TECHCET—the electronic materials advisory firm providing business and technology information—warns that semiconductor materials are at risk of shortage in the US. In response to President Biden Executive Order on America’s Supply-Chains, TECHCET submitted a report highlighting US semiconductor material supply-chains at risk. The oncoming expansions planned in the US by Intel, TSMC, Samsung, and others will push up demand and strain the materials supply-chains further. Those materials most vulnerable include wet chemicals, solvents, photoresists, gases, and wafers/substrates. In particular, ultra-high purity wet chemicals are in threat of running short unless additional capacity is put in place.

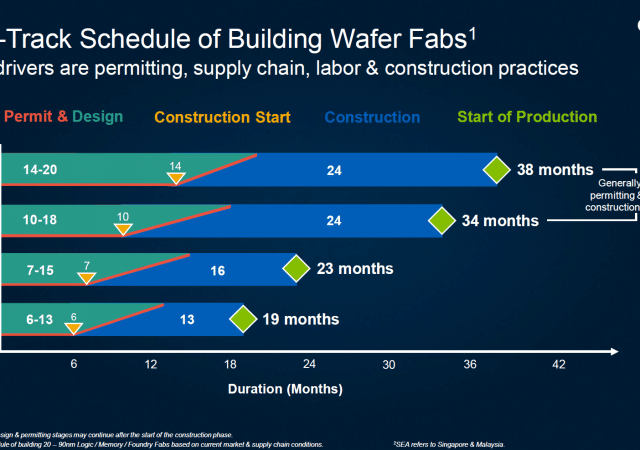

US Semiconductor device production over the past two decades has declined significantly from 37% of worldwide output to 12%. Now with the potential increase of 30% in US chip production over the next 3-5 years from the top 3 IC manufacturers, materials availability will tighten and may become critical. TECHCET projects that increases in domestic capacity are critical to avoid shortages. Given the time required to bring a new plant online, the time frame for new capacity is now. Note: It typically takes 2-3 years to build a plant to support semiconductor quality chemicals, given all the steps involved in the process. If capacity is not expanded soon, there may be shortages experienced by 2023.

The wet chemicals supply-chain is of highest risk because of several key variables:

- 40% increase in volume demand by 2025

- Lack of additional domestic capacity

- Increasing dependencies on Asian suppliers

- Transportation challenges and rising costs, including ocean freight, and

- Container, storage, and warehousing challenges impacting cost and quality

At present, the US Semiconductor market gets 31% of its Ultra High Purity (UHP) chemicals from Asia. Continued dependency on overseas chemical manufacturing means that as the US

chip industry ramps, device manufacturers will be ever more dependent on very long, sometimes fragile supply-chains.

US supply and capacity for chemicals such as semiconductor grade purity sulfuric acid (H2SO4), hydrochloric acid (HCl), isopropyl alcohol (IPA), hydrogen peroxide (H2O2), hydrofluoric acid (HF), phosphoric acid (H3PO4), ammonium hydroxide (NH4OH), and nitric acid (HNO2), has been running at parity with demand. Few to no domestic sources of these chemicals have announced plans to invest in additional capacity, given low margins relative to the high cost of new facilities. As pointed out by Lita Shon-Roy, TECHCET’s President & CEO, “These materials continue to have US supply-chain shortages every other year, if not every year, wreaking havoc on US and European chip fabricators. Without growth in the US wet chemical supply-chain, the US semiconductor industry will continue to have shortages and availability issues, limiting chip expansion plans.”

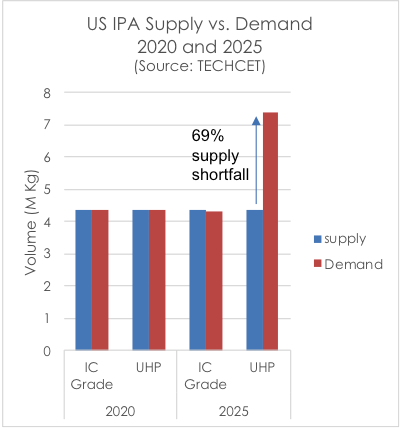

US Expansion Plans Reliant On Imports

TECHCET estimates 14% of all US Semiconductor Wet Chemicals are supported by Imports. However, when considering only UHP products for leading-edge chip production, this number jumps to 31%, as stated in TECHCET’s latest study, “Impact of US Chip expansion on Wet chemical Supply.” The need to import products such as IPA and H2SO4 is a clear indication of the shortcomings of the US UHP supply-chain. As shown in the figure, approximately 100% of all UHP IPA demand is supported by imports. The majority of chemical products coming from overseas are UHP grade because the US has very little ultra-high purity manufacturing capability for many of the semiconductor wet chemicals.

Although many chemical manufactures hesitate to add or build new capacity in the US, it is evident from TECHCET’s research that given the volumes anticipated, the costs to expand chemical production facilities should be justifiable. The key issue will be whether the IDMs will make enough of a commitment for the chemical supplier to invest in new capacity before supply shortages become critical. Failure to further expand US domestic critical materials manufacturing will likely hinder US chip expansion plans.

For more information about US materials supply-chain risks, contact TECHCET on how to get a copy of: “Impact of Chip Expansion on US Chemical Supply-Chain” https://techcet.com/product/impact-of-chip-expansion-on-us-chemical-supply-chain/