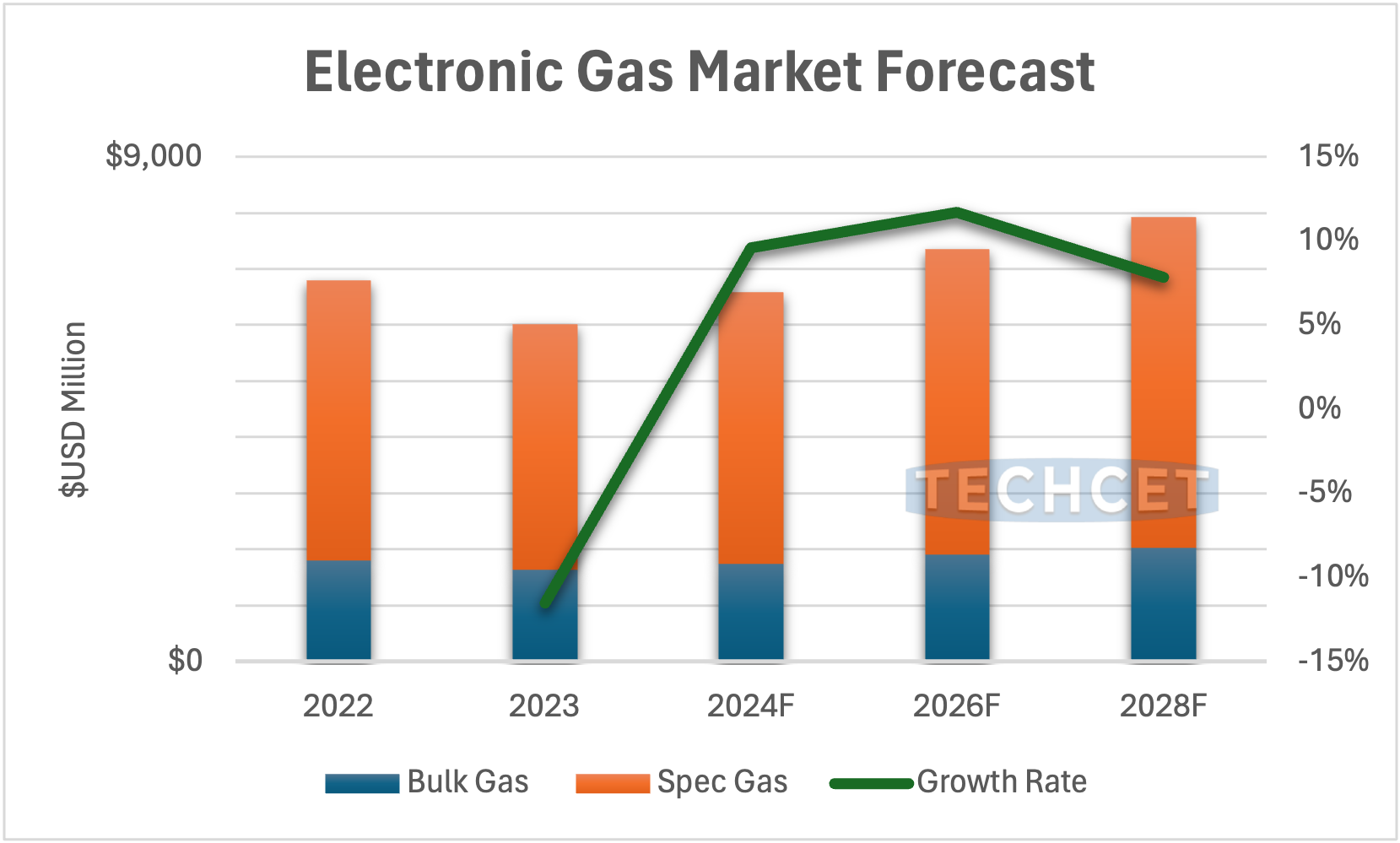

TECHCET is forecasting the Semiconductor Electronic Gases market to increase by around 10% in 2024 to hit US $6.59 billion, returning close to 2022 numbers. This rebound comes after a decline of nearly 12% in 2023 due to the overall industry downturn. Steady growth is expected through 2028, with a potential pause in 2027. For more detailed forecasting and market insights, check out TECHCET’s new Electronic Gases Critical Materials Report.

One of the highest growing segments is NF3, which is expected to increase by 18% in 2024, with a 20% CAGR from 2023-2028. NF3 demand is on pace to outstrip capacity, but adoption of alternate F2 diluted in N2 will help to displace some of this, to address sustainability initiatives. The exact timing for this is unclear, though at least one large Taiwanese multinational foundry is reported to have adopted the alternative F2 in N2 for thermal deposition processes.

Geopolitical tensions have increased sourcing and logistics risks for gases, causing China and many other countries to focus on developing domestic and/or local sourcing to strengthen business continuity planning. For example, several countries are implementing their own ASUs (Air Separation Units) to produce rare gases xenon, neon, and krypton. Helium prices are also experiencing instability due to trade disruptions between Russia and the West.

The industry is becoming more vocal towards reducing the environmental impacts of semiconductor production. There is announcement of at least one new plant with significant infrastructure to recycle “all” argon. Additionally, SK Hynix and EFC Gases & Advanced Materials have both announced the development of neon gas recycling systems. SK Hynix’s technology was developed in partnership with TEMC, and EFC’s was qualified by Cymer. Samsung has also announced that it will use recycled gas in chip manufacturing starting in 2025.