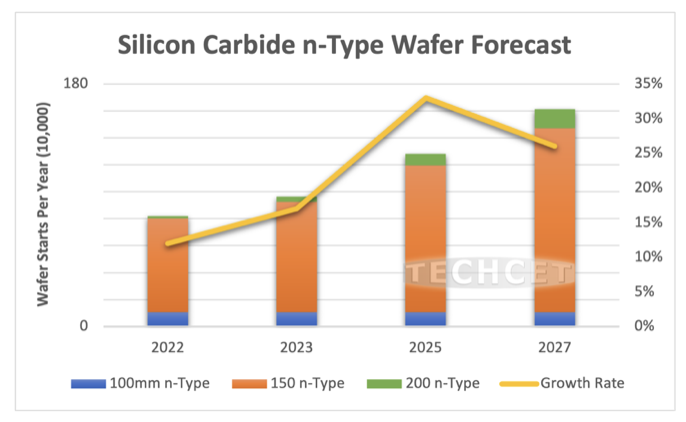

TECHCET is forecasting continued strong growth for silicon carbide (SiC) wafer through 2023, despite the slowdown in the general global economy and other semiconductor materials markets. In 2022, the SiC N-type Wafer Output Market grew ~15% over 2021, totaling 884k wafers (150 mm equivalent), as highlighted in TECHCET’s new Silicon Carbide Wafers Materials Report. This market is expected to grow even further in 2023, reaching 1072k wafers (just over 1 million 150 mm equivalent) growing ~22% over 2022, as shown below. The overall 2022-2027 CAGR is estimated to be approximately 17%.

![]()

High demand for SiC wafers comes as a result of silicon-based power devices approaching its physical limits, particularly for high-speed or high-power applications. Wide bandgap semiconductors represent the most promising of the current alternatives, and SiC is at the forefront in terms of both materials properties and supply chain maturity. Additionally, demand from electric vehicles, charging infrastructure, green energy production, and more efficient power devices in general is pushing demand higher for SiC.

While SiC is growing increasingly popular, chemical properties of the material have made it difficult to process boules into actual wafers. This has led to undersupply in the SiC wafer market. In an effort to increase boule supply over the past several years, a significant number of companies entered into or announced major expansions in SiC boule growth capacity, but very few companies have actually entered the wafering services market.

Some of this gap is being addressed by the vertically integrated SiC device companies, such as Wolfspeed, ON Semiconductor, and ST Microelectronics, who are able to balance their own production capacities internally. Other companies are attempting to address the gap by offering process services, such as X-trinsic and Halo Industries.

For more details on the Silicon Carbide (SiC) Wafer market segment and growth trajectory, go to: https://techcet.com/product/silicon-carbide-wafers/