Yole Group announces a 2024 revenue (calendar year) to increase by 1.3% year-on-year, reaching $108.1 billion, despite a 12% quarter-to-quarter drop in Q1 2024.

Global market evolution in 2024

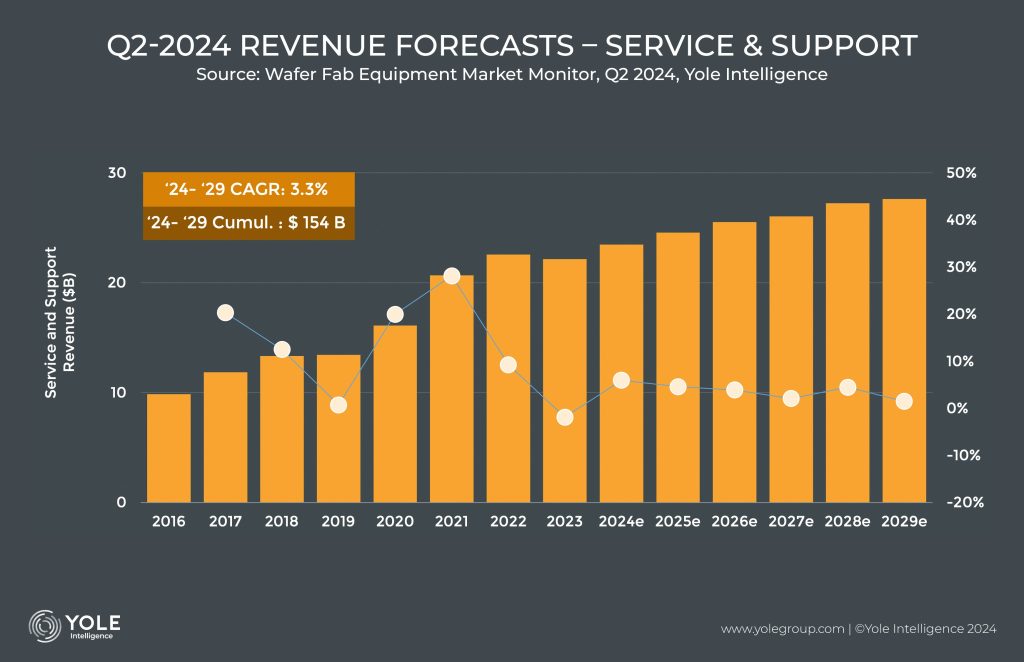

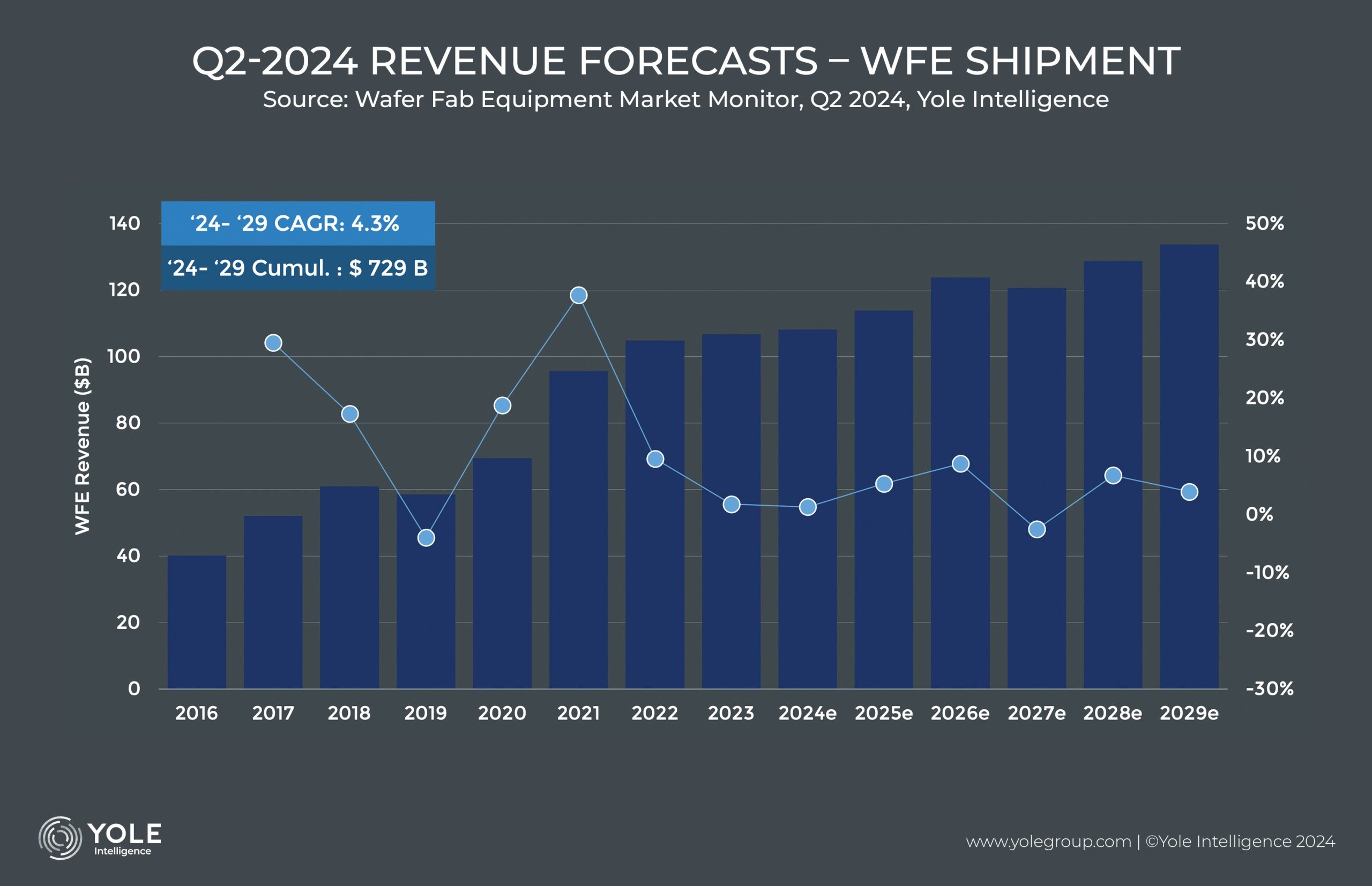

The 1.3% year-to-year growth is driven by increased spending on advanced logic, NAND, and DRAM memory, alongside robust investment in legacy nodes. Additionally, service and support revenue is expected to grow by 6% YoY to $23.5 billion due to rising fab utilization rates globally. Over the long term, WFE revenue is anticipated to experience a CAGR of 4.3% from 2024 to 2029, reaching $133.7 billion by 2029. Service and support revenue is also expected to grow, reaching $27.6 billion in 2029, with a CAGR of 3.3% over the same period. This moderate growth follows significant increases in 2021-2022, driven by high demand for semiconductor devices.

WFE equipment vendors view 2024 as a transition year, with an expected increase in shipments in 2024 and 2025. Vendors are ramping up inventory to meet these needs and introducing new equipment solutions for upcoming process challenges. In Asia, especially in Greater China, there is ongoing IPO activity, while global M&A activity remains stagnant.

In the 2nd half of 2024, WFE revenues are expected to rise. Q1 2024 saw a 12% QoQ (quarter-on-quarter) decline to $25.2 billion. A slight increase to $25.3 billion is expected in Q2 2024, followed by more substantial growth in Q3 2024 and Q4 2024. Yole Group announces respectively, 9% and 8% QoQ).

