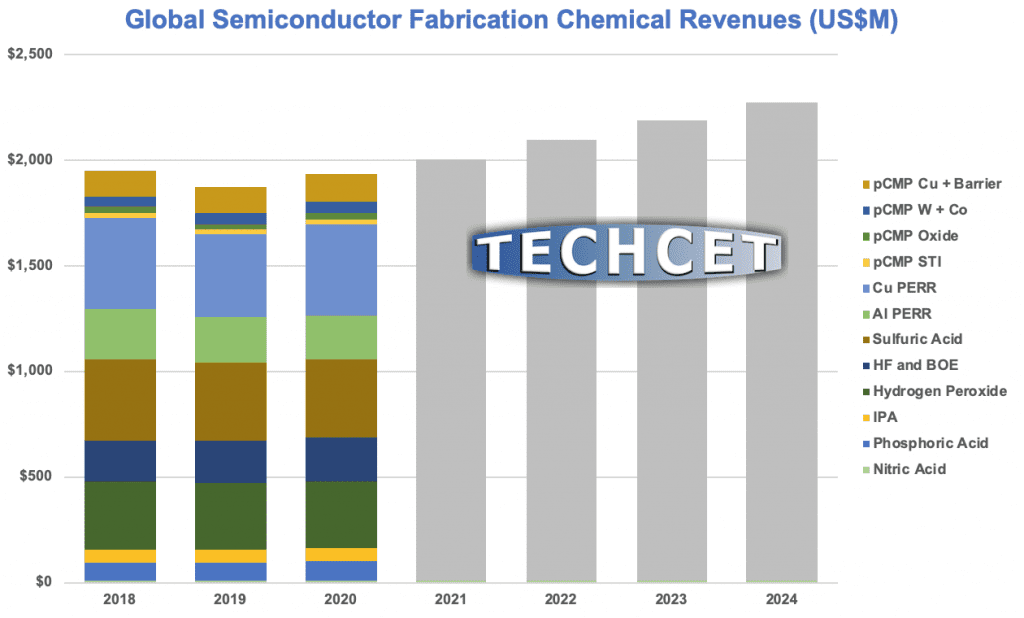

TECHCET—the electronic materials advisory firm providing business and technology information—announces the global market for wet chemicals needed for global semiconductor fabrication in 2021 is forecast to reach US$2 billion. However, recent trade wars threaten the stability of global supply-chains for critical materials, with China, the European Union, Japan, and the U.S. all announcing plans to create parallel local sources for electronic materials, and South Korea and Taiwan increasing investments in chemical production. There are many specialty blends needed as well as ultra-pure neat chemicals, and all are growing in demand as seen in the Figure (below) from the latest Critical Materials ReportTM (CMR) quarterly update on Wet Chemicals & Specialty Cleans.

The most advanced IC fabs for logic and memory chips require purity levels in materials so extreme that trace contaminants below parts-per-billion can cause millions in dollars of commercial yield losses. When raw materials sources or refining processes change there are corresponding changes in the trace contaminants and the chemical fingerprint so semiconductor fabs require that suppliers use advanced metrology and sophisticated analytic methods to re-qualify any changes.

“Advanced commercial ICs can only be profitably fabricated when the critical materials supply-chain is locked in from the very beginning at the mine or other industrial feedstock,” explained Terry Francis, TECHCET Director of Technology and Senior Analyst and author of the report. “For anhydrous-HF supply, we’re seeing a shift in the fluorine source from fluorspar mining to alternates including FluoroSilicic Acid (FSA),

depleted uranium hexafluoride, and aluminum fluoride. All of these alternates will have different trace contaminants which will have to be re-qualified by fabs.”

SK Materials began mass producing 15 tons-per-year of ultra-high-purity (UHP) hydrogen fluoride (HF) gas at its in Yeongju, South Korea to support fabs and help reach the government’s goal of 70% local electronic materials supply by 2023. South Korea’s imports from Japan have been replaced to a great extent by an increase in imports from China and Taiwan.

In China, Wengfu has four plants producing Anhydrous-HF (AHF) from FSA, with a fifth plant due to come onstream by early 2021. The company claims that the total capacity of all five plants will be ~105,000 tons/year AHF produced using this route.

This wet chemical market report covers these suppliers: Arkema, Avantor, BASF, Cabot Microelectronics/KMG, CF Industries, Dow/DuPont, Eastman, Evonik, GrandiT, Hansoi Chemical, Hubei Sinophorous, Jianghua Microelectronics Materials, Kanto Chemical, Merck/EMD, Mitsubishi Gas Chemical, PeroxyChem, Rudong Zhenfeng Yiyang, Runma Chemicals, SACHEM, SK Materials, Solvey, Suzhou Crystal Clear, Xingfa, Wengfu.