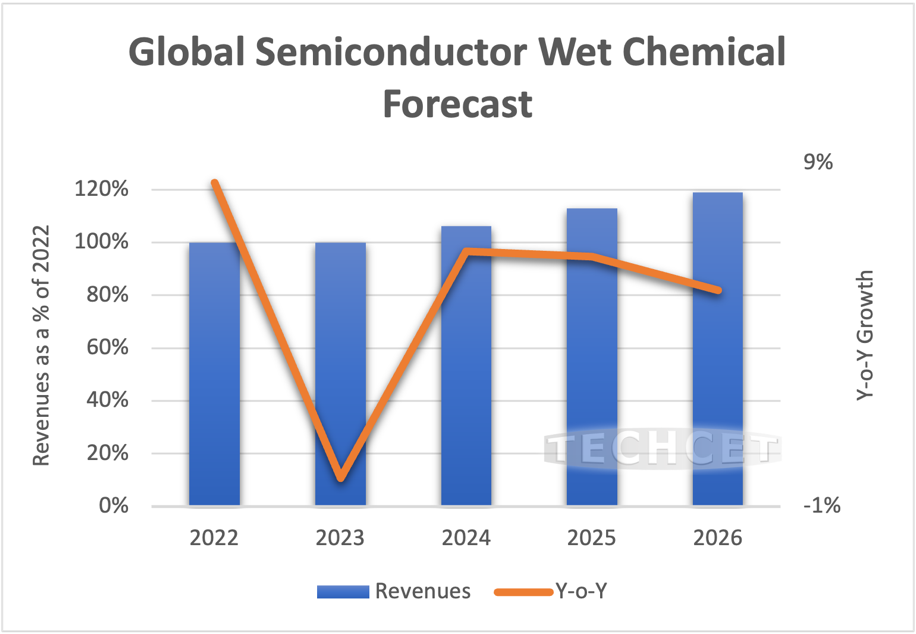

TECHCET—the electronic materials advisory firm providing market and supply-chain information — sees the semiconductor wet chemicals market contracting slightly in 2023, followed by a 6% rebound in 2024. The future ramp will be largely driven by growth in chemical consumption from leading-edge device technology, especially as expansion in 3DNAND layers ramp to 5xxL layer count. The continued expansion of global chip fab capacity will grow the wet chem market 6% YoY (2023-2027 CAGR). By 2027, TECHCET estimates the wet chemicals market segment to reach US$6.9 billion, as indicated in TECHCET’s 2023-2024 Critical Materials Report™ on Electronic Wet Chemicals.

![]()

From the device perspective, increased process steps and demanding yield requirements will drive growth and consumption of wet chemicals since cleaning steps are critical for achieving high yields. For example, as the layer count increases in 3DNAND, Highly Selective Nitride etch (HSNE) formulation is expected to see strong growth since it is an important driver in phosphoric acid consumption.

Dynamics in the wet chemicals market have changed over the past couple of years given logistic challenges, energy costs, and geopolitical events. As a result of geopolitical events and global fab expansions, a regional supply base catered to the requirements of Integrated Device Manufacturers (IDM’s) is becoming increasingly necessary to be competitive in the wet chemicals market. There is concern that specific chemical supply chains may face economic problems connected with inflation, the Russia-Ukraine situation, and raw material sources from China.

In addition, energy costs are changing in several regions, which heightens risks for material costs. Today, higher energy costs have contributed to upwards pricing pressures for materials. Prior to 2020, prices were seldom adjusted. However, the market saw significant changes to pricing in 2021 and 2022 with no ease in pricing in 2023. Given concerns about increased costs from energy and regonalization, TECHCET expects a continued pushback from suppliers on requests to return to pre-pandemic prices.