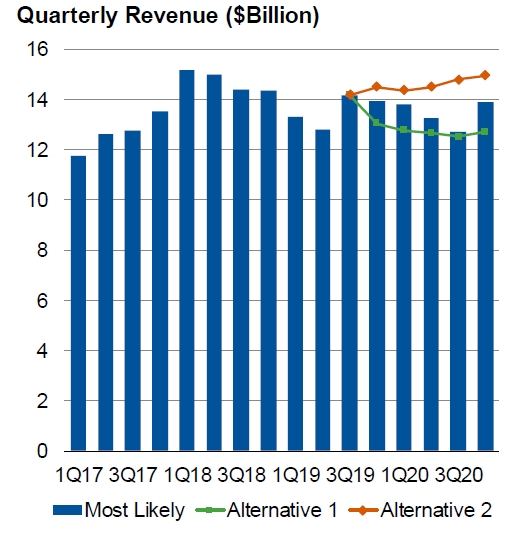

Capital investment spending or “capex” is a topic of high interest to ISS attendees in that they are mostly execs from equipment and materials suppliers. Johnson gave three different scenarios of what they might expect to see in 2020. As shown in Figure 4, the most likely scenario is -1% growth. This assumes that there would be strong 5G phone demand, that TSMC continues 5nm investment in the first half to enable 90,000 wafer starts per month, that Intel and Samsung continue strong logic investments, and memory investment resumes in the second half of 2020.

The more negative “Alternative 1” shown in Fig. 4 assumes 5G chip demand softens as sales disappoint; TSMC slows 5nm ramp, and Intel and Samsung get conservative in investments; and memory investments slips to 4Q20 or 1Q21.

A more positive “Alternative 2” is based on strong 5G demand, an introduction of a full band 5G phone from Apple, mm wave 5G chips putting pressure on 5nm capacity; memory investment starts in late 2Q or early 3Q20; and China’s indigenous demand for semiconductor production leads to a surge of new fab investment. “If Apple, which is one of the big wild cards, comes out and announces full band 5G phones, that all of a sudden would make TSMC go ’Wow!’ They would start investing lots of money in more 5nm capacity, so that could jump it up,” Johnson said.

Also see:

ISS: The 2020 Outlook for Consumer Electronics