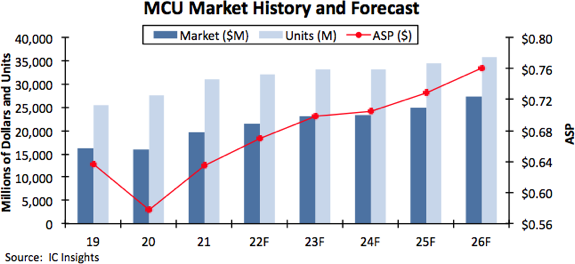

Microcontroller sales boomeranged back with strong growth in the economic recovery of 2021, when the MCU market climbed 23% to a record-high $19.6 billion after falling 2% in the 2020 outbreak year of the Covid-19 virus crisis, according to IC Insights’ 1Q Update to its 2022 McClean Report. IC Insights is forecasting worldwide microcontroller sales to increase 10% in 2022 to reach an all-time high of $21.5 billion (Figure 1), with automotive MCU growth outpacing most other end-use categories this year.

A strong 2021 rebound in the average selling price of microcontrollers lifted the ASP by 10% to $0.64, which was the pre-Covid-19 pandemic pricing average in 2019. The 2021 ASP increase was the highest annual growth rate for MCU selling prices in more than 25 years and resulted from tight supplies of microcontrollers in the 2021 economic rebound. For two decades, the MCU market has faced significant price erosion, but the ASP decline slowed in the last five years. IC Insights now expects the ASP for MCUs to rise by a compound annual growth rate (CAGR) of 3.5% between 2021 and 2026.

Bottlenecks in production and the supply chain held back total MCU unit shipments growth to 12% in 2021, which raised worldwide deliveries of microcontrollers to an all-time high of 30.9 billion last year. IC Insights’ forecast shows total MCU shipments growing by a CAGR of 3.0% in the five-year period to 35.8 billion units in 2026.

Between 2021 and 2026, total microcontroller sales are projected to increase by CAGR of 6.7% and reach $27.2 billion in the final year of the forecast. In the next five years, sales of 32-bit MCUs are expected to grow by a CAGR of 9.4% to hit $20.0 billion in 2026. Meanwhile, 4/8-bit MCU sales are projected to show no growth over the next five years, remaining stuck at about $2.4 billion in 2026. Revenues for 16-bit microcontrollers are expected to rise by a CAGR of 1.6% in the 2021-2026 period to $4.7 billion at the end of the forecast.

The automotive slump and weak global economy in 2019 contributed to a 9% drop in MCU shipments that year, which was the worst unit decline since the 2009 semiconductor downturn (-11%). But surprisingly, MCU unit shipments rebounded in 2020, growing 8% despite the coronavirus crisis and widespread lockdowns to slow the pandemic. MCU demand in the 2020 virus crisis was driven mostly by sales of home entertainment systems and electronics being bought by quarantined consumers, including large-screen TVs, Internet of Things-connected products and more sensors being packed into smartphones.

About 46% of microcontroller sales are generated by MCUs in “general” embedded applications (including smartphones, computers and peripherals, industrial uses, and consumer products) while a little over 40% come from automotive systems, and 14% from the smartcard market for banking, credit and debit purchases, transit fares, identification cards, and other uses. Automotive MCU sales are expected to grow by a CAGR of 7.7% in the next five years, while general MCU revenues are forecast to increase 7.3%, and the smartcard segment is projected to rise by an annual rate of 1.4% through 2026.