Craig Walters, Vice President Business Process Outsourcing, Semiconductor, Kelly

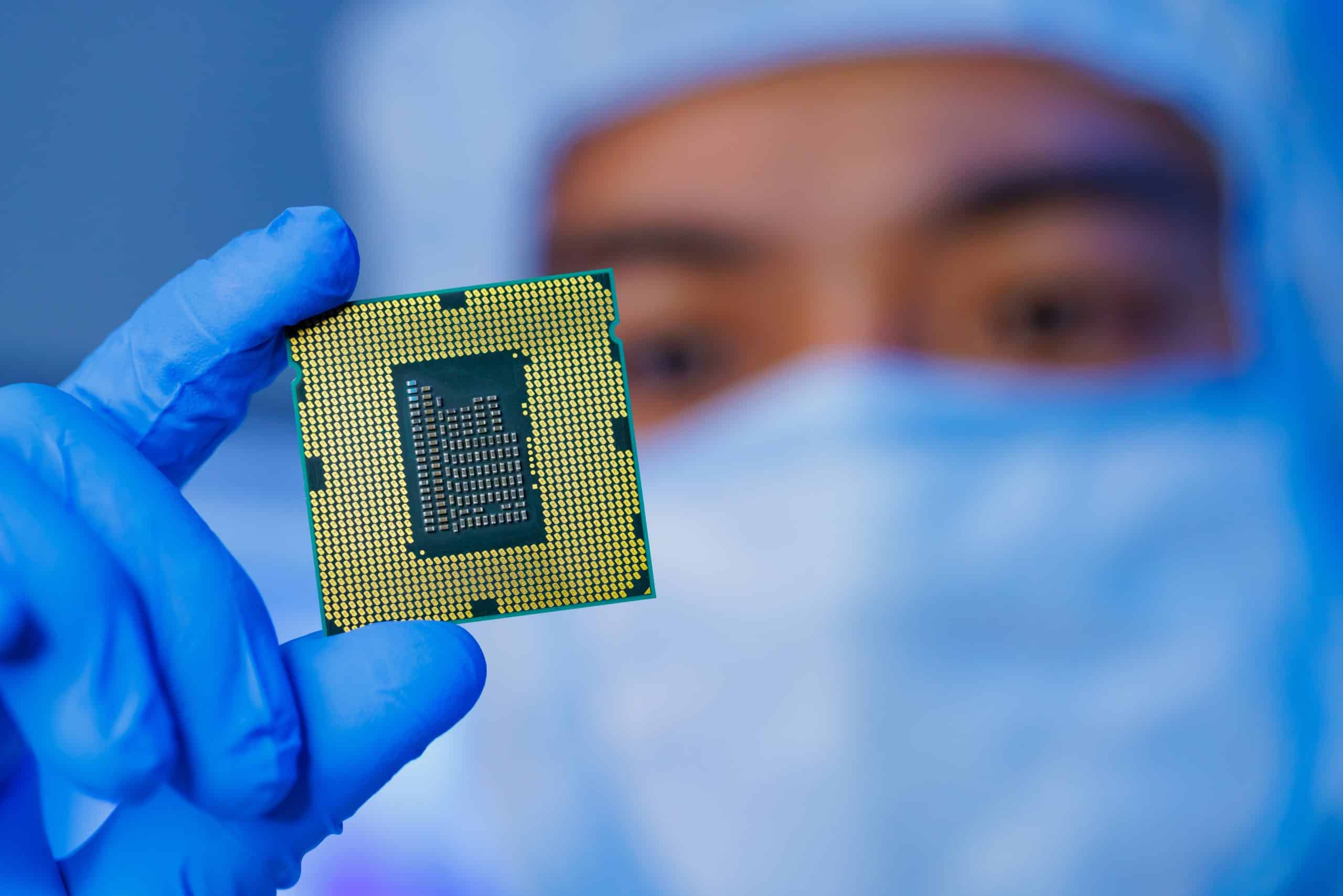

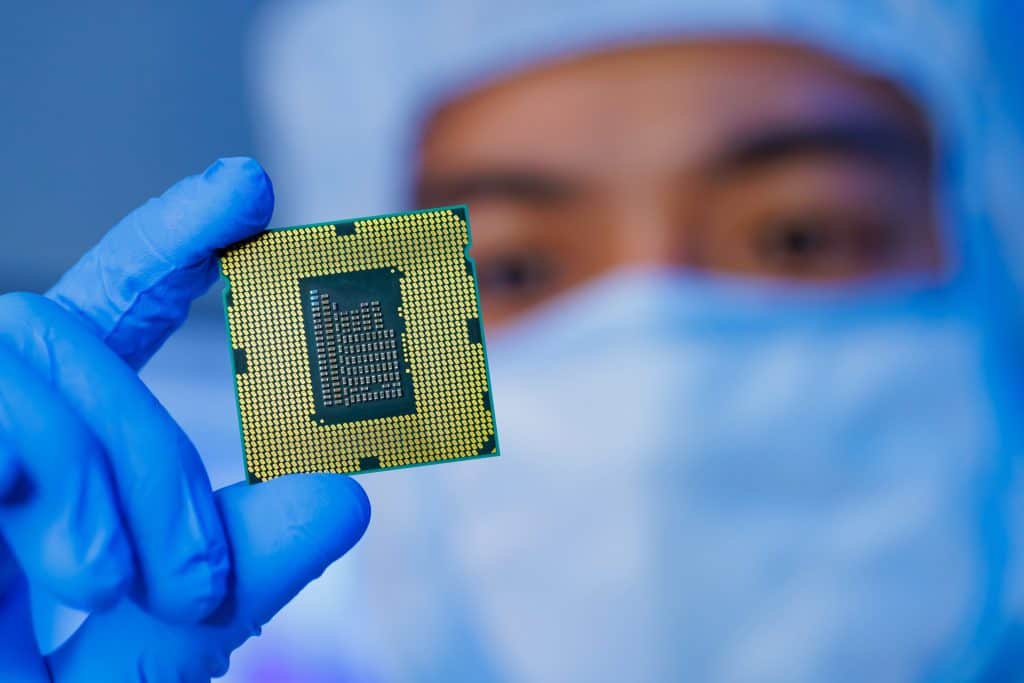

The U.S. semiconductor industry is at a strategic crossroads. Despite being a global technology leader, the U.S. currently manufactures only about 12 percent of the world’s semiconductors—not including the most advanced types.

Recognizing the strategic importance of this sector, the U.S. government took decisive action in August 2022 by signing the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act into law. This legislation allocated more than $75 billion to revitalize American competitiveness in the industry and to limit the need for foreign suppliers.

While this opens up an amazing potential for U.S. companies to take a larger portion of the highly profitable global semiconductor market (estimated to reach $1 trillion by 2030), there is a significant shortage of skilled tech talent. The gap between available positions and qualified workers is expected to persist through 2030—threatening to limit growth and innovation.

With nearly 80 years of experience in workforce management and decades of hands-on experience in the semiconductor industry, Kelly® is at the forefront of addressing this critical talent gap through our expertly designed, custom business process outsourcing (BPO) solutions.

The semiconductor talent challenge

While the CHIPS and Science Act of 2022 represents a significant step toward revitalizing the U.S. semiconductor industry, it does not mitigate the pressing talent shortage facing the sector. This challenge is rooted in long-term trends and requires a multifaceted approach.

Decline in domestic manufacturing workforce According to McKinsey data, the U.S. domestic semiconductor manufacturing workforce has declined by 43% since its peak in 2000, leaving the industry with a diminished talent pool.

Demanding jobs and lack of clear pathways contribute to attrition The semiconductor industry is known for its demanding work environment—characterized by long hours, high-pressure deadlines, and rapidly evolving technologies. These factors, coupled with a lack of clear career progression pathways in some companies, make the competition for talent fierce and contribute to employee attrition.

Without well-defined career development plans, employees can feel undervalued and uncertain about their future within the company, leading them to seek opportunities elsewhere.

Massive investments and job creation Public and private investments aimed at rapidly expanding the U.S. semiconductor industry are projected to exceed $250 billion by 2032. This influx of capital is expected to create more than 160,000 new jobs in engineering and technician roles, and additional positions in related construction fields.

The growing talent gap The scale of the skilled tech talent shortage becomes apparent when comparing current graduation rates with projected demand.

Engineers:

- Approximately 1,500 engineers join the semiconductor industry annually.

- By 2029, the demand for semiconductor engineers is forecast to reach 88,000 workers.

Technicians:

- Only about 1,000 new technicians enter the field each year.

- By 2029, demand for these workers is expected to rise to 75,000 workers.

According to McKinsey’s analysis, the demand for talent is likely to far exceed available labor—even if numerous programs are designed to bridge the gap in supply and achieve their stated aims.

Bridging the semiconductor talent gap How can the American semiconductor industry fully take advantage of funds provided by the CHIPS and Science Act, with such a considerable skilled tech talent gap? Staffing shortages on this scale put domestic objectives at risk. They can drive up labor costs and delay or diminish the return on the monumental investments being made in the sector.

Solving this problem requires a significant change from the customary strategies for cultivating, sourcing, and retaining talent.