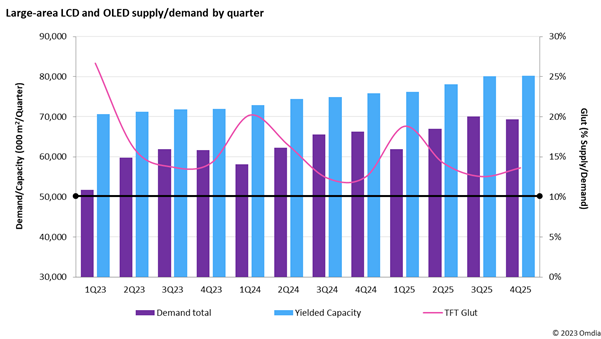

The large-area LCD and OLED supply-to-demand glut ratio declined dramatically in 2023 from an excessively high 26.7% in 1Q23 to a relatively healthy 13.7% in 3Q23. This improvement was driven by a 19.6% expansion in area demand compared to only a 1.6% growth in capacity over the first nine months of the year. It supported a weighted LCD TV panel price increase of 31% as well as incremental profitability improvements for many panel makers. However, according to the recently released OLED and LCD Supply Demand and Equipment Tracker from Omdia, demand is now softening and the glut ratio is forecast to again shift toward oversupply from 4Q23 and into 1H24.

“Since recovering from supply shortages during the height of the pandemic, there has been, and remains, more than sufficient factory capacity to meet FPD demand. Even so, by adopting make-to-order production strategies and restricting glass input, for most of the year panel makers were able to successfully exploit rising demand to drive up prices”, commented Charles Annis, Omdia’s Display Research Practice Leader.

Growing demand combined with careful production management enabled weighted average area utilization at large glass fabs to increase monthly from 60.3% in January to a peak of 85.3% in July. However, with prices still relatively high and end-market demand remaining sluggish, TV set makers have become reluctant to buy and stock panels. Sensing this, panel makers are again reducing glass input, attempting to regain pricing power. As a result, Gen 7 – Gen 10.5 fab utilization is currently expected to decline to an average of 75% in 4Q23.

Furthermore, leading Chinese panel makers are also considering extending the Lunar New Year holidays, and thus shutting down production for an extra week in February, so that utilization could fall below 60%. This pre-emptive strike is aimed at mitigating seasonally weak 1Q24 demand and positioning panel makers to best take advantage of the forecast demand recovery during 2Q24 – 3Q24.

Regardless, it is unclear how successful these strategies will prove to be in the current market. Set makers themselves are struggling from a lack of profitability and are hoping to push down prices before ramping up volume purchases again.

“Panel makers and set makers will remain locked in a battle of glass input restrictions versus panel purchase controls as both try to ride out the oversupply and until a sustained demand recovery takes hold next year, hopefully, raising the fortunes of both”, added Annis.