Overview by WFE market segment

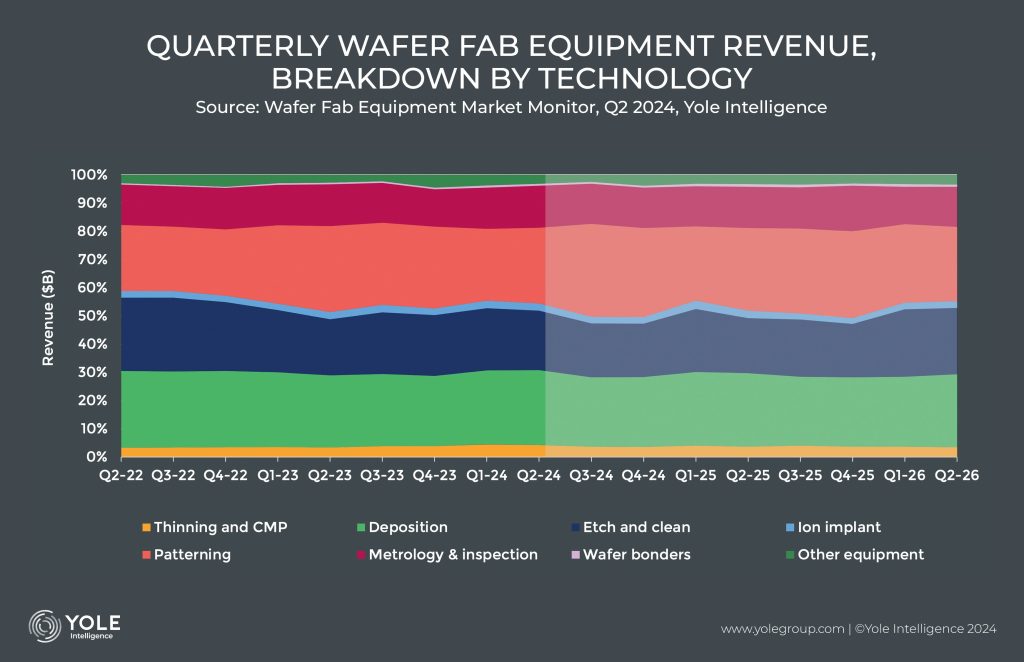

The patterning WFE segment constituted 29% of the total WFE revenue in 2023, with ASML leading the market. Despite a 25% QoQ revenue decline in Q1 2024, the patterning segment is expected to maintain its market share in 2024.

The deposition WFE segment is projected to remain flat in 2024, with a modest 0.9% YoY increase, and is expected to recover to 2022 revenue levels by 2026.

In parallel, the etch and clean segment, which includes dry and wet processes, experienced a significant revenue decline of 16.7% YoY in 2023 due to reduced NAND CapEx. This segment is expected to see a sluggish recovery in 2024 but should improve in 2025 by 5% YoY and in 2026 by 27% YoY, explains Yole Group’s analysts. The deposition and etch segments also saw declines in Q1 2024 by 7% and 8%, respectively.

The metrology and inspection WFE segment maintained its position in 2023 with only a 1% decline and is expected to grow by 4.1% YoY to $15.7 billion in 2024. The segment’s 3.7% revenue dip in Q1 2024 is anticipated to be offset in subsequent quarters. The ion implantation WFE market saw a reduction in market share, but the limited number of suppliers and favorable application mix should lead to revenue increases in both 2023 and 2024. The thinning and CMP (chemical mechanical planarization) segment is growing YoY, with quarterly variations linked to the fiscal years of major vendors in Japan and the USA.

The “other equipment” segment, which includes fab automation, declined by 6% YoY in 2023 due to fab construction delays and lower utilization rates. This segment is expected to grow in 2024. The wafer bonder WFE segment increased by 13.8% YoY in 2023 and is projected to grow by 26% YoY in 2024 due to the limited number of suppliers. Although wafer bonders represent only 1% of the total WFE revenue, they are crucial for fabricating multi-stacked CMOS image sensors, stacked NAND, and advanced logic devices using the Power Delivery Network.