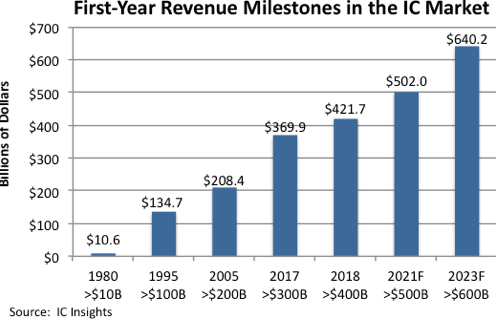

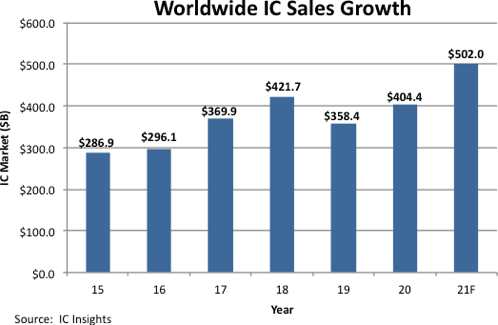

IC Insights will soon release its Mid-Year Update to The McClean Report that includes its most current forecast for the global IC market from 2021 through 2025. In a very rare event, 32 of the 33 major IC market categories defined by WSTS are forecast to enjoy an increase in sales this year, with 29 of the product categories expected to see significant double-digit gains. Strong demand across the entire IC market this year is projected to lift sales for the total IC market 24% and break through the $500 billion plateau for the first time in history (Figure 1).

At the mid-point of 2021, IC production was returning to normal levels, but a surge in chip demand caused by the Covid-19 pandemic meant that ICs used in smartphones, computers, TVs, automobiles, and other end-use applications remained in short supply—an industry condition that could last well into 2022.

The IC market is forecast to see continued growth next year and again in 2023 when worldwide IC revenues are projected to exceed $600 billion for the first time (Figure 2). Throughout the forecast period, momentum is expected to surge for 5G connectivity, artificial intelligence, deep learning, virtual reality, and other emerging applications in mobile, data center and cloud-computer servers, automotive, and industrial markets, resulting in a robust IC market CAGR of 10.7% from 2020-2025.