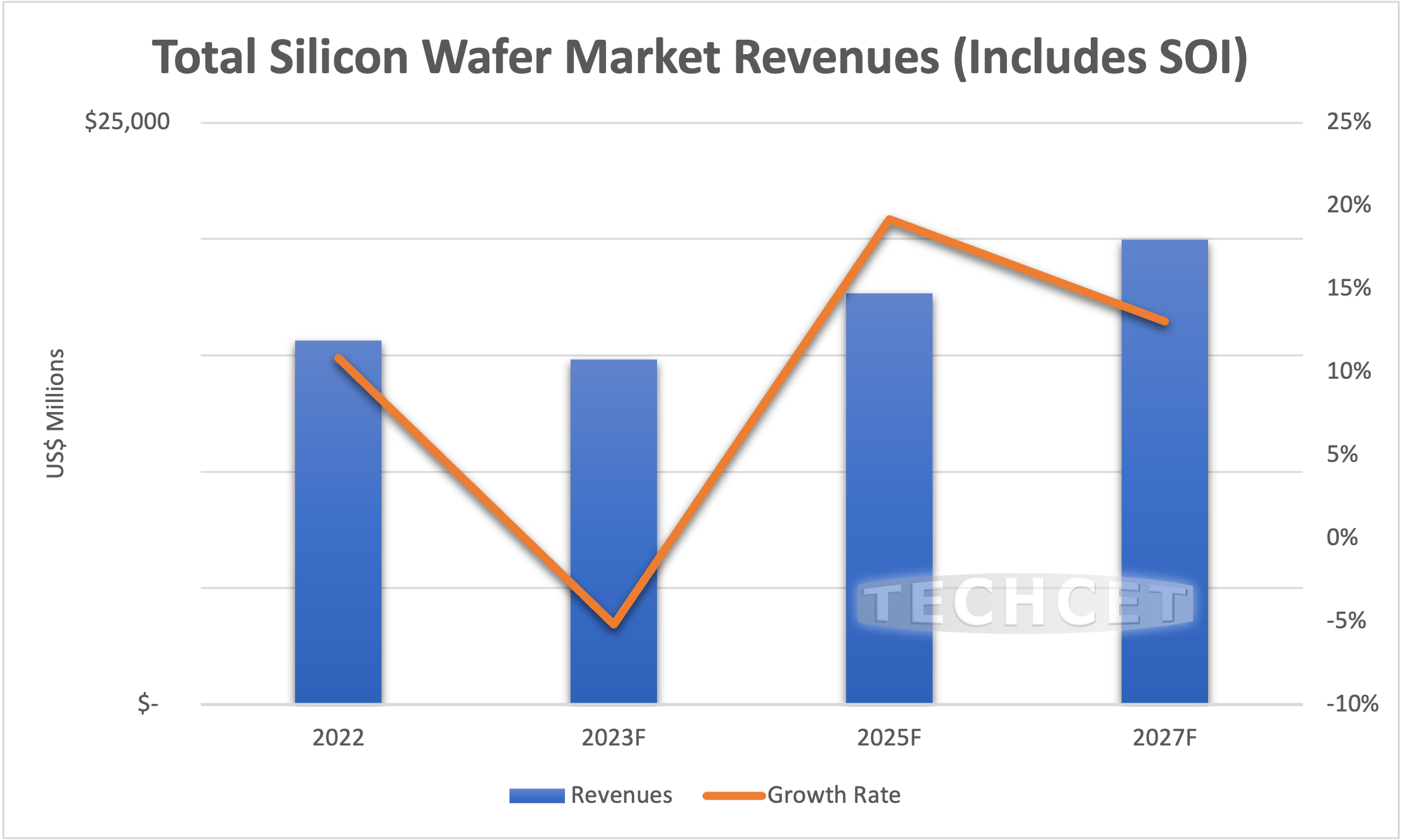

TECHCET—the electronic materials advisory firm providing business and technology information—is forecasting a -7% decline for Total Silicon Wafer shipments for the 2023 year due to overall slowdowns in the semiconductor industry. These slowdowns in combination with wafer inventory build has reduced strains on wafer supply/demand in 2023 and allowed for a net positive supply-demand balance. In 2024, total wafer shipments are expected to rebound and grow about 8%, as highlighted in TECHCET’s newly released Critical Materials Report™ on Silicon Wafers. Growth for Silicon Wafer revenues is expected to continue through 2027 at 5%, reaching US$20B by 2027. SOI Wafers will see the strongest growth, with a high 11.5% CAGR from 2022-2027.

![]()

Previous supply/demand imbalance for 300 mm wafers has been corrected given reduced wafer demand in 2023. Suppliers report high inventory levels, given the industry slowdown.

Through the forecast years, both epitaxial and SOI wafers expect strong growth. 300 mm epi is becoming more critical in advanced logic applications, and shipments are forecasted to grow at a CAGR of 6% through the 2027 forecast period.

All of the top five wafer suppliers (SEH, Sumco, GlobalWafers, Siltronic, and SK Siltron) have announced new greenfield expansion plans, which will lead to ramps in capacity beginning in 2024 and into 2025. However, it is known that some of the expansion projects are being pushed out in the current market environment. Depending on market conditions and the status of Long-term Agreements (LTA), suppliers are expected to ramp capacity in additional phases post-2025 as well. China suppliers also continue to invest to establish a position in the 200 mm and 300 mm wafer segments.

In the longer term, TECHCET is forecasting supply/demand imbalance to stabilize in 2024 and tighten once again in 2025. Into 2026, TECHCET is anticipating another slowdown and subsequent reduction in supply tightness as the natural course of inventory builds. For more details on Silicon Wafers market trends, supply-chain issues and supplier profiles like Eswin, GlobalWafers, Sumco, Siltronic, SEH and more, go to: https://techcet.com/product/silicon-wafers/

New reports are out now for ALD/CVD Precursors, Gases, CMP Consumables and Ancillaries, Photoresist, Silicon Wafers, Wet Chemicals, and Quartz Equipment Components. To learn more, go to: https://techcet.com/product-category/critical-materials-reports/