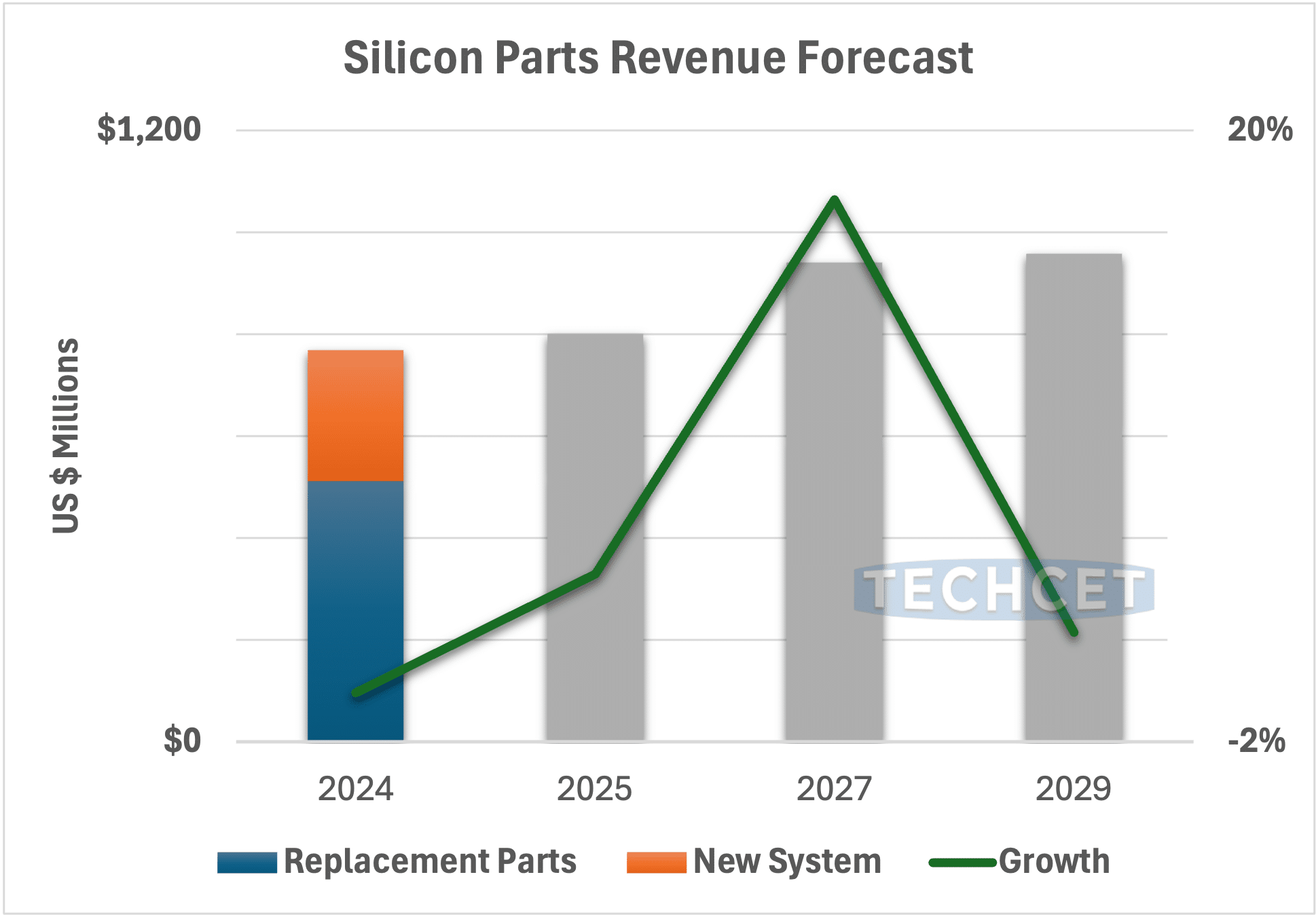

TECHCET forecasts an increase in semiconductor silicon parts revenue for 2025, reaching $800M. This growth is driven by a moderate increase in new system sales and replacement parts sales, leading to an 8% rise in parts sales for new systems and 2% increase in replacement parts sales. The market is expected to experience 4.5% compound annual growth rate (CAGR) from 2024 to 2029, with revenue expected to reach $940M in 2027, according to TECHCET’s Critical Materials Report™ on Silicon Parts.

![]()

While 2024 showed limited growth, driven by efforts to improve semiconductor manufacturing yields and efficiency, demand for high-purity silicon components remains strong. The need for advanced semiconductor manufacturing equipment and ongoing technology upgrades will continue to drive the market, even as macroeconomic uncertainties linger. Companies are expected to benefit from fab expansions and increasing replacement part needs in aging systems.

Geopolitical tensions, particularly the ongoing U.S.-China trade conflicts, are expected to pose challenges to the silicon parts market. New export restrictions and tariffs have led to increased costs and supply chain disruptions, with China also imposing controls on critical materials. These geopolitical risks highlight the need for companies to diversify their supply chains and secure alternative material sources to maintain production stability in the coming years.