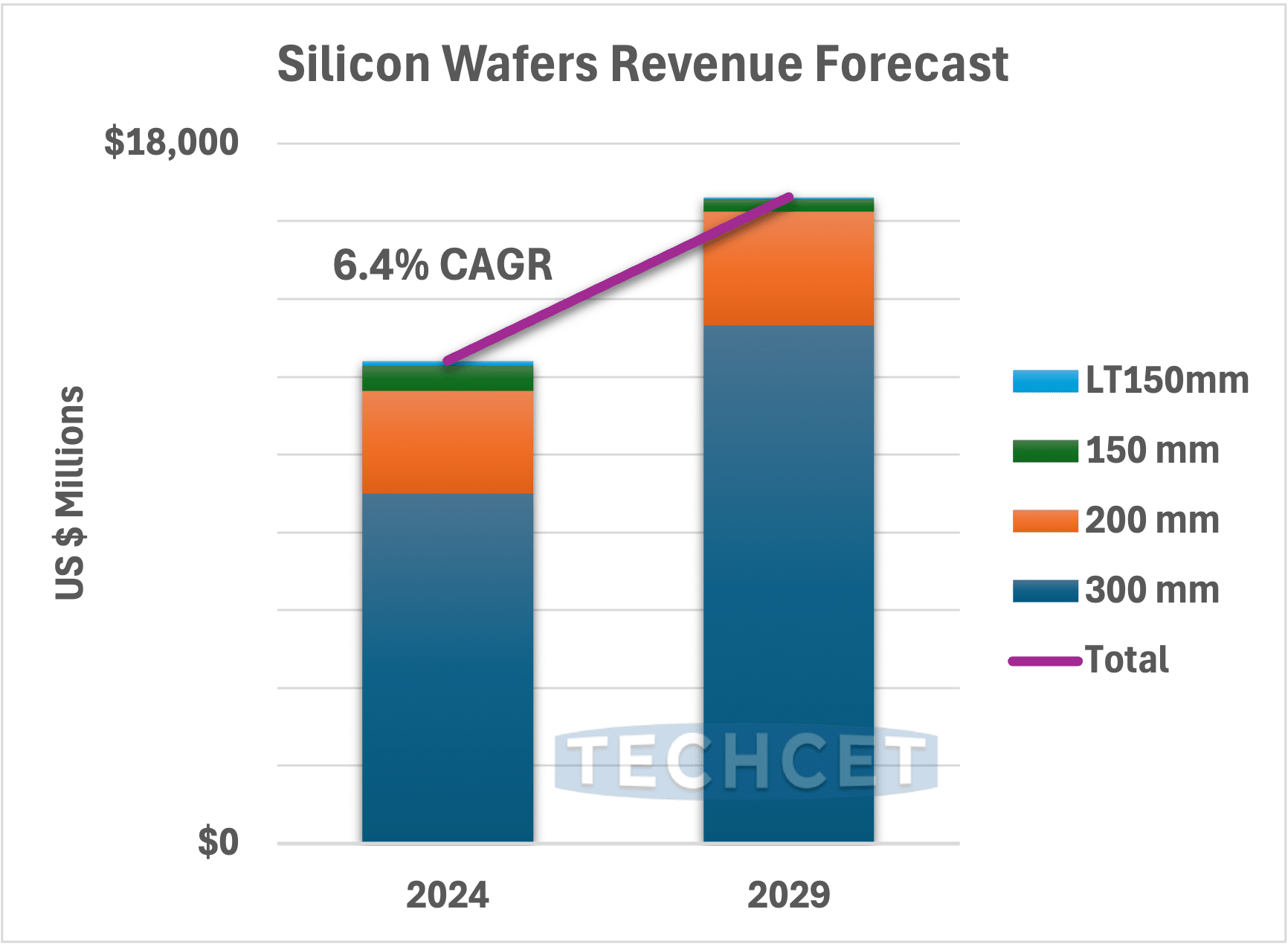

TECHCET — the electronic materials advisory firm providing semiconductor materials supply chain information — forecasts a 3.8% increase in silicon wafer revenues in 2025, reaching approximately US $14.0 billion. Shipment volumes are expected to climb by 5.4% year-over-year, driven by improved order activity as inventory levels correct, and semiconductor production begins to rebound. TECHCET projects a 6.4% CAGR in wafer revenue through 2029, supported by a sustained demand for 300mm wafers and the transition to more advanced logic and packaging technologies as showcased in TECHCET’s Critical Materials Report™ on Silicon Wafers.

![]()

In 2024, the silicon wafer market declined, with shipment volumes dropping 3.6% to 12,400 million square inches (MSI) and revenues falling 5.8% to approximately US $13.5 billion. The downturn was attributed to weakened industrial and automotive chip segments coupled with some sluggishness in mainstream memory and excess wafer inventory, which limited new orders. 300mm wafer shipments slipped 1.6%, while smaller diameter wafers saw steeper declines, particularly LT150mm (less than 150mm), which fell over 20%. As a result, 300mm wafers retained their dominant position, driven by their role in advanced device manufacturing.

Looking forward, the silicon wafer market is expected to benefit from growth in AI and high-performance computing, requiring increasingly pure and defect-free wafers. However, the industry faces ongoing pressure from pricing, overcapacity in small diameter segments, and geopolitical risks. China’s push for self-sufficiency and its “Buy Chinese” policies are affecting global competition and market access. Environmental and safety considerations around wafer production and upstream polysilicon sourcing also remain key concerns. Even so, the industry’s strategic role in enabling next-gen semiconductors while supporting a broad set of current devices underscores its long-term global importance.