Carbon nanotubes (CNTs) have been known for many decades, but the moment of significant commercial growth is just approaching. Through expansions, partnerships, acquisitions, and greater market adoption there are clear indicators that now is the time for true market success to be realized.

In the report “Carbon Nanotubes 2021-2031: Market, Technology, Players,” IDTechEx has forecast the market for CNTs to grow from under $150m in 2019-20 to over $500m within the next decade. This report gives granular 10-year forecasts, player analysis, technology benchmarking, and a deep-dive in core application areas. This detailed technical analysis is built on a long history in the field of nanocarbons and is based on primary-interviews with key and emerging players.

For MWCNTs there are 3 key news stories: the funding raised and planned expansion of Jiansgu Cnano Technology, the new LG Chem capacity, and the acquisition of SUSN by Cabot Corporation.

Most of this market movement is linked with the energy storage industry; the demand for lithium-ion batteries will boom over the next decade and CNTs are well-positioned to benefit from this. The nanotubes act as a conductive additive for either electrode in both current and next-generation lithium-ion battery designs, incorporation of a relatively small weight % can have a significant boost to energy density. The enhanced conductivity is obvious, but the mechanical properties are also very important in providing anchorage that enables thicker electrodes, wider temperature range, or materials that give a higher capacity. How they are dispersed, used with or without a binder, and combined with other additives are all examined in extensive detail within the report.

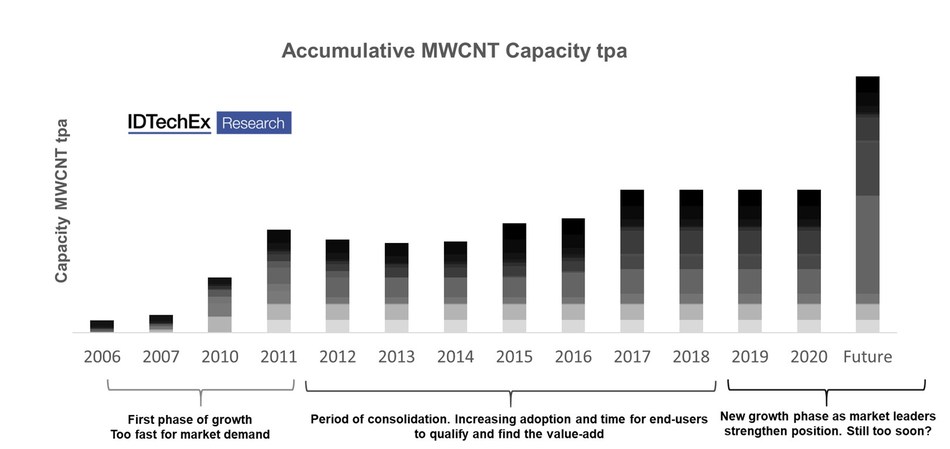

This is not the first time this expansion has been planned. In the build-up to 2011, there were several expansions that ultimately proved premature; as a result some players left the field and a subsequent period of capacity stagnation was observed. However, during this period utilization grew and end-users continued to experiment and find application areas where there is genuine added value. Beyond 2020, we are entering into a new age of expansions; the demand from LiBs and other applications suggests there is good reasons in expecting the timing to be right this time.

Given the diverse range of properties, the market potential for MWCNTs extends far beyond lithium-ion batteries, with conductive polymers, ultracapacitors, coatings, thermal interface materials, and more all-seeing market uptake and detailed throughout the report.

There is also the exciting area of single-walled carbon nanotubes. SWCNTs are at a more nascent stage with a wider manufacturing diversity ranging from the use of CO feedstocks (HiPCO and CoMoCAT) to OCSiAl’s plasma process, Nano-C’s combustion synthesis method, Meijo Nano Carbon eDIPS technique, and more. SWCNTs will compete with MWCNTs, particularly as additives for energy storage and elastomer applications, but given their unique properties they are also gaining traction in novel areas such as memory, sensors, and other electronic applications.

There are also some key news stories worth highlighting including: OCSiAl opening their new 50tpa facility, Fujitsu intending to launch a device with Nantero’s CNT-enabled NRAM, and Brila Carbon establishing a partnership with Chasm Advanced Materials.

This report provides a deep technical assessment on MWCNTs, FWCNTs, and SWCNTs with analysis of their production, post-processing, and integration; the scope extends to “macro-CNT” products most commonly in the form of sheets/veils or yarns with vertically aligned variants being the most exciting by taking advantage of the inherent anisotropy. IDTechEx has an extensive history in the field of nanocarbons and their interview-led approach brings the reader unbiased outlooks, analysis of the impact from COVID-19, benchmarking studies, and player assessments on this diverse and expanding industry